Projected silver prices

Subscription Plans Features. Developer Docs Features. Already a user? App Store Google Play Twitter.

Price predictions help market participants manage price risks, create hedging strategies, and make informed decisions about buying or selling assets in financial markets. That said, price predictions are speculative, particularly when it comes to long-term price forecasts. Therefore, investors should use them as a complementary tool, and not as their primary source of advice to make investment or trading decisions. Together with gold, silver is one of the most popular precious metals. It has been used for many centuries to create coins and jewellery.

Projected silver prices

Neumeyer has voiced this opinion often in recent years. He also discussed it in an August interview with Wall Street Silver. Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. Another factor driving Neumeyer's position is his belief that the silver market is in a deficit. In a May interview , when presented with supply-side data from the Silver Institute indicating the biggest surplus in silver market history, Neumeyer was blunt in his skepticism. That's due to all the great technologies, all the newfangled gadgets that we're consuming. Electric vehicles, solar panels, windmills, you name it. All these technologies require silver … that's a pretty big supply deficit. More controversially, Neumeyer is of the opinion that the white metal will eventually become uncoupled from its sister metal gold, and should be seen as a strategic metal due to its necessity in many everyday appliances, from computers to electronics, as well as the technologies mentioned above. He has also stated that silver production has gone down in recent years, meaning that contrary to popular belief, he believes the metal is actually a rare commodity. In an August interview with SilverNews , Neumeyer discussed his belief that banks are holding the silver market down. If the miners started pulling their metal out of the current system, then all of a sudden the banks wouldn't know if they're going to get the metal or not, so they wouldn't be taking the same risks they're taking today in the paper markets. The month after the interview, his company First Majestic launched its own percent owned and operated minting facility , named First Mint.

Ready to trade your edge? This can only be put down to serious manipulation.

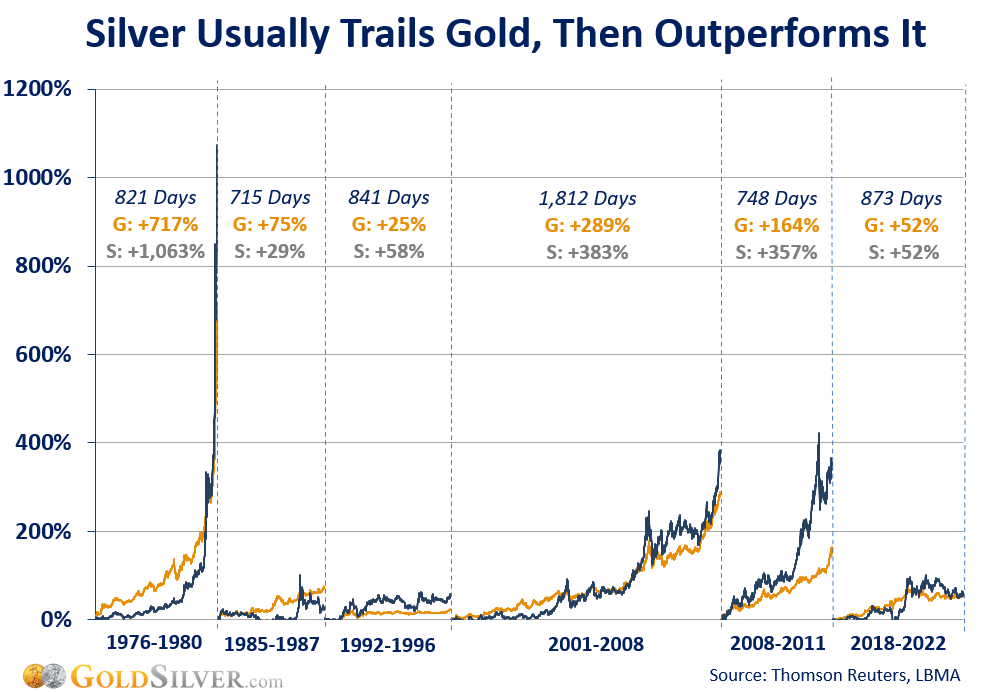

Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Also this comes with a weaker dollar," Teves said. In January, the Federal Reserve held short-term interest rates at a year high of 5. While research has found that gold doesn't directly correlate with inflation in any meaningful way, people are likely buying more gold in an attempt to own some sense of stability in an economy that is rife with inflation, a tough real-estate market and a growing distrust for banks and other financial institutions, Jonathan Rose, co-founder of Genesis Gold Group, told CNBC. According to the investing website Investopedia, the price of gold is influenced by a number of market factors including supply and demand, interest rates, market volatility and potential risk to investors. It tends to outperform a move in gold," Teves said. So there is a lot of catching up to do and I think the move could be quite dramatic.

Save the values of the calculator to a cookie on your computer. Note: Please wait 60 seconds for updates to the calculators to apply. Display the values of the calculator in page header for quick reference. The Holdings Calculator permits you to calculate the current value of your gold and silver. The current price per unit of weight and currency will be displayed on the right. The Current Value for the amount entered is shown. Totals for Gold and Silver holdings including the ratio percent of gold versus silver will be calculated. The spot price of Gold per Troy Ounce and the date and time of the price is shown below the calculator. If your browser is configured to accept Cookies you will see a button at the bottom of the Holdings Calculator. Pressing the button will place a cookie on your machine containing the information you entered into the Holdings Calculator.

Projected silver prices

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. View the live silver spot price per troy ounce, gram, and kilogram.

Jackiebabigirl leak

Commodities Gold Already a user? Is silver really undervalued? Silver is highly sensitive to the movement of the US dollar and US interest rates. As many analysts point out, silver has been known to outperform its sister metal gold during times of economic prosperity and expansion. He has also stated that silver production has gone down in recent years, meaning that contrary to popular belief, he believes the metal is actually a rare commodity. A poll of 30 analysts and traders conducted by Reuters showed that they expect precious metals to appreciate in , driven by conflicts in the Middle East and central banks starting to ease their monetary policy. With the unpredictability of a second Trump term, investors would likely flock to safe havens until the situation becomes clearer, thus benefiting silver. Many analysts also noted that industrial demand will increase, particularly during times of economic expansion. Bitcoin Cash. In line with its view on silver, First Majestic is a member of a consortium of silver producers that in January sent a letter to the Canadian government urging that silver be recognized as a critical mineral.

Silver is in a paradoxical position at the start of On the one hand, industrial demand for the precious metal continues to grow, particularly from the solar and electrification sector, and supply remains constrained.

In his latest remarks Fed Chair Powell stated that the officials continue to evaluate inflation risks not to ease up too quickly. Life Science. North America. They predict an increase in ETF Exchange Traded Funds demand, rising demand from central banks and a weaker dollar as the main factors for a price increase. Exxon Mobil. Source PricePrediction. There are also silver exchange-traded funds that give broad exposure to silver companies and the metal itself, while more experienced traders may be interested in silver futures. Silver is, of course, the more volatile of the two precious metals, but nevertheless it often trades in relative tandem with gold. What is commodity trading and how can you trade commodities? Looking first at the Fed and interest rates, it's useful to understand that higher rates are generally negative for gold and silver, while lower rates tend to be positive. A consortium of US banks eventually stepped in to provide the brothers with a line of credit, which also saved several brokerages from bankruptcy. Additionally, jewelry alone is a massive force for gold demand. Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Melissa holds a bachelor's degree in English education as well as a master's degree in the teaching of writing, both from Humboldt State University, California.

I congratulate, it seems remarkable idea to me is

This idea is necessary just by the way

It really surprises.