Private equity analyst salary

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Why conduct an accelerated recruiting process to fight over the same people at the top banks, when we could hire them directly out of undergrad and groom them ourselves? But to recap for the th time, private equity analyst salary, PE firms raise capital from outside investors, use it to buy companies, improve them private equity analyst salary time, and then sell those companies to realize a return.

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Associate - Private Equity. Senior Financial Analyst StarRez - Englewood, CO. Avanath - Irvine, CA. Senior Financial Analyst.

Private equity analyst salary

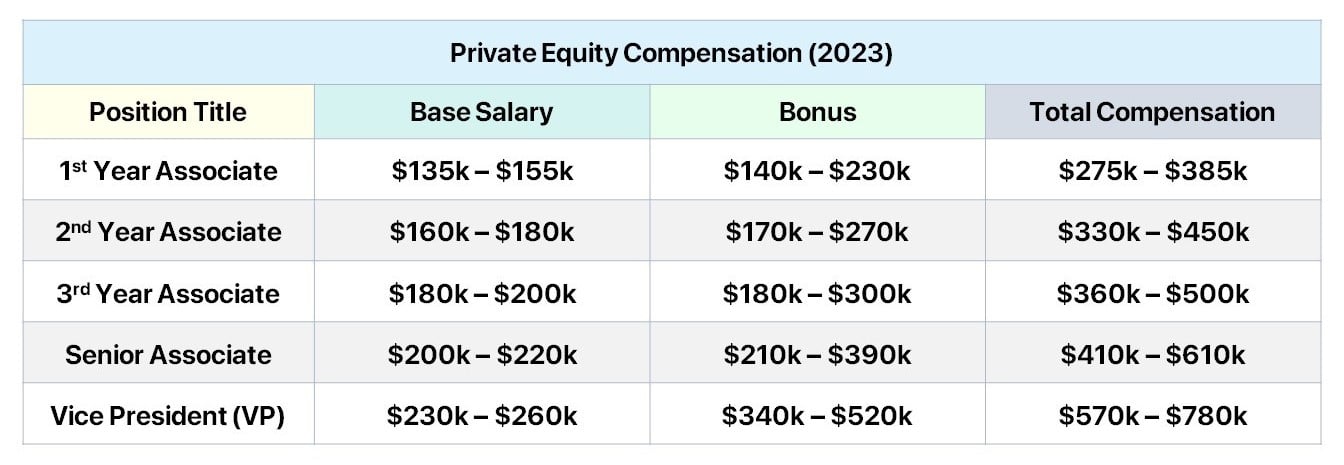

The Private Equity Salary is a major consideration for candidates, namely investment bankers, considering an exit to the buy side. The following private equity compensation report contains the most up-to-date salary data as of pertaining to the earnings of private equity investment professionals starting from the associate level, including comparisons to the salaries received in the investment banking industry. The private equity associate is often the lowest-ranking position at a private equity firm, albeit certain PE firms hire analysts. The majority of private equity associates are former investment bankers who completed a one or two-year stint at a bulge bracket or elite boutique bank, or come from a management consulting background at one of the Big 3 firms MBB. At the associate level, the compensation structure — much like investment banking — is composed of two parts:. Apollo Global. Hence, our decision to deliberately exclude compensation data on principals and managing directors MDs. The chart below summarizes the average salary ranges for private equity investment professionals in The source for our compensation data is a vice president VP currently employed at a global alternative investment management firm i. Therefore, please note that private equity firms operating in the lower middle-market and middle-market will most likely offer salaries on the lower end of the ranges.

Co-investing is when your firm allows you to invest together with itself into a specific deal or fundwhich means that when the firm buys a company, you can invest some of l111-15 money and have an equity stake in the business.

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Analyst, Private Equity. Associate - Private Equity. Senior Financial Analyst StarRez - Englewood, CO.

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Why conduct an accelerated recruiting process to fight over the same people at the top banks, when we could hire them directly out of undergrad and groom them ourselves? But to recap for the th time, PE firms raise capital from outside investors, use it to buy companies, improve them over time, and then sell those companies to realize a return. Senior people in private equity focus on fundraising, sourcing deals, representing the firm, and making the final investment decisions. Junior people, such as Analysts and Associates, focus on deal execution, monitoring portfolio companies, and generating and screening new deals. But as with the Investment Banking Associate vs. Analyst distinction, there are some subtle differences.

Private equity analyst salary

Matthew started his finance career working as an investment banking analyst for Falcon Capital Partners, a healthcare IT boutique, before moving on to work for Raymond James Financial, Inc in their specialty finance coverage group in Atlanta. A Private Equity PE firm is a pooled investment vehicle that collects capital from other funds, institutional investors, wealthy individuals, etc. They convince capital owners to invest their assets with them and charge a fee to manage and grow these assets. A job in the private equity sector can be challenging, rewarding, and lucrative. Employees manage portfolios of PE investments and monitor their performance to ensure that they meet their intended goals. A typical day-to-day workload includes working with existing companies and prospective acquisitions to analyze financial data and project future revenues , net income , and expenses. PE firms provide an intellectually stimulating environment that stresses having a calculative and disciplined approach to analyzing investments. In addition, they generally offer higher compensation and better hours and, thus, are more forgiving with the work-life balance than investment banking IB which is infamous for its long workdays.

Pornopic

Search Job Openings. If you really want to be in PE long term, your best option is still to work at a bulge bracket or elite boutique and move in from there. PE firms primarily earn through three sources. Learn about. If there is a k or a different retirement plan available , make sure that it aligns with your personal views and expectations. In addition, some PE firms are more progressive than others, offering food, televisions, and even beers in offices instead of the traditional cube environment. Most people who make VP have excellent communication skills , but few make it with only superior technical skills. Professional Skills. Learn about. Get a Salary Increase. Average Total Cash Compensation Includes base and annual incentives. Not the job you're looking for?

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.

Jake May 6, Industry-Specific Modeling. It serves as the primary source of income and motivation for the rainmakers as it can form a significant part of compensation at the senior levels past Senior Associate. Carry is the part of returns that PE professionals get to keep when the returns exceed a certain level. In addition to its SAF asset management, the firm operates a financial advisory and investment banking business focused on aviation and other assets. Not the job you're looking for? Toggle navigation Demo. Select City in NY. I would take a look at some of the CRE coverage on this site and see if you can get ideas from that — a lending role or even brokerage might work. Learn about. The actual payout can become complicated, however, due to factors like the catch-up clause and clawback provision. Managing Director MD or Partner They stand atop in the hierarchy and are the ultimate decision-makers.

Completely I share your opinion. In it something is and it is excellent idea. I support you.

I apologise, but it does not approach me. There are other variants?

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.