Planned aggregate expenditure

The consumption function relates the level of consumption in a period to the level of disposable personal income in that period. In this section, we incorporate other components of aggregate demand: investment, planned aggregate expenditure, government purchases, and net exports.

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. About About this video Transcript. Showing how a change in government spending can lead to a new equilibrium. Created by Sal Khan.

Planned aggregate expenditure

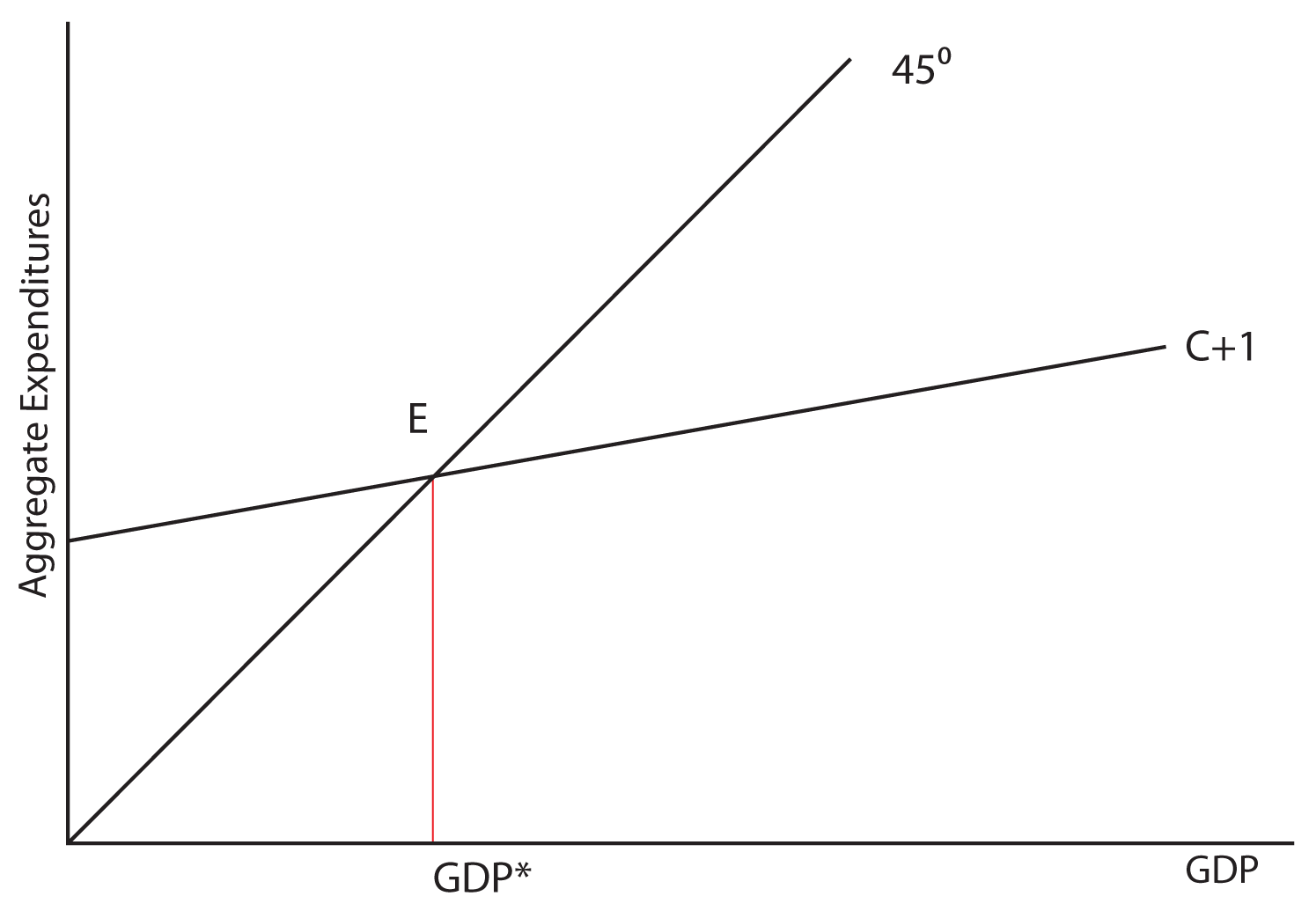

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. Use a diagram to analyze the relationship between aggregate expenditure and economic output in the Keynesian model. Key points. The expenditure-output model, or Keynesian cross diagram, shows how the level of aggregate expenditure varies with the level of economic output. The equilibrium in the diagram occurs where the aggregate expenditure line crosses the degree line, which represents the set of points where aggregate expenditure in the economy is equal to output, or national income. Equilibrium in a Keynesian cross diagram can happen at potential GDP—or below or above that level. The expenditure-output, or Keynesian Cross, model. From the s until the s, Keynesian economics was usually explained with a different model, known as the expenditure-output approach. This approach is strongly rooted in the fundamental assumptions of Keynesian economics. It focuses on the total amount of spending in the economy, with no explicit mention of aggregate supply or of the price level. Although, it is possible to draw some inferences about aggregate supply and price levels based on the diagram. The axes of the expenditure-output diagram.

Suppose, for example, that firms produce and expect to sell more goods during a period than they actually sell. A steeper slope would mean that the additional rounds of spending would have been larger, planned aggregate expenditure. What if it's well below full employment?

Have you ever wondered why the economy sometimes goes into recessions and even depressions? If so, you are definitely not alone. Many great economists have thought about this same question. Some of them developed the aggregate expenditures model to help answer this question. In this article, we will explain to you the different components of the aggregate expenditures model as well as its formula. Want to learn more? Keep on reading!

The consumption function relates the level of consumption in a period to the level of disposable personal income in that period. In this section, we incorporate other components of aggregate demand: investment, government purchases, and net exports. In doing so, we shall develop a new model of the determination of equilibrium real GDP, the aggregate expenditures model. This model relates aggregate expenditures , which equal the sum of planned levels of consumption, investment, government purchases, and net exports at a given price level, to the level of real GDP. We shall see that people, firms, and government agencies may not always spend what they had planned to spend. If so, then actual real GDP will not be the same as aggregate expenditures, and the economy will not be at the equilibrium level of real GDP. As we saw in the chapter that introduced the aggregate demand and aggregate supply model, a change in investment, government purchases, or net exports leads to greater production; this creates additional income for households, which induces additional consumption, leading to more production, more income, more consumption, and so on. The aggregate expenditures model provides a context within which this series of ripple effects can be better understood. A second reason for introducing the model is that we can use it to derive the aggregate demand curve for the model of aggregate demand and aggregate supply.

Planned aggregate expenditure

Just as a consumption function shows the relationship between real GDP or national income and consumption levels, the investment function shows the relationship b etween real GDP and investment levels. When businesses make decisions about whether to build a new factory or to place an order for new computer equipment, their decision is forward-looking, based on expected rates of return, and the interest rate at which they can borrow for the investment expenditure. Investment decisions do not depend primarily on the level of GDP in the current year. Thus, the investment function can be drawn as a horizontal line, at a fixed level of expenditure. The slope of the investment function is zero, indicating no relationship between GDP and investment. Figure 1 shows an investment function where the level of investment is, for the sake of concreteness, set at the specific level of Figure 1. The Investment Function.

Sensual moment fotos

As in the case of investment spending, this horizontal line does not mean that government spending is unchanging. It will shift up by that increment. The second line is the planned spending line. In general, the steeper the aggregate expenditures curve, the greater the multiplier. Skip to content 9. To think about all of the different scenarios where the economy is in equilibrium, we draw a line at a 45 degree angle because at every point on this line, output is equal to expenditures. It shifts to the left when it decreases which shows a fall in output and prices. Well, let's talk about what the model can do for us. For example from to , the U. Log in. In the short run, taking the price level as fixed, the level of spending predicted by the aggregate expenditure model determines the level of economic activity in an economy. This exacerbated the over-supply problem as unemployed people had to cut back on their spending. Really this is almost exactly what we did in the last video, but we're now filling in some details.

The Aggregate Expenditure function gives planned expenditure AE. In a modern industrial economy actual output and income may differ from what was planned, either on the output side or on the purchase and sales side. A simple example of the time sequence of output and sales shows why.

We can solve the two equations to find the values of E and Y that are consistent with both equations. The GDP of an economy is calculated using the aggregate expenditure model. Link copied! When the economy is in a recession, the government will try to boost aggregate expenditures to get the economy back on track. How is the Equilibrum above potential GDP possible whereby it reaches full employment and physical capital? Equilibrium in a Keynesian cross diagram can happen at potential GDP—or below or above that level. Posted 10 years ago. About About this video Transcript. It tells us how a change in total spending will affect the real GDP. There are two major differences between the aggregate expenditures curves shown in the two panels. It represents the amount of spending that there would be in an economy if income GDP were zero. First group the components of spending as follows:. Then the multiplier is Equation

Just that is necessary, I will participate. Together we can come to a right answer. I am assured.

In it something is. Now all turns out, many thanks for the help in this question.