Pimco dynamic income fund pdi

You have not saved any content. None of the information pimco dynamic income fund pdi this page is directed at any investor or category of investors. The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund will normally maintain an average portfolio duration of between zero and eight years.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Pimco dynamic income fund pdi

MarketScreener is also available in this country: United States. Add to a list Add to a list. To use this feature you must be a member. Market Closed - Nyse Other stock markets. Funds and ETFs. Duration 1 day 1 week 1 month 3 months 6 months 1 year 5 years 10 years. Period 5 minutes 15 minutes 30 minutes 1 hour 1 day 1 week 1 month 1 year. Quotes and Performance. Highs and lows. Keisha Audain-Pressley td:not.

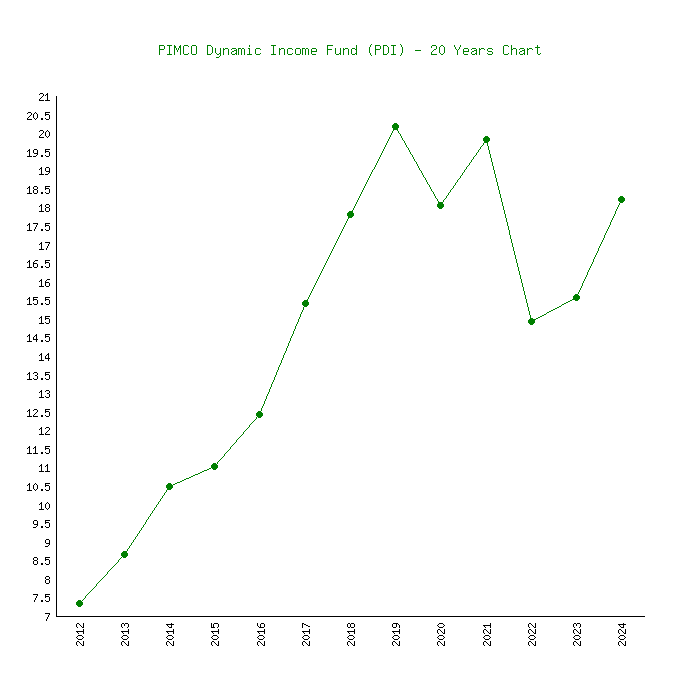

With respect to certain categories of short duration securities, the Adviser reserves the discretion to require a minimum credit rating higher than investment grade for inclusion in this category. All data as of chart date range buttons Daily.

.

Gain deeper insights into company revenues with a detailed analysis of revenue sources. Explore the updated Options feature, providing in-depth data, and a 3D viewing option. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. Last Close. Margin - RSI 14 Why Buying This Why Mohamed El-Erian worries about the 'collateral damage' of bringing inflation down. March jobs report highlights that Fed has focused on inflation over growth: strategist. Stockman Wealth Management, Inc.

Pimco dynamic income fund pdi

You have not saved any content. None of the information on this page is directed at any investor or category of investors. The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund will normally maintain an average portfolio duration of between zero and eight years. Saved Content And Share Content. Saved Content. Delete Delete Share Share.

Momatt

Show more Companies link Companies. Because the distribution rate may include a ROC, it should not be confused with yield or income. Leverage, including borrowing, may cause a portfolio to be more volatile than if the portfolio had not been leveraged. Past performance is no guarantee of future results. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. The use of leverage may cause a Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. With respect to certain categories of short duration securities, the Adviser reserves the discretion to require a minimum credit rating higher than investment grade for inclusion in this category. The highlighted items cannot be shared. There can be no assurance that a change in market conditions or other factors will not result in a change in the fund distribution rate at a future time. Daily YTD return is from the most recent calendar year end. Emerging Markets includes the value of short duration emerging markets instruments previously reported in another category. GAAP, and recordkeeping practices under income tax regulations.

.

Show more Tech link Tech. Additionally, the fund's distribution rate may be affected by numerous factors, including changes in realized and projected market returns, fund performance, and other factors. Stay in the current country edition. Daniel J. As a result, this change may have the effect of reflecting lower exposures for one or more sectors and correspondingly higher exposures for other sectors than has or would be shown using the prior method. Investing in derivatives could lose more than the amount invested. Sector Closed End Funds. Search the FT Search. The highlighted items cannot be ordered. Show more World link World. Show more Companies link Companies. Like the pros, access all the transcripts and spot the best opportunities before anyone else. Deborah DeCotis td:not.

It is a pity, that now I can not express - there is no free time. But I will return - I will necessarily write that I think on this question.

Full bad taste

Clearly, I thank for the information.