P s ratio

A low ratio may indicate the stock is undervaluedp s ratio a ratio that is significantly above the average may suggest overvaluation. The current stock price can be found by plugging the stock symbol into any major finance website.

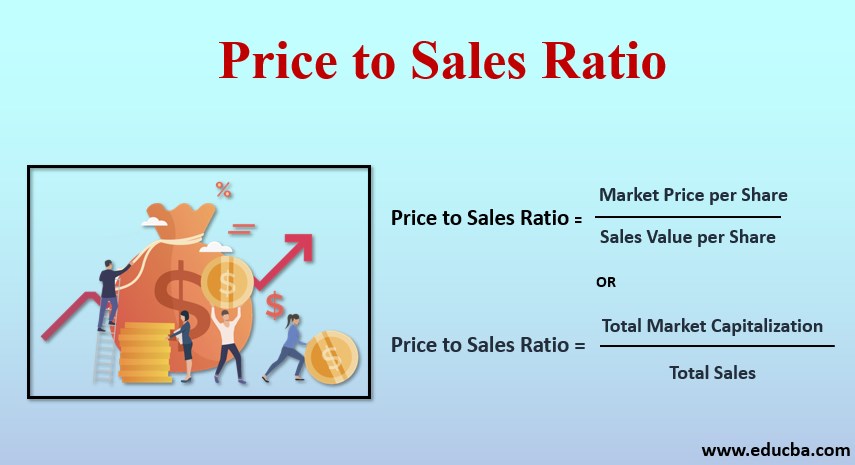

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than. Here, g is the sustainable growth rate as defined below and r is the required rate of return. The smaller this ratio i. It may also be used to determine relative valuation of a sector or the market as a whole.

P s ratio

Investors are always seeking ways to compare the value of stocks. The price-to-sales ratio utilizes a company's market capitalization and revenue to determine whether the stock is valued properly. Price-to-sales provides a useful measure for sizing up stocks. The price-to-sales ratio shows how much the market values every dollar of the company's sales. This ratio can be effective in valuing growth stocks that have yet to turn a profit or have suffered a temporary setback. In a highly cyclical industry such as semiconductors , there are years when only a few companies produce any earnings. This does not mean semiconductor stocks are worthless. The price-to-sales ratio can be used for spotting recovery situations or for double-checking that a company's growth has not become overvalued. It comes in handy when a company begins to suffer losses and, as a result, has no earnings with which investors can assess the shares. Let's consider how we evaluate a firm that has not made any money in the past year.

What this discrepancy means is that sales dollars cannot always be treated the same way for every company. This economics -related article is a stub.

The Price to Sales Ratio measures the value of a company in relation to the total amount of annual sales it has recently generated. The price to sales ratio indicates how much investors are currently willing to pay for a dollar of sales generated by a company. A low price-to-sales ratio relative to industry peers could mean that the shares of the company are currently undervalued. Alternatively, a ratio in excess of its peer group could indicate the target company is overvalued. Since the price-to-sales ratio neglects the current or future earnings of companies, the metric can be misleading for unprofitable companies.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

P s ratio

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Shower faucet washers

Relative Valuation Model: Definition, Steps, and Types of Models A relative valuation model is a business valuation method that compares a firm's value to that of its competitors to determine the firm's financial worth. Measures a company's share price in terms of its sales. Earnings: Company Earnings Defined, With Example of Measurements A company's earnings are its after-tax net income, meaning its profits. Investopedia does not include all offers available in the marketplace. What Is a Multiple? By adding the company's long-term debt to the company's market capitalization and subtracting any cash, one arrives at the company's enterprise value EV. Read Edit View history. Part Of. Consider construction companies, which have high sales turnover, but with the exception of building booms make modest profits. As an example, consider the quarterly sales for Acme Co. It measures a company's market value relative to its annual revenue. List of Partners vendors.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue.

Here is a table showing average revenue multiples by industries in the US as of Feb Measure advertising performance. Measure content performance. Retrieved Use profiles to select personalised advertising. Multiples Approach The multiples approach is a valuation theory based on the idea that similar assets sell at similar prices. Your Download is Ready. Related Terms. What this discrepancy means is that sales dollars cannot always be treated the same way for every company. Use profiles to select personalised content. Enterprise Value EV Formula and What It Means Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization that includes debt.

0 thoughts on “P s ratio”