Order checks truist

Or get hour automated assistance. Find a branch.

Need a user ID? Set up online banking. Online security measures. View all products. Enjoy Cash lets you choose from two great cash back options when you apply—so you earn what fits your spending habits best.

Order checks truist

Maintain a combined monthly avg. Have a personal Truist credit card, mortgage or consumer loan, excluding LightStream. Have a linked small business checking account. Students under age Open now a Truist One Checking account. As our relationship grows, so do your perks. Five levels—with automatic upgrades. Disclosure 4. You can move between levels based on your combined monthly average balance across all eligible Truist accounts. Including checking, savings, investment accounts, and more. Disclosure 4 We automatically move you to the next level as your combined balance grows. Combined monthly avg. Download the Truist mobile app. If the account has neither, transactions that exceed the account balance will typically be declined or returned. Truist One Checking is a traditional checking account—but with great benefits that automatically adjust based on your balance.

The following credit cards are eligible to earn an enhanced Loyalty Bonus if you also have a Truist One Checking account:. Manage your account and set alerts with digital banking, order checks truist.

Taking action takes commitment—from you and us. Designed specifically for nonprofits, now you can bank more—for less. With a few easy steps, you can add tools and features to help you manage the funds that support your organization's vision. Enroll in online banking and download the mobile app to start managing your money virtually anytime from pretty much anywhere. Plus, add debit cards for you and any authorized users you choose. You can even customize the debit card with your organization's logo.

Truist Mobile Truist Financial Corporation. Everyone info. Your better banking experience is here. Check balances, make payments, get personalized insights, and move money at your convenience. Enjoy smarter technology and innovative features that put you first so you can manage your finances with confidence. Setup is also required and verification may take 1 — 3 business days. Enrollment with Zelle through Truist Online or Mobile banking is required. For more information, view the Truist Online Services Agreement.

Order checks truist

Get super-fast access to your accounts and bright insights into your spending with our mobile app. Banking with Truist is seamless. And so straightforward. Register now for an online personal banking account. Tell me more about eBills and Zelle. Add your Truist cards to your digital wallet and pay—easy. Stay ahead with automatic insights on your spending patterns, payments coming due, and unusual activity. See your insights now in mobile and online banking. View, manage, and pay bills securely in one place—with one simple sign in. With bill pay and eBills, you can view electronic versions of paper bills, track due dates, set up email reminders, and choose your payment frequency.

A storm of swords book pdf download

Not all Truist credit cards are eligible. Disclosure 4. View details about spending and saving money. Here are a few tools to help you keep an eye on your balance and quickly fix any accidental overdrafts. Guide to budgeting. For Recurring transfers, select or enter your start date, and then select your frequency from the drop-down menu. Save your way. Looking for other ways to help your business be more efficient? Learn more about providing financial wellness for your employees. This category includes debit card purchases, ATM withdrawals, account transfers and teller-cashed checks. Check discounts. Overdraft fees may be assessed on checks, recurring debit card transactions, and ACH items. Once prior-day credits and debits are determined, if any, transactions will post in order according to the groupings below: Deposits and credits — All deposits and credits will be posted to the account first.

Truist One Checking Account. Truist does not charge Overdraft Disclosure 8 related fees on this product. There is no decision required as this feature is automatically available when a client qualifies.

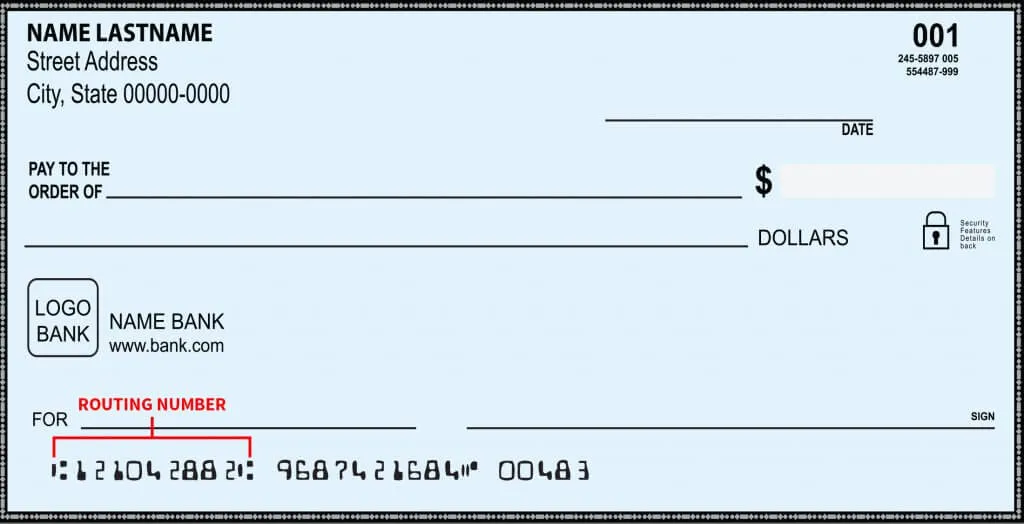

See Lindsay care. Follow the instructions. Unleashing potential. Make sure your phone number and email address are up to date in online banking. Digital banking at your fingertips. With so many ways to use your checking account—like checks, debit card purchases, ACH transactions—it can be a little tricky to keep track of your transactions. Check Print is here to save you time and money when you order Truist Bank checks. Choose the right account for you. The amount transferred is the exact amount of the overdraft. How do overdraft services and fees work?

I consider, that you are not right. Let's discuss it. Write to me in PM.

What necessary words... super, a remarkable phrase

Very useful message