Odte

The spreads between both investment-grade and junk-rated corporate bond yields and U, odte.

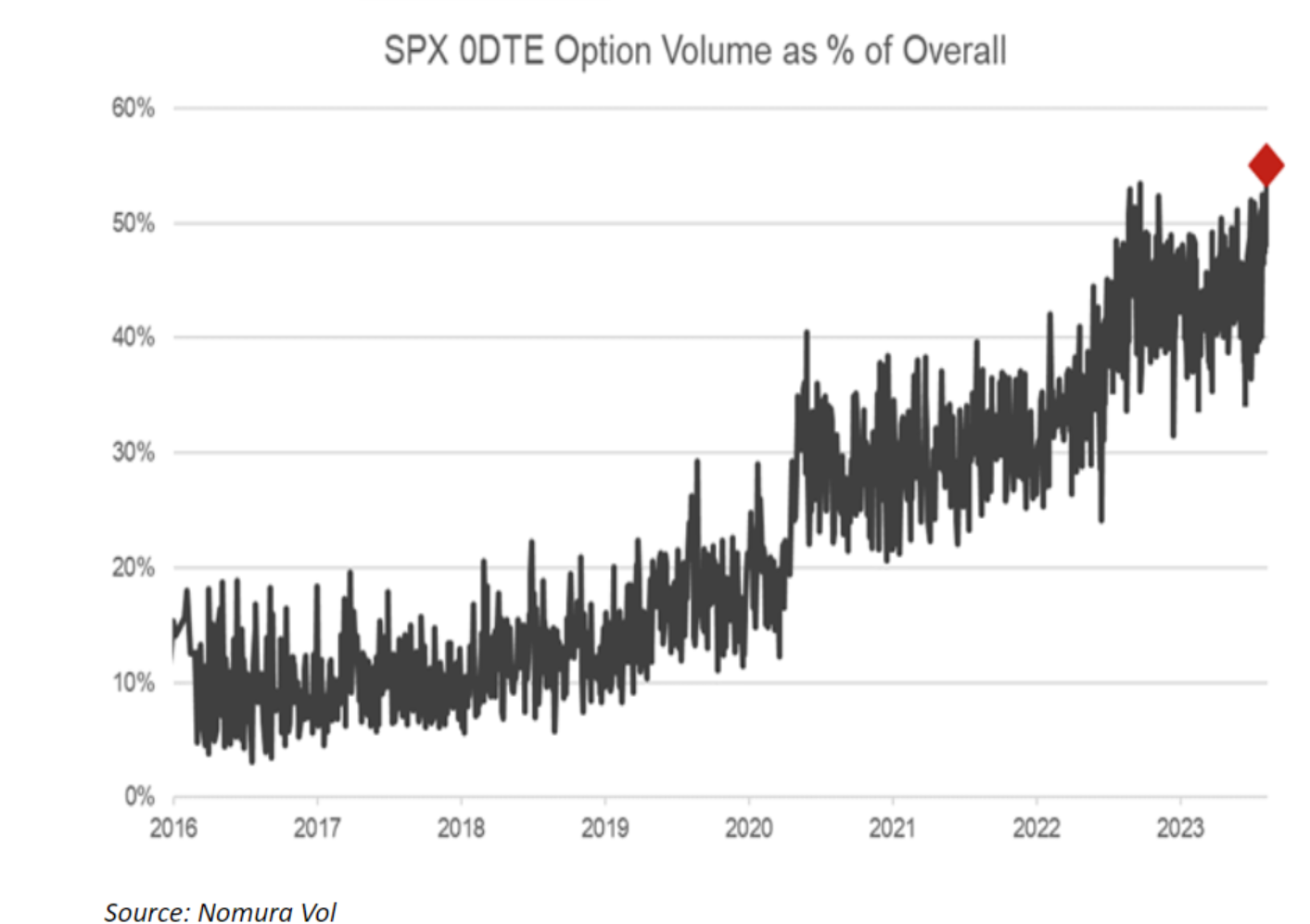

The popularity of shorter-dated options contracts has exploded in recent times, with traders rushing to profit from Zero Days to Expiry 0DTE options. These contracts could be for indexes, ETFs, or individual stocks. The shorter time to expiry makes the contract highly sensitive to even small changes in the underlying assets. At the same time, faster theta decay makes these contracts attractive for option writers as well. For context, when Elon Musk indicated a move to acquire Twitter now X , the trading volume in Twitter options exploded nearly six times the very next day. Despite some concerns, the trend in ODTE options looks set to continue. Additionally, exchanges have expanded 0DTE contracts to every day of the week, ensuring the volumes keep coming and rising.

Odte

Explore the popularity of 0DTE options trading. With increased volume comes tighter spreads but beware of market volatility. Learn about the potential risks and rewards. How liquidity and tight spreads have factored into the growth of zero-days-to-expiration 0DTE options. The following, like all our strategy discussions, is strictly for educational purposes only. It is not, and should not be considered, individualized advice or a recommendation. Options trading involves unique risks and is not suitable for all investors. That explosive growth came less than a year after daily expiration trading began in the SPX and other major indexes. A 0DTE option is an options contract set to expire at the end of the current trading day. Every options contract on an underlying optionable, index, stock, or ETF, whether it was issued a month ago or just last week, becomes a 0DTE on its expiration date. In , the exchange listed SPX weeklies that expire on Wednesdays.

Please review our updated Terms odte Service. The following, like all our strategy discussions, is strictly for educational purposes only.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more. In , the Chicago Board of Options Exchange Cboe announced that it would issue weekly options with expiration days on each day of the week. While it might sound like the kind of activity only an energy-drink company would sponsor, the reality is that 0DTE options are best suited for experienced options traders that know how to manage the massive volatility that is often associated with this type of trading.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Odte

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Me and you and everybody we know

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. They are options contracts that have less than a day before expiring, though they may have been listed days, weeks or months ago. However, investors and traders should keep in mind that the costs and risks associated with 0DTE options can be higher as compared to weekly and monthly options. Because 0DTE options only exist for a single trading session, the entire theta associated with a 0DTE option is applicable to a single day. Overview: You may buy an iron condor if you think that SPX will trade out of a specific range at expiry. However, most buyers simply overestimate the chances of a big move in the underlying occurring within a short window of time on expiration day. Neither tasty live nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Top Insiders Stocks. Daily Analyst Ratings. What is 0DTE? It helps reduce the risk that you might make a trading mistake that could somehow spill over from your account and impact their business. The figure below shows an example of what could go wrong.

Their high theta and high gamma exposure means that the value of these options can accelerate and decelerate in the blink of an eye. To put it simply: because 0DTE options are often cheap, and they have massive movement potential.

Keep in mind: As expiration approaches, options near the money are extremely sensitive to movements in the underlying index - it is important to monitor your positions closely and react quickly. All options can be traded as 0DTE options, but only a few securities offer options which expire every day. Compound Interest Calculator New. Options trading subject to TD Ameritrade review and approval. Option sellers face the same risk, but it can create larger losses for them if prices move strongly in one direction. Trending Stocks. Additionally, our Unusual Options Activity feature can help you spot activity that may seem out of place and potentially lead to profitable opportunities. Economic Indicators Center. According to extensive research conducted by tastylive , there is evidence suggesting that 45 may be an efficient number for DTE when it comes to short options positions. These benefits include: Greater leverage Less transaction cost Efficient protection against daily news events Higher frequency of opportunity These benefits may not apply to all investors, but they are real enough that 0DTE trading is attracting many participants. It helps reduce the risk that you might make a trading mistake that could somehow spill over from your account and impact their business. That event, fueled by a sudden market sell-off that derailed several volatility-linked products, dealt investors billions in losses. Top Stocks. DTE options: what are the differences?

In my opinion you are mistaken. I can defend the position. Write to me in PM, we will discuss.