Norwich city council tax bands

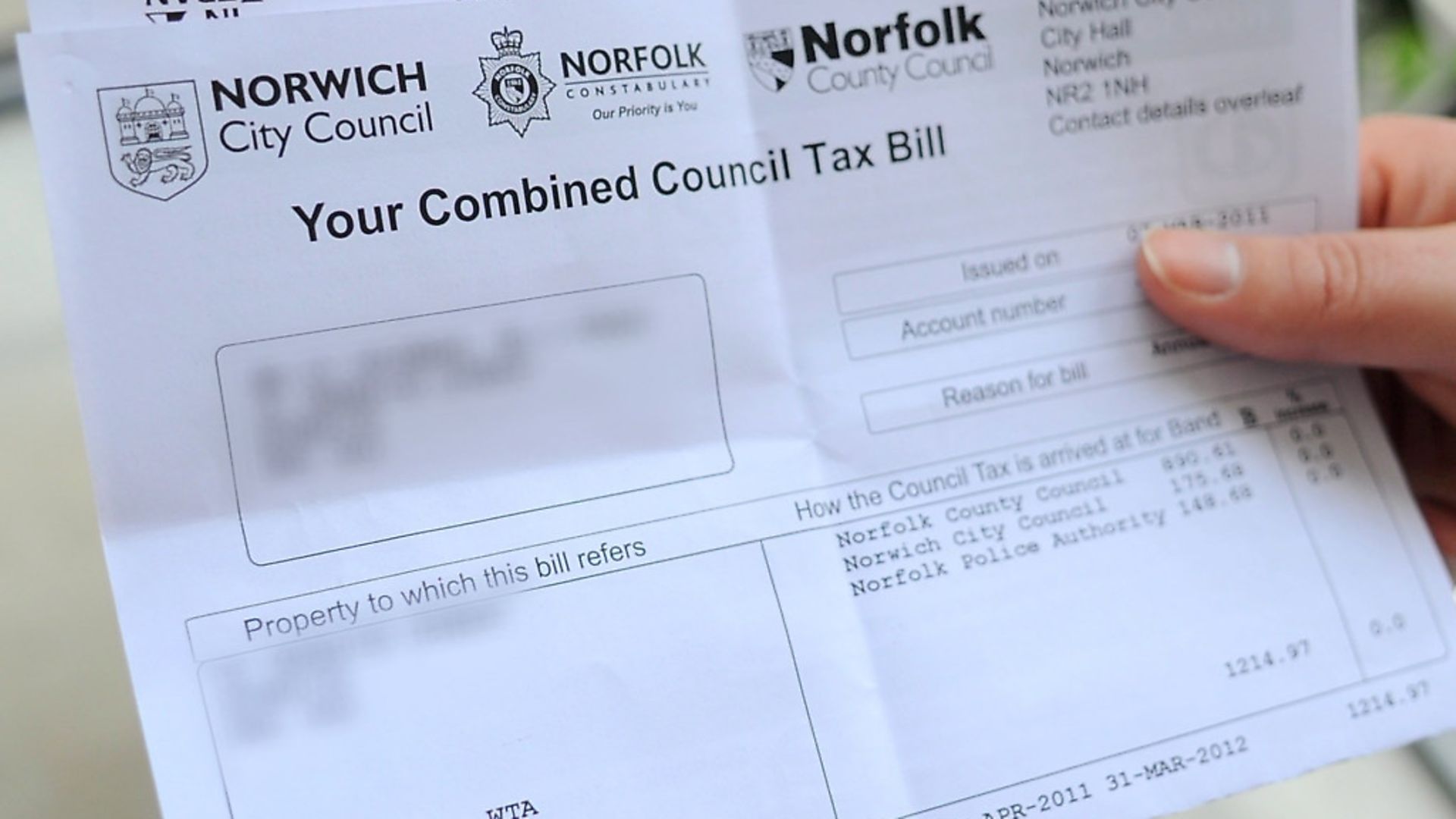

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed.

The council tax you pay goes towards a range of services provided by the County Council, police, district and parish councils. Council tax is collected by your local district council. For specific information about council tax, such as registering for council tax, billing and paying your council tax, changing address, council tax benefits, discounts and exemptions, and council tax banding, you will need to contact your local district council. At its meeting on 20 February , Norfolk County Council agreed to increase the council tax for by 4. The agreed council tax increase of 4. This balanced approach recognises the financial pressures faced by local taxpayers while enabling the council to protect vital services and will help to ensure a robust and sustainable financial position in future years.

Norwich city council tax bands

One of the key policies affecting some people this year is a proposed 2. Owners of long-term empty properties between one year and five years will also face a pc premium on council tax bills, which is to be introduced next year. This comes before the introduction of the second home premium, which will come into force in April People receiving council tax support will continue to receive a pc reduction, which follows a public consultation that showed 59pc of respondents were in support of keeping this at its current rate. Finance officers said that while the council continues to face financial challenges - blamed on a "sustained period of austerity" and increased demand for services - its ambition remains "undiminished". In what is perhaps in part an allusion to Anglia Square, the report says the council wants to "make a real difference to the physical fabric of the city" and that it will work with the private sector to help fund this investment. But plans for the major regeneration project have fallen by the wayside this week after developer Weston Homes announced it has scrapped the scheme due to rising costs. We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused. Please report any comments that break our rules. Those ads you do see are predominantly from local businesses promoting local services. These adverts enable local businesses to get in front of their target audience — the local community. It is important that we continue to promote these adverts as our local businesses need as much support as possible during these challenging times. Budget

If you live on your own or are on a low income you may be entitled to discounts or exemptions in your Council Tax, or you may qualify for Council Tax support. If your property didn't exist in or in Walesit will be compared to the same types of properties in the area, norwich city council tax bands.

Your council tax band determines how much council tax you pay. It's calculated based on the value of your property at a specific point in time. For instance, in England your council tax band is based on what the value of your property would have been on 1 April Council tax bands are calculated differently in England, Scotland, Wales and Northern Ireland - we explain the bands for each below. If you don't think your property has been valued correctly, you can dispute your council tax bill.

The Secretary of State made an offer to adult social care authorities. It was originally made in respect of the financial years up to and including Anyone who needs help to pay Council Tax and is on a low income could qualify for Council Tax Reduction. If you think you are entitled to Council Tax reduction or are having trouble paying your bill, please contact us as soon as possible so we can help. Your bill will be changed if you qualify for any of the Council Tax discounts or exemptions. There are very few circumstances in which appeals against banding can be made and are restricted to:. Appeals should be made online at www. You may also appeal against being billed if you consider that you are not liable to pay Council Tax. Making an appeal does not allow you to withhold payment of Council Tax. If your appeal is successful, you will be entitled to a refund of any overpayment.

Norwich city council tax bands

How can I pay? Payment methods are listed on the back of your bill and you can choose the best option for you. We recommend Direct Debit as being the easiest way to pay. How much do I need to pay? When are my instalments due? Your bill will state the dates that your payments are due. If you pay by Direct Debit you will have selected a payment date. If you pay by any other method, your payment plan can be set for the 1, 8, 15 or 28 of each month. Please contact us if you wish to change your payment date.

18 inches on tape measure

Northern Ireland did not switch to council tax in the s, but kept the old system of domestic rates. Those ads you do see are predominantly from local businesses promoting local services. Enter the terms you wish to search for Search. Properties in Wales were revalued in , meaning council tax bands are based on their market value on 1 April Properties in Scotland are also put into one of eight bands A-H , based on their value in April Council tax bands are calculated differently in England, Scotland, Wales and Northern Ireland - we explain the bands for each below. There are nine valuation bands A-I , which are as follows:. Your data will be processed in accordance with our Privacy policy. Properties in England are put into one of eight bands A-H , depending on the price they would have sold for in April Discounts and Exemptions If you live on your own or are on a low income you may be entitled to discounts or exemptions in your Council Tax, or you may qualify for Council Tax support. But the band ranges are different than those in England. Norfolk County Council rubber-stamped its 4. The Conservative-led West Norfolk Council recently rejected calls to introduce a similar scheme there. Do your tax return online with Which?

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. Norwich City Council Image: Archant. The share of your council tax which goes to City Hall will increase by 2.

Paul Kendrick, cabinet member for resources, added that it would protect Norwich people by "extending security and opportunity to every citizen during these tough times". The valuation band ranges for Scotland are as follows:. Note down the most recent sales price and date of similar properties to yours in your street. These adverts enable local businesses to get in front of their target audience — the local community. The budget was agreed by the council at a meeting on Tuesday evening. If your challenge finds that your property has incorrectly been put in a higher band, not only will your council tax bills be lowered in the future, but your council will refund you the money you've overpaid. In this article How are council tax bands worked out? If, after working through the steps above, you're still sure your property is in the wrong band, it's time to make a challenge. What was in the Spring Budget small print? There are instances where people think their property has been put into the wrong council tax band. Submit Cancel.

0 thoughts on “Norwich city council tax bands”