Nifty max pain today

If you find different versions of Bank Nifty Option chain, don't get confused. The way of presenting Bank Nifty Option Chain may be different but the data will always remain the same.

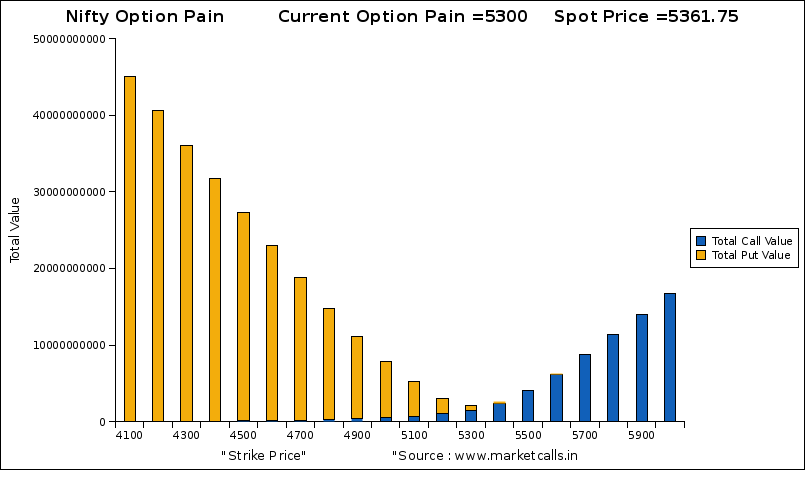

Learn why to use Max Pain calculator, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE. In the financial world, many consider options trading as one of the complex and dynamic reasons. The reason is traders have to apply various strategies to increase their profits and manage the risk effectively. Also, they use various types of tools and software to choose the right strategy. Among them, one concept is very important for every trader to understand - Options Max Pain. It represents the price level at which the maximum number of options contracts will expire worthless, resulting in the least amount of loss for options traders. In simple words, the Options Max Pain for Nifty , Bank Nifty theory says that the price of the underlying asset may come to the point that results in the max loss to the option buyers at the time of expiry.

Nifty max pain today

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:. The Put Call Ratio is a fairly simple ratio to calculate. The ratio helps us identify extreme bullishness or bearishness in the market. PCR is usually considered a contrarian indicator. Meaning, if the PCR indicates extreme bearishness, then we expect the market to reverse, hence the trader turns bullish.

Bank Nifty Option Chain can have different presentations but data remains the same.

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker. Search Stock or Index Pull Call ratio.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Nifty max pain today

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:. The Put Call Ratio is a fairly simple ratio to calculate. The ratio helps us identify extreme bullishness or bearishness in the market. PCR is usually considered a contrarian indicator.

Chanel trainer sneakers

Learn why to use Max Pain calculator, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE. Intraday Analysis Nifty Live Max pain chart analysis provides a unique perspective for the selected underlying asset, which helps traders make robust and informed trading decisions. All rights reserved. With such tools in your trading basket, you can get an extra edge to navigate the complex world of financial trading. And when strike price is equal to security price, it is an at the money call option. For the best possible experience, please disable your Ad Blocker. You need to understand these factors to predict where MaxPain will be at the end of the expiry week. Built using WordPress and the Mesmerize Theme. Calculating Max Pain Max pain is a simple but time consuming calculation. Risk Mitigation A proper understanding of the Options Max pain for Nifty and Bank Nifty allows traders to better manage and mitigate the risk; they can effectively adjust their positions and strategies as per the market sentiment. Market Secrets. A proper understanding of the Options Max pain for Nifty and Bank Nifty allows traders to better manage and mitigate the risk; they can effectively adjust their positions and strategies as per the market sentiment. Risk Management. Bank Nifty Max Pain.

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website.

Open interest can be a used as a tool to measure the market activities. How can a trader benefit? Risk Management. So the Bank Nifty Option Chain is divided into two parts: Put option contracts and call option contracts. Learn why to use Max Pain calculator, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE. Gold GOLD. Many technical analysts have come to believe that the knowledge of OI can present important information about the market. Volume PCR. If you find different versions of Bank Nifty Option chain, don't get confused. Open Interest. Get the latest updates in your inbox!

0 thoughts on “Nifty max pain today”