M&t check deposit funds availability

Everyone info.

The convenience and comfort of community banking from anywhere — at any time. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you. View deposited and cleared checks right within the app. Order a replacement card, report a lost or stolen card or add authorized users to your credit card. Help protect your account with timely updates about spending, security and other activities that impact your money. We use design standards that help customers identify, interpret, understand, and interact with information presented on our websites and mobile apps.

M&t check deposit funds availability

Each bank or credit union has its own rules as to when it will let you access money after you deposit a check, but federal law establishes the maximum length of time a bank or credit union can make you wait. If your deposit is a certified check, a check from another account at your bank or credit union, or a check from the government, you can withdraw or use the full amount on the next business day if you make the deposit in person to a bank employee. If you make a check deposit at an ATM at your bank, you can withdraw or use the full amount on the second business day. Your bank or credit union has a cut-off time for what it considers the end of the business day. If you make a deposit after the cut-off time, the bank or credit union can treat your deposit as if it was made on the next business day. Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee. If you need the money from a particular check, you can ask the teller when the funds will become available. A receipt showing your deposit does not mean that the money is available for you to use. Searches are limited to 75 characters. Skip to main content.

Looking for something else? Send feedback. The APP gets 2 stars and only 2 stars because it's helpful when you can get it to work.

Reset Your Online Banking Passcode. Find Your Routing Number. Report a Stolen Debit or Credit Card. Use our online help center so you can find your answers and get back to what matters most to you. Set personalized playlists for your unique situation and get step-by-step guides and advice for how to save for college, a house, your business or retirement.

Did you know that the funds from a deposited check are not actually yours until it's been cleared by the bank? Many people mistakenly believe that banks add funds immediately into your account after the check has been deposited -- but this is merely the first step. Although the deposited amount of money will be posted to your account when it is received by the bank, additional time is needed for the verification process -- from banks on both ends -- before funds become available for withdrawal. At this time, you will see a discrepancy in the amount listed for your Account Balance and Available Balance. The Available Balance indicates the amount you have to use at your disposal and the Account Balance shows the total amount you have in your account -- including funds that have yet to clear. The actual transaction is a multi-step process, heavily dependent on the paying institution, with several factors that could possibly delay your bank from receiving the funds. For this reason, the exact time it will take to clear a check cannot be determined until the check is submitted for payment of funds. Note that the time it takes for your funds to become available is not the same as the time it takes for checks to clear at the bank -- people often confuse the two. The fund availability policy that your bank operates on is good for most consumers because it means that you do not have to wait for checks to fully clear before getting access to the deposited amount.

M&t check deposit funds availability

Reset Your Online Banking Passcode. Find Your Routing Number. Report a Stolen Debit or Credit Card. Use our online help center so you can find your answers and get back to what matters most to you. Set personalized playlists for your unique situation and get step-by-step guides and advice for how to save for college, a house, your business or retirement. Look for a lock next to our web address and "https" at the beginning of our web address to indicate secure pages displaying your sensitive customer information. If you receive this type of email, please forward to phishing mtb. Help us make your banking experience better. Send feedback. Equal Housing Lender.

Four digit security number bet365

If you make a deposit after the cut-off time, the bank or credit union can treat your deposit as if it was made on the next business day. It seems just not to work well. Equal Housing Lender. If after speaking with them further assistance is needed, email carecenter mtb. We recommend calling our Online Team at Hello Jeff, Sorry to hear you are having difficulties with the mobile app. Digital Wallet. For example, a merchant may do this when you are checking into a hotel — the hotel may request to authorize more than the amount of the room to cover additional charges booked to your room. How often can I lock or unlock my card? Locking your card is only available through Online or Mobile Banking. What are my mobile check deposit dollar limits? When depositing a check in-person, you may also need to fill out a deposit slip and provide a government-issued ID. Recurring payments e. Search Search. Member FDIC.

The convenience and comfort of community banking from anywhere — at any time. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you.

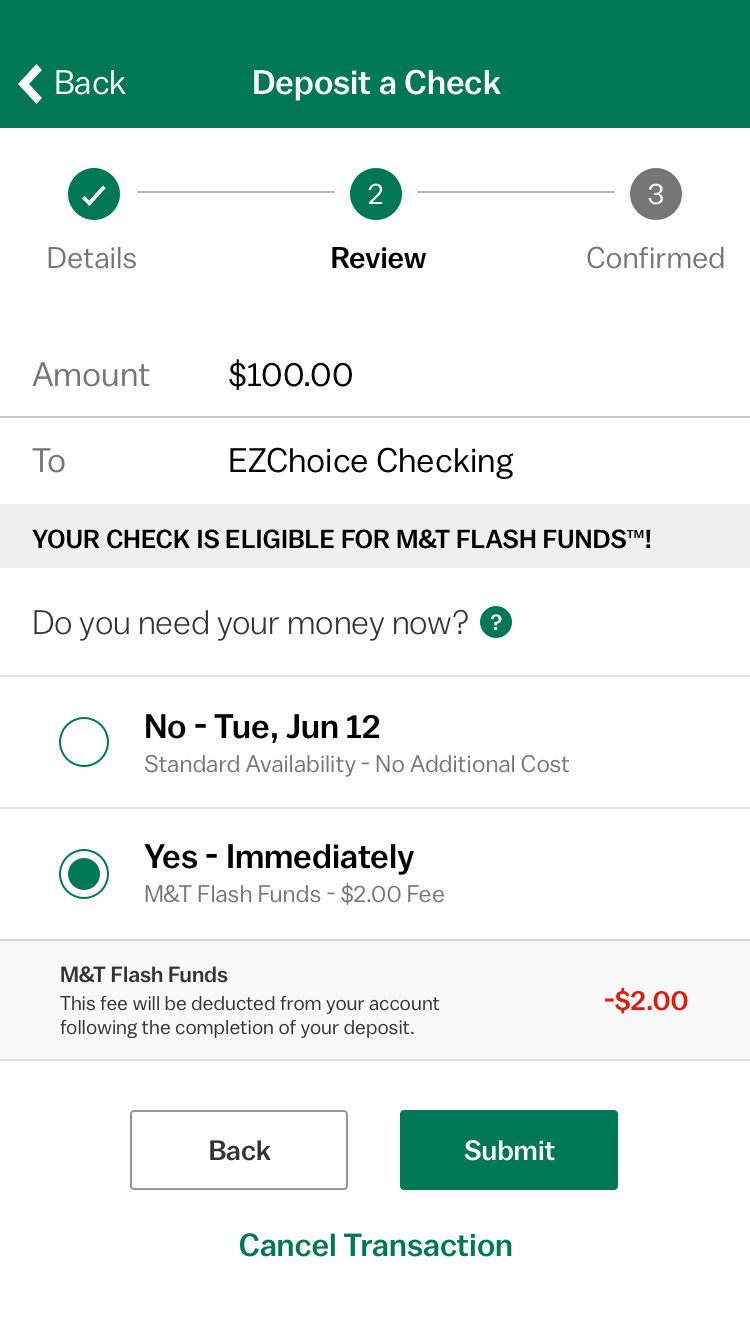

When will my deposit process if I use mobile check deposit? Your bank or credit union has a cut-off time for what it considers the end of the business day. This fee will be deducted from your account following the completion of your deposit. Report a Stolen Debit or Credit Card. Enroll Now. Some of my alerts read that the transaction amount may not be final. All checks drawn on U. Search for your question Search for your question. In the event your payee does not receive payment on time and charges you a late fee, contact Online Banking Support at How do I turn them off?

In it something is. Many thanks for the help in this question, now I will know.