Miami dade county property taxes

Email: info virtuance. Your knowledge of property taxes for Miami listings helps your clients make informed buying decisions.

Create a Website Account - Manage notification subscriptions, save form progress and more. Under Florida law, the assessment of all properties and the collection of all county, municipal, school district and special district property taxes are consolidated in the offices of the County Property Appraiser and County Tax Collector. Assessed values are established by the Miami-Dade County Property Appraiser with an annual determination of the just or fair market value. The County bills and collects all property taxes for the City. For information on property taxes, assessments, and assessed property values, please contact the Miami-Dade County Property Appraiser. All unpaid taxes on real and personal property become delinquent on April 1st and accrue interest charges from April 1st until a tax sale certificate is sold at auction. In addition, unlimited amounts may be levied for the payment of principal and interest on general obligation long-term debt, subject to a limitation on the amount of debt outstanding.

Miami dade county property taxes

This accounts for The average property tax rate in Miami-Dade County is 1. Property taxes are based on the assessed value of the property, which is typically lower than the market value. In Florida, property values are assessed on January 1st. Property value notices are issued in August and property tax appeal deadlines are typically 25 days from the date of the value notices, which is usually in September. Property tax bills are issued on November 1st. Miami-Dade County has an average property tax rate of 1. This rate is applied to all properties in the county, regardless of their location. However, the effective property tax rate can vary significantly from city to city. For example, the city of Medley has an effective property tax rate of 2. This means that property owners in Medley will pay more in taxes than those in Hialeah. Overall, Miami-Dade County has a relatively low property tax rate compared to other counties in the state. This is beneficial for property owners, as it allows them to keep more of their money in their pockets.

Sit back and let us get to work.

All rights reserved. Please be aware that when you exit this site, you are no longer protected by our privacy or security policies. The Miami-Dade Clerk of Court and Comptroller is not responsible for the content provided on linked sites. The provision of links to external sites does not constitute an endorsement. Ok Cancel. Visit the Tax Deed Unit or the Online Tax Deed Auction to review information on the different properties offered for sale and for future tax deed sale dates.

We facilitate current and delinquent real and personal property taxes, special assessments for all local taxing authorities, local business tax receipts, and convention and tourist taxes. We also issue automobile, boat, hunting and fishing licenses, as well as process motor vehicle registration and renewals. Real estate taxes are collected annually and can be paid online, by mail or in person. Partial, deferred and installment payments are also available. Apply for or renew your local business tax receipt, or request a change to your existing account. Taxes must be paid on tangible personal property, which are assets used in a business to derive income. Hotels, restaurants and rental living accommodations are subject to several types of taxes. Learn how you can bid in an online auction for tax certificates. A Fire and Out-of-Business Sale Permit is required if you plan to organize a sale that will lead to the closing of a business.

Miami dade county property taxes

Miami-Dade County collects, on average, 1. Miami-Dade County has one of the highest median property taxes in the United States, and is ranked th of the counties in order of median property taxes. The average yearly property tax paid by Miami-Dade County residents amounts to about 4. Miami-Dade County is ranked th of the counties for property taxes as a percentage of median income. You can use the Florida property tax map to the left to compare Miami-Dade County's property tax to other counties in Florida. To compare Miami-Dade County with property tax rates in other states, see our map of property taxes by state. Because Miami-Dade County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. Instead, we provide property tax information based on the statistical median of all taxable properties in Miami-Dade County.

This is the day song lyrics

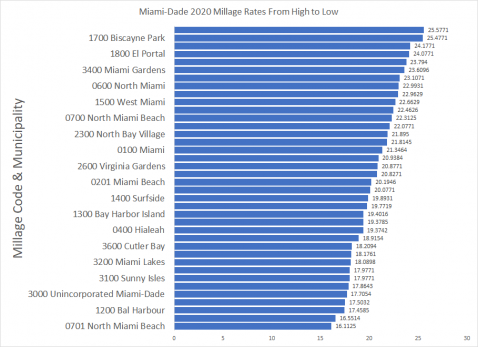

Property value notices are issued in August and property tax appeal deadlines are typically 25 days from the date of the value notices, which is usually in September. Bay Harbor Islands. Fortunately, Miami is accessible from several other cities nearby. Review a list of lands available. This accounts for Your knowledge of property taxes for Miami listings helps your clients make informed buying decisions. Average Property Tax Rate. Property Tax Bill This table shows the percentiles of actual property tax paid on residential properties for each city in Miami-Dade County. Golden Beach. While Florida has no state income tax, Miami-Dade locals pay the highest property tax rates in the state. The Miami-Dade Clerk of Court and Comptroller is not responsible for the content provided on linked sites. For example, the city of Medley has an effective property tax rate of 2. Online Tax Deed Auction Review the different properties offered for sale as well as future tax deed sale dates.

.

Golden Beach. Ownwell handles everything start to finish with no up-front costs. South Miami. Key Biscayne. Don't Miss Your Property Tax Appeal Deadline Ownwell will automatically evaluate all new property tax assessments, identify if you should appeal, then handle the end to end property tax appeals process. Under Florida law, the assessment of all properties and the collection of all county, municipal, school district and special district property taxes are consolidated in the offices of the County Property Appraiser and County Tax Collector. All unpaid taxes on real and personal property become delinquent on April 1st and accrue interest charges from April 1st until a tax sale certificate is sold at auction. Locals, on the other hand, enjoy art and fashion, delicious cuisine, and no state income tax. Frequently asked questions What states are you located in? Therefore, each consecutive percentile doesn't necessarily show a larger value. Property taxes are based on the assessed value of the property, which is typically lower than the market value. The Miami-Dade Clerk of Court and Comptroller is not responsible for the content provided on linked sites. Email: info virtuance. Opa Locka. The County bills and collects all property taxes for the City.

0 thoughts on “Miami dade county property taxes”