M&g dynamic allocation

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US.

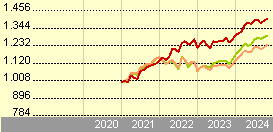

The fund has a highly flexible investment approach with the freedom to invest in different types of assets issued anywhere in the world and denominated in any currency. The fund will typically use derivatives to gain exposure to these assets. As well as the ability to take long and short positions, the fund managers can go negative duration. Asset allocation is expected to be the main driver of returns over time. This can be thought of as a strategic asset allocation.

M&g dynamic allocation

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here. The Quantitative Fair Value Estimate is calculated daily. For detail information about the Quantiative Fair Value Estimate, please visit here. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time.

About Us.

We'd also like to use analytics cookies so we can understand how you use our services and to make improvements. You've accepted analytics cookies. You can change your cookie settings at any time. You've rejected analytics cookies. We use cookies to make our services work and collect analytics information. To accept or reject analytics cookies, turn on JavaScript in your browser settings and reload this page.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

M&g dynamic allocation

This multi-asset strategy dynamically responds to shifting price relationships between assets, with a view to maintaining a forward-looking view of diversification at all times. It aims to target a high total return and is suited to investors with a higher-than-average risk tolerance. With a high degree of flexibility to invest across asset classes, regions and currencies, and the ability to take short positions, the strategy can exploit a wide range of opportunities. Exposure is normally gained via derivatives using strict risk management techniques. This strategy is well-positioned to react to any significant market movements that appear to be driven by irrational changes in market sentiment.

Alexa escape room cheats jail

The fund has a highly flexible investment approach with the freedom to invest in different types of assets issued anywhere in the world and denominated in any currency. Hide this message. Role In Portfolio. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. Top 5 Regions. Show more Opinion link Opinion. Non-UK stock. FT has not selected, modified or otherwise exercised control over the content of the videos or white papers prior to their transmission, or their receipt by you. Advanced Graph. Per cent of portfolio in top 5 holdings: Management Manager Name. All rights reserved. Price EUR

.

UK bond. Non-UK bond Rising life expectancy across the world increases opportunities for healthcare, financial services and leisure companies. To accept or reject analytics cookies, turn on JavaScript in your browser settings and reload this page. The fund allows for the extensive use of derivatives. Skip to content. Emerging Market. We'd also like to use analytics cookies so we can understand how you use our services and to make improvements. The green columns show the expected return or real yield from each type of asset. Investing for Retirement.

0 thoughts on “M&g dynamic allocation”