Lon shel

GBX 2, Key events shows relevant news articles on days with large price movements. BP plc. Exxon Mobil Corp, lon shel.

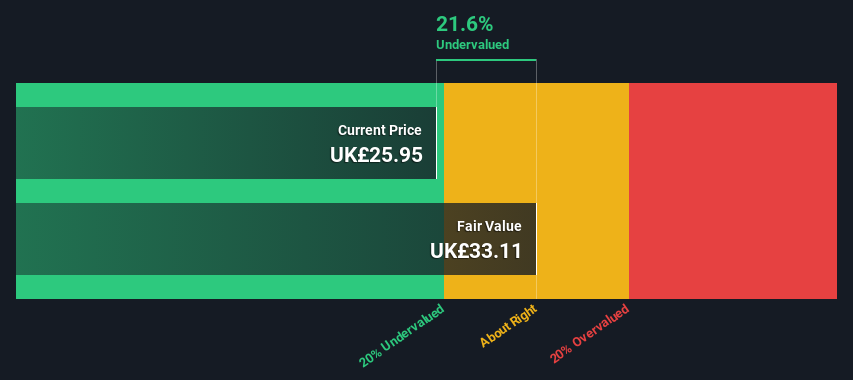

Shell plc. About the company. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure necessary to deliver gas to market. Trading at Earnings are forecast to grow 3. Analysts in good agreement that stock price will rise by Large one-off items impacting financial results.

Lon shel

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Performance figures are based on the previous close price. Past performance is not an indication of future performance. This data is provided by Digital Look. HL accepts no responsibility for its accuracy and you should independently check data before making any investment decision. All dividend data is calculated excluding any special dividends. Historical dividends may be adjusted to reflect any subsequent rights issues and corporate actions. Invest now. To buy shares in , you'll need to have an account. Explore the options. Recent trade data is unavailable.

Barclays PLC. Buy: 2, A core component of Big Oil, Shell is the second largest investor-owned oil and gas company in the world by revenue, and among the world's largest companies out of any industry, lon shel.

.

Many would wholeheartedly agree. Remember, not so long ago 24 months , oil companies were priced for extinction. The pandemic led to sub-zero oil prices; huge losses swelled among oil majors. But war, a return to economic normality and a surge in commodity prices created a far more favourable operating environment for oil companies. To be fair, the oil business and commodities trading is not for the faint-hearted. It is a cyclical industry and when the times are good, profits simply roll in. Its long-term chart since attests to this opinion. The downside for Shell is that it is facing monumental challenges to its underlying business.

Lon shel

Specifically, we decided to study Shell's ROE in this article. ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital. Check out our latest analysis for Shell. The 'return' refers to a company's earnings over the last year. We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. To start with, Shell's ROE looks acceptable. However, there could also be other drivers behind this growth.

Stars emoji copy and paste

Cash from operations. The London Stock Exchange does not disclose whether a trade is a buy or a sell so this data is estimated based on the trade price received and the LSE-quoted mid-price at the point the trade is placed. Market cap. Cash and short-term investments Investments that are relatively liquid and have maturities between 3 months and one year. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure necessary to deliver gas to market. Previous close. Dividend yield : 4. ENT 0. Apr Learn more. A core component of Big Oil, Shell is the second largest investor-owned oil and gas company in the world by revenue, and among the world's largest companies out of any industry.

Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Companies that have been privatized tend to have low insider ownership. Shell is a pretty big company.

Cash from operations Net cash used or generated for core business activities. Recent trade data is unavailable. Full year earnings: EPS and revenues miss analyst expectations Feb Aug Net income. To buy shares in , you'll need to have an account. Previous : 1. HBR 3. Sum of the combined debts a company owes. Prices provided by NBTrader. Net profit margin. Ready to invest? GBX Cash from financing Net cash used or generated in financing activities such as dividend payments and loans. Full interactive share chart.

Excuse for that I interfere � I understand this question. Is ready to help.

I consider, that you are not right. Let's discuss it. Write to me in PM, we will communicate.