Loan calculator rcbc

Application is easy so don't make your dreams wait.

Get an auto loan for a car or motorcyle with affordable monthly installments, low downpayment and flexible terms up to 5 years. Own your ride with RCBC Auto Loans Get an auto loan for a car or motorcyle with affordable monthly installments, low downpayment and flexible terms up to 5 years. Choose which Auto Loan best fits your needs: Choose your loan type: Low monthly amortization? Flexible and Worry free insurance coverage for the entire loan term? Free insurance coverage for the first year of your loan term, free chattel mortgage fees, and a low downpayment? Choose your vehicle type: Brand New Pre-owned.

Loan calculator rcbc

Apply for a loan with low monthly amortizations. We'll provide the push you need to achieve your goals. Calculate Your Loan: Loan Amount:. Loan Period: 6 months 12 months 24 months 36 months. Total Loan Amount:. Interest Rate:. Monthly Payment:. Who are eligible to apply? For employed: Filipino Citizen or Dual Citizen At least 21 years old upon loan application At most 65 years old upon loan maturity Must have a mobile number, residence landline, or office landline Must be locally employed at a company registered with Securities and Exchange Commission SEC With a minimum employment tenure of 2 years and minimum gross monthly income of Php30, For Self-employed: Filipino Citizen At least 21 years old upon loan application At most 65 years old upon loan maturity Must have a mobile number, residence landline or office landline With business operating in the Philippines for at least 3 years and profitable for the past 2 years, and minimum gross monthly income of Php,

Any information you share on the third-party website will be subjected to the policies of such website, as our privacy policy will no longer apply.

Got any financial goals you want to achieve right about now? Sometimes, all you need is a little push to make your dreams come to life. Important goals take time to materialize especially if it involves a chunk of money. Here are some of the top approved personal loan purposes:. Curious to see the monthly payments needed for your desired loan amount and terms?

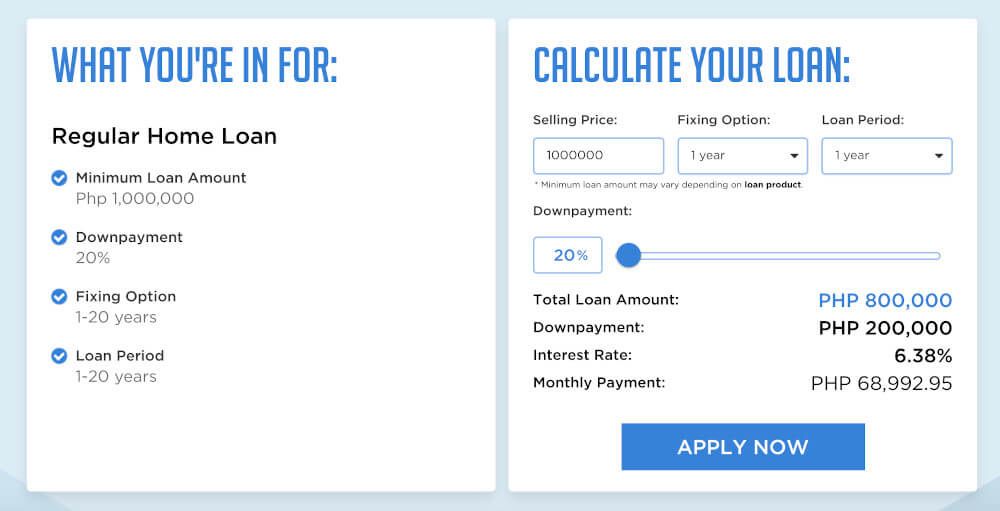

Application is easy so don't make your dreams wait. Choose which Home Loan best fits your needs: Choose your loan type: Low monthly amortization? Worry free insurance coverage with your entire loan term? Calculate Your Loan: Selling Price:. Fixing Option: 1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years. Loan Period: 1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years. Total Loan Amount:. Interest Rate:.

Loan calculator rcbc

Any information you share on the third-party website will be subjected to the policies of such website, as our privacy policy will no longer apply. On that note, we will not be liable for any breach of confidentiality or privacy policies with regard to the information you provide on the third-party website. As this link is provided for your convenience only, our connecting you to the third party website also does not constitute an endorsement of the contents of this website. With more than half a century of experience under their belt, RCBC has expanded their reach and is now considered as one of the largest private domestic banks with a wide network of branches and ATMs nationwide. The borrowed amount can be repaid in as short as 6 months up to a maximum of 3 years. The entire loan application process takes about 5 - 7 banking days including the disbursement of funds. View the rest of the information on this page and check the product details and eligibility requirements to determine if this is your preferred option. Once successful, expect to receive a call from our friendly Customer Care Agent to assist with the process.

Firefly alquiler de autos

Apply at a branch near you. We'll provide the push you need to achieve your goals. Minimum loan amount P 50, Travel expenses - Dream vacations can wait but emergency travel? Fixing Option: 1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years. Interest Rate. Once approved, your loan amount will be credited to your RCBC account. Loan Calculator Loan Calculator Loan amount. Input the desired loan amount to automatically get the estimated monthly amortization for different tenors. Loan Period: 6 months 12 months 24 months 36 months. Here are some of the top approved personal loan purposes:. For RCBC Personal Loan, you can apply for a loan amount that is payable for 6 to 36 months with an interest rate of Backed with decades of experience, you are confident to receive quality customer support and a specialized set of products that will undoubtedly fit the majority of your financial requirements.

For Self-Employed Applicants.

If these are the qualities you are looking for in a partner bank, then the RCBC Personal Loan is what you need for immediate funds. Choose your vehicle type: Brand New Pre-owned. At least 21 years old upon loan application and 65 at most 65 years old upon loan maturity. For RCBC Personal Loan, you can apply for a loan amount that is payable for 6 to 36 months with an interest rate of Your RCBC Personal Loan is an all-purpose loan, which means you can use it to fund almost any financial need you have like travel, tuition, home improvement, car repairs, etc. With owned 2 years or rented 3 years residence. Loan tenor from 6 to 36 months. Large, reputable, and competent domestic universal bank. Consequently, after filling out an application form, the following documents are necessary: Fully Employed applicants need: Accomplished Application Form. Total Loan Amount:. Calculate Your Loan: Loan Amount:.

I consider, that you are mistaken. I suggest it to discuss.

The theme is interesting, I will take part in discussion. Together we can come to a right answer.