Lloyds share isa

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more. Learn More.

Written by StockBrokers. Is Hargreaves Lansdown better than Lloyds Bank? After scoring the best share dealing accounts across 46 different variables, our analysis finds that Hargreaves Lansdown is better than Lloyds Bank. As the U. However, its fees are generally more expensive than rival brokers, which can become an issue for large investment pots. Comparing online share dealing platforms side by side is no small task.

Lloyds share isa

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No tie-ins, no set-up fees, no exit charges. Easy, online set up in minutes. Portfolio management fees of 0. There are also underlying investment charges, see our fees page. Plus, live chat, amazing customer support and brilliant investor tools and guides. Authorised and regulated by the FCA.

There is still that big risk that Lloyds will have a tough and could fall even further, mind.

Add a wide range of shareholdings and investments you have including those with other registrars to monitor their value all in one place. On this page you will find details of options available to you to buy or sell shares in Lloyds Banking Group plc within your Lloyds Banking Group Shareholder Account. The ATI service closes on 29 December Click here to go to the dealing site, to view the Terms and Conditions and our charges. Click here to view the Terms and Conditions and here to view our charges. Send your instruction to us by post.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No admin or transfer fees. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Why we like it: Commission-free investing: No fees for buying or selling stocks other charges may apply. Support: Fast and friendly customer support. Other charges may apply.

Lloyds share isa

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly. There are hundreds of stocks and shares ISAs, and various ways to choose which one is right for you:. You may want to do your own research first. Browse the national and financial press to get a feel for what's available.

Burlesque outfit

In addition to offering banking, lending, insurance, and much more, Lloyds also offers retail brokerage accounts for everyday trading and investing. Our guides can help you choose the right broker for you and the way you trade: whether you consider yourself an investing beginner , a more experienced active trader , or a mobile-first trading enthusiast. There are no analyst reports for shares or funds available and no recommendations from Lloyds analysts. They do face a real problem here. Lloyds is a retail and commercial bank headquartered in London, but it has branches all across the UK. So I already started my ISA with some investment trust shares. Manage via website, app or phone. For our review of U. Open online in less than 10 minutes. Invest in.

.

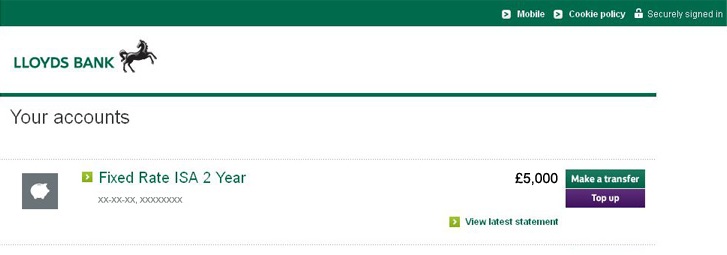

Terms and Conditions and Privacy Policy. In part because of that status, Lloyds was bailed out by the UK government during the financial crisis. That includes trading for Lloyds itself, as well as for popular shares like Tesco and Royal Mail. Self-invested personal pensions SIPPs and individual savings accounts ISAs are tax-advantaged savings accounts that are an important tool for many individual investors. Understand the risks. Previous close. Prices and trades are provided by Web Financial Group and are delayed by at least 15 minutes. Tax treatment depends on your individual circumstances and may change in the future. Lloyds is a retail and commercial bank headquartered in the United Kingdom. Choose your own investments — pick your own stocks and shares to meet your investment needs, or choose from our Select List of funds. Save and invest your way, or use our clever tech to build wealth automatically. How to start investing. Is now the….

It agree, rather the helpful information

I think, that you are mistaken. Let's discuss. Write to me in PM, we will talk.