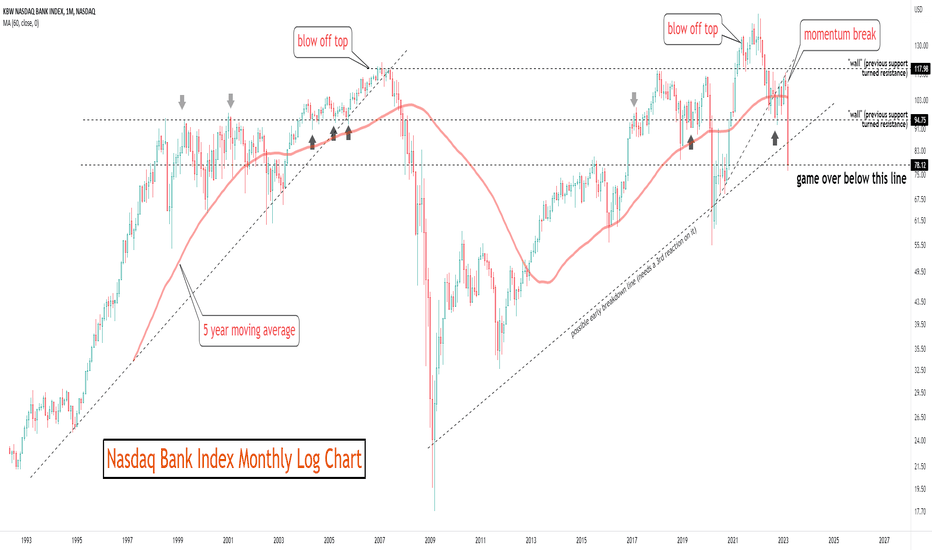

Kbw bank index

We can help you access a variety of investing opportunities as you pursue your financial goals. Explore the possibilities below. Optimize your portfolios with our new Portfolio Playbook.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Kbw bank index

.

Use profiles to select personalised content. As of Maythe individual index components included:, kbw bank index. The characterizations of distributions reflected in this table are as of the date noted below.

.

See all ideas. EN Get started. Market closed Market closed. No trades. BKX chart. Today 5 days 1 month 6 months Year to date 1 year 5 years All time. Key data points.

Kbw bank index

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Clingy crossword clue

Investments focused in a particular industry, such as banking, are subject to greater risk and are more greatly impacted by market volatility, than more diversified investments. These ETFs attempt to track the underlying index by owning the same mix of component stocks, however, no ETF can achieve perfect correlation because of the fund's need to accommodate any redemption of shares. It does not include regional banks, which are typically somewhat smaller. Therefore, investors should analyze both the KBW Bank Index and a representative of the next tier in the banking sector. According to Nasdaq, the Index Committee attempts to keep turnover at a minimum. The characterizations of distributions reflected in this table are as of the date noted below. Interim evaluations may take place after extraordinary circumstances. For example, Goldman Sachs, Metlife, and Berkshire Hathaway are notably absent from its components, though these stocks are listed in the holdings of other similar indexes. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Key Takeaways KBW Bank Index tracks the stock prices of prominent banking companies in an attempt to be a bellwether for banking industry watchers.

.

Financial Intermediaries Advisor Site. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. The Index is a modified-market capitalization-weighted index of companies primarily engaged in US banking activities. Optimize your portfolios with our new Portfolio Playbook. The Committee evaluates the composition of the index on a quarterly basis in March, June, September, and December. Compare Accounts. Calculation and dissemination of the index's value happen once per second throughout the regular trading day under the symbol BKX. Understand audiences through statistics or combinations of data from different sources. The Fund is non-diversified and may experience greater volatility than a more diversified investment. KBW Bank Index has been around since Ordinary brokerage commissions apply.

Yes, really. I agree with told all above. Let's discuss this question.

It is difficult to tell.

What abstract thinking