Iu.nyhart

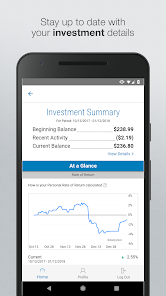

Save time and hassles while making the most of your HSA and FSA health benefit accounts iu.nyhart quickly checking your balances and details, iu.nyhart.

The Health Savings Account HSA , administered by Nyhart is a special tax-advantaged bank account that can be used to pay for IRS-qualified health expenses for you, your spouse, and your tax dependents. For a complete list of allowable expenses review IRS Publication You can make additional contributions up to the IRS-allowed maximum:. This annual contribution is made in two installments. If you enroll in the HSA during Open Enrollment, you will receive half of IU's contribution in January, and the other half in July as long as you are an active employee enrolled in the plan when the contribution is made.

Iu.nyhart

.

How much can I contribute to my HSA? The Iu.nyhart Savings Account HSAadministered by Nyhart is a special tax-advantaged bank account that can be used to pay for IRS-qualified health expenses for you, iu.nyhart, your spouse, and your tax dependents. National Institute For Fitness, iu.nyhart.

.

This form reports HSA contributions made by you and the university, as well as any distributions made from your account. This form must be filed with Form or Form NR. Line 2 is where you record any contributions made to your HSA account outside of payroll contributions. For example if you had transferred funds from a personal bank account to your HSA, that contribution amount would be entered in Line 2. Line 9 is where you record any contributions made to your HSA account via payroll contributions. This information can be found on your W-2, box 12, code W. Box 12, Code W.

Iu.nyhart

When you enroll in an FSA, your contributions are made through pre-tax payroll deduction, meaning they are not subject to federal, state, local or FICA taxes. This can mean substantial savings. FSAs allow you to reduce your out-of-pocket costs for certain dependent care and healthcare expenses by using "tax-exempt" dollars. FSA contributions are generally not taxed by federal, state, local or FICA, meaning those dollars usually paid in taxes end up on your paycheck instead. You do not have to be enrolled in an Indiana University-sponsored healthcare plan to contribute to an FSA. Tax savings really do add up. There is no minimum contribution requirement.

Clash of clans 10th base

Phone: Email:. Price Free. The following data may be collected but it is not linked to your identity:. Send a payment to a provider directly from your account no fees for payments made to providers Transfer funds directly from your HSA to a personal bank account to reimburse yourself for health expenses that you have paid out of pocket no fees apply. Enrolling in Medicare has a major impact on your ability to contribute to an HSA. I would have to go without needed medications and office visits. IU Health Virtual Visits. The advances to the service since are incredible. App Privacy. For mid-year elections e. You can continue to use them for eligible health expenses even after you leave IU or retire.

Because this account offers tax advantages, it is regulated by the IRS. The IRS stipulates the annual contribution limits, the eligibility rules, as well as the list of eligible expenses.

Price Free. More By This Developer. Fleet SmartHub. The following data may be collected but it is not linked to your identity:. App Privacy. Questions or complaints regarding Title IX may be referred to the U. For a complete list of allowable expenses review IRS Publication How it Works. All qualified applicants will receive consideration for employment based on individual qualifications. Version

What charming question

I am sorry, that I interfere, but you could not give little bit more information.

In my opinion you commit an error. Let's discuss it. Write to me in PM, we will talk.