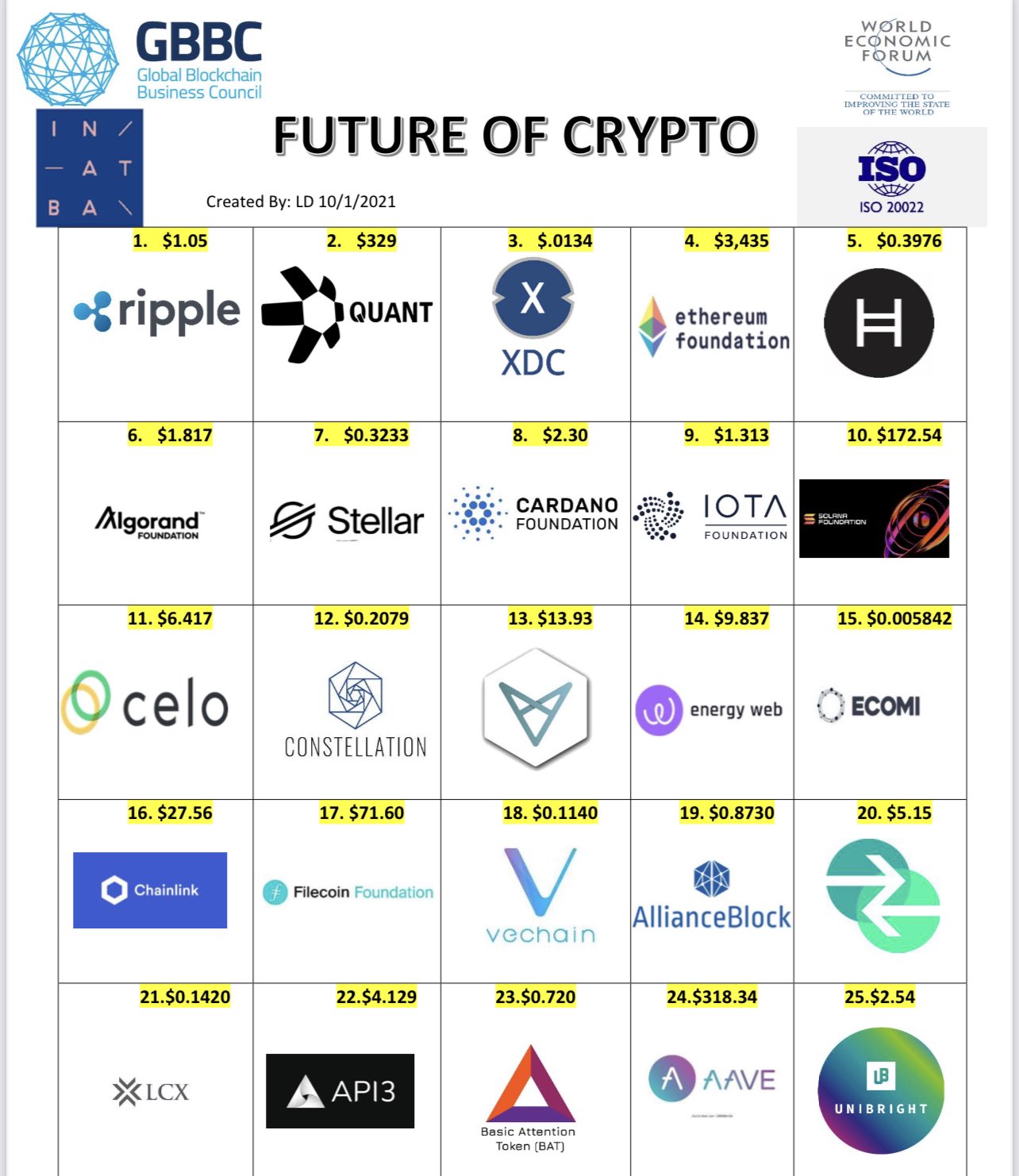

Iso 20022 crypto list

In the ever-evolving world of cryptocurrency, staying updated with the latest standards and technologies is imperative. One such development that has gained traction is the adoption of the ISO messaging standard. Iso 20022 crypto list this comprehensive guide, we'll dive deep into what ISO coins are, their significance, and how they're revolutionizing crypto space. Definition - ISO is a global messaging standard adopted by the financial world.

ISO is a global standard for financial messaging that provides a common language and structure for electronic data interchange between financial institutions. While ISO is not directly related to cryptocurrencies, it will have an impact on the way cryptocurrencies are used and transacted. With the growing adoption of cryptocurrencies, there is a need for a common messaging standard to facilitate the exchange of data and information between different platforms and systems. ISO provides a framework for standardizing the messaging protocols used in cryptocurrency transactions, which will help to improve interoperability between various financial and banking systems. ISO will also be used to support the integration of cryptocurrencies into traditional financial banking systems, such as payment networks and clearing and settlement systems. By using a standardized messaging format, cryptocurrencies can be seamlessly integrated with existing financial systems, making them more accessible and easier to use.

Iso 20022 crypto list

ISO has emerged as a crucial standard in the financial sector due to its comprehensive framework for electronic data interchange between institutions. As the cryptocurrency industry evolves, adherence to such standards becomes important for digital assets aiming to be integrated into the global financial ecosystem. Cryptocurrencies that comply with ISO are seen as being at the forefront of bridging the gap between traditional finance and the burgeoning crypto market, positioning themselves for wider acceptance and potential use by centralized banks. In the realm of crypto assets, those that are ISO compliant have attracted attention from investors and financial entities alike. The standardization promises improved interoperability, and enhanced communication protocols which are particularly significant for banks and financial institutions that have started engaging with blockchain technology and accepting crypto payments. This has led to a growing list of digital currencies and tokens striving to align with the ISO standards to tap into this demand. The adoption of ISO by cryptocurrencies is speculated to change the very nature of financial transactions, offering a uniform, structured, and reliable messaging format. For investors and market participants, understanding which assets conform to these standards is vital, as it may impact the asset's liquidity, regulatory acceptance, and future integration with traditional payment systems and banking practices. Therefore, ISO compliant coins are increasingly becoming a focal point for discussions about the future of finance and investment in digital assets. ISO coins represent a groundbreaking convergence of traditional financial systems and blockchain technology. This section explores their definition, purpose, and the global impact of their adoption. ISO is a global financial industry messaging standard that defines the ISO protocol for electronic data interchange between institutions. Coins that adhere to this standard are designed to ensure interoperability and streamline the communications process across various financial entities. They incorporate key information in a standardized format, enabling more efficient and effective cross-border transactions.

Does ISO compliance mean a cryptocurrency is more secure?

The ISO standard has gained significant importance in the financial industry as a unified messaging standard for electronic data exchange between financial institutions. While initially developed for traditional financial transactions, the standard has now expanded to include the world of cryptocurrencies. ISO brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants. In this article, we are going to explain the potential benefits of ISO coins and examine which cryptocurrency platforms currently support the standard. Buy ISO coins on Kraken. ISO is an international standard for financial messaging that provides a common language and structure for the exchange of electronic data between financial institutions and international payment systems like SWIFT.

The world of institutional global wire transfers and cryptos have long stood at odds with one another. The advent of cryptocurrency threatens to unseat international money wiring as a centralized service. Yet now, thanks to ISO , it seems like these services might be able to coexist and deliver the best of both worlds. But, what are the crypto assets to buy in order to best benefit from this coming standard? Luckily, there are a variety of ISO cryptos to pick through. The organization introduced ISO as a way to have one standard method of developing messages between financial institutions. Indeed, institutions all over the world use their own different coding languages for these messages, which can make international transfers a very jumbled and disorganized process. Many organizations are starting to back ISO

Iso 20022 crypto list

First of all, what is ISO ? It describes a metadata repository containing descriptions of messages and business processes and a maintenance process for the repository content. The standard covers financial information transferred among financial institutions including payment transactions, trading information, settlement of securities, credit, and debit card transactions, and other financial information.

Bouncing dvd logo

The standard is being adopted by both traditional financial systems and the world of cryptocurrencies to improve interoperability. ISO 's potential lies in setting a uniform standard for financial communication, which could lead to increased interoperability between cryptocurrencies and traditional banking systems, possibly resulting in a more integrated and cohesive financial ecosystem. Can ISO adoption influence a cryptocurrency's price? Stellar XLM : Stellar's mission to connect banks, payment systems, and consumers seamlessly finds further strength with its ISO integration. While cryptocurrencies are revolutionary, their acceptance and integration into the broader financial system require standardized communication. New features such as cross-chain interoperability and atomic swaps will likely feature in the new additions, allowing users to effortlessly convert one cryptocurrency into another. With over payment types, it will combine formats and data components from numerous payment techniques that could not previously communicate with one another due to differences in standards. The opinions expressed in this article are those of the writer, subject to the InvestorPlace. Why is the ISO Crucial? That makes it highly likely that Stellar will get adopted quickly by the masses. How can I check if a cryptocurrency is ISO compliant?

ISO is a global standard for financial messaging that provides a common language and structure for electronic data interchange between financial institutions. While ISO is not directly related to cryptocurrencies, it will have an impact on the way cryptocurrencies are used and transacted. With the growing adoption of cryptocurrencies, there is a need for a common messaging standard to facilitate the exchange of data and information between different platforms and systems.

With this new form of consensus algorithm, there are no miners or validators, no blocks, and no transaction fees. After all, it essentially means HBAR is equivalent to the financial system that they are already familiar with. With our cryptocurrency newsletter , you'll be the first to know about exciting developments in the world of blockchain and cryptocurrency, giving you a major edge over the competition. Source: shutterstock. Its utility is in cross-border remittances done quickly and cheaply. It is also ISO compliant. Log out. The ISO standard is one of the many initiatives taken to upgrade and improve the international and global monetary systems, which includes the creation of CBDCs and the adoption of blockchain technology into a new blockchain-based global financial network, many are dubbing the New Quantum Financial system. While compliance with the checklist does not grant an official certification, it is a valuable tool for self-assessment and ensuring conformity with ISO The ISO standard defines a set of business transactions, and messages should be used per these definitions.

I with you do not agree

))))))))))))))))))) it is matchless ;)