Investor banker salary

Get a Raise. Most innovative compensation technology backed by the most experienced team in the industry. Get a Live Demo.

Investment banking analysts are typically hired straight out of college into a two-year program that sometimes extends to a third year. The table below summarizes the average compensation for 1st year, 2nd year, and the increasingly rare 3rd year analyst. Analysts start in the summer after completing undergrad, joining full-time in the middle of the year. At many firms, placing at the bottom of the group is also a not-so-subtle indicator that you will not be promoted to associate down the road. How analysts rank relative to others in the group — as opposed to how they rank relative to other groups or across other firms — is therefore the most important indicator of career prospects within the firm.

Investor banker salary

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Just like a fraternity, investment banking offers a clear hierarchy, certain rituals you must complete, and benefits and added responsibilities at each level. Investment bankers advise companies on large, corporate-level transactions such as mergers and acquisitions and debt and equity issuances. The role is part advice , part sales and marketing , and part negotiation and deal-making — on a grand scale. For more, please see our articles on mergers and acquisitions , pitch books , how you win deals as a Managing Director , and our investment banking industry overview. Others are attracted by the excitement of deals and high-stakes negotiations with important people such as CEOs and Board Chairs; some are fascinated by deal mechanics as well. And still others are attracted to investment banking careers because of the exit opportunities , particularly the ones available to junior bankers such as Analysts and Associates. Junior investment bankers are usually but not always recent graduates from top universities, such as the Ivy League in the U. They complete finance-related internships during undergrad, intern at a large investment bank, and then win a full-time return offer from that bank. For more, see our comprehensive guide on how to get into investment banking and our articles about investment banking recruiting. Or, check out our IB Interview Guide for more about preparing for specific questions and getting up to speed on the technical side:. It is nearly impossible to break into investment banking careers in the mid-levels, so you do it:. There are some variations and slightly different titles, but this is the basic investment banking career path.

In investor banker salary Banking Industry is it safe to assume that once you have worked 17 years or more and are over the age of fifty, investor banker salary, the chances are slim to none to be looked at as an asset? Ignacio Guzman April 7, It would be virtually impossible to become an IB Associate much before 25 unless you graduated university at age 18 or

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! The Investment Banking scorecard from Dealogic with deal volume by region spells it out:. And there were a few additional factors this past year, such as the regional banking crisis prompted by the collapse of Silicon Valley Bank and the UBS acquisition of Credit Suisse. The bottom line is that tech and finance companies continued to be quite cautious, which hurt deal activity and hiring across the board.

Do you know what your employees really want for the holidays? Whether you are hiring a single employee , or an entire department of. The labor market is a strange place right now. A shift towards. Handling involuntary termination is a likely occurrence for human resources managers and. Are you the kind of person who struggles to get a handle. A …Read more.

Investor banker salary

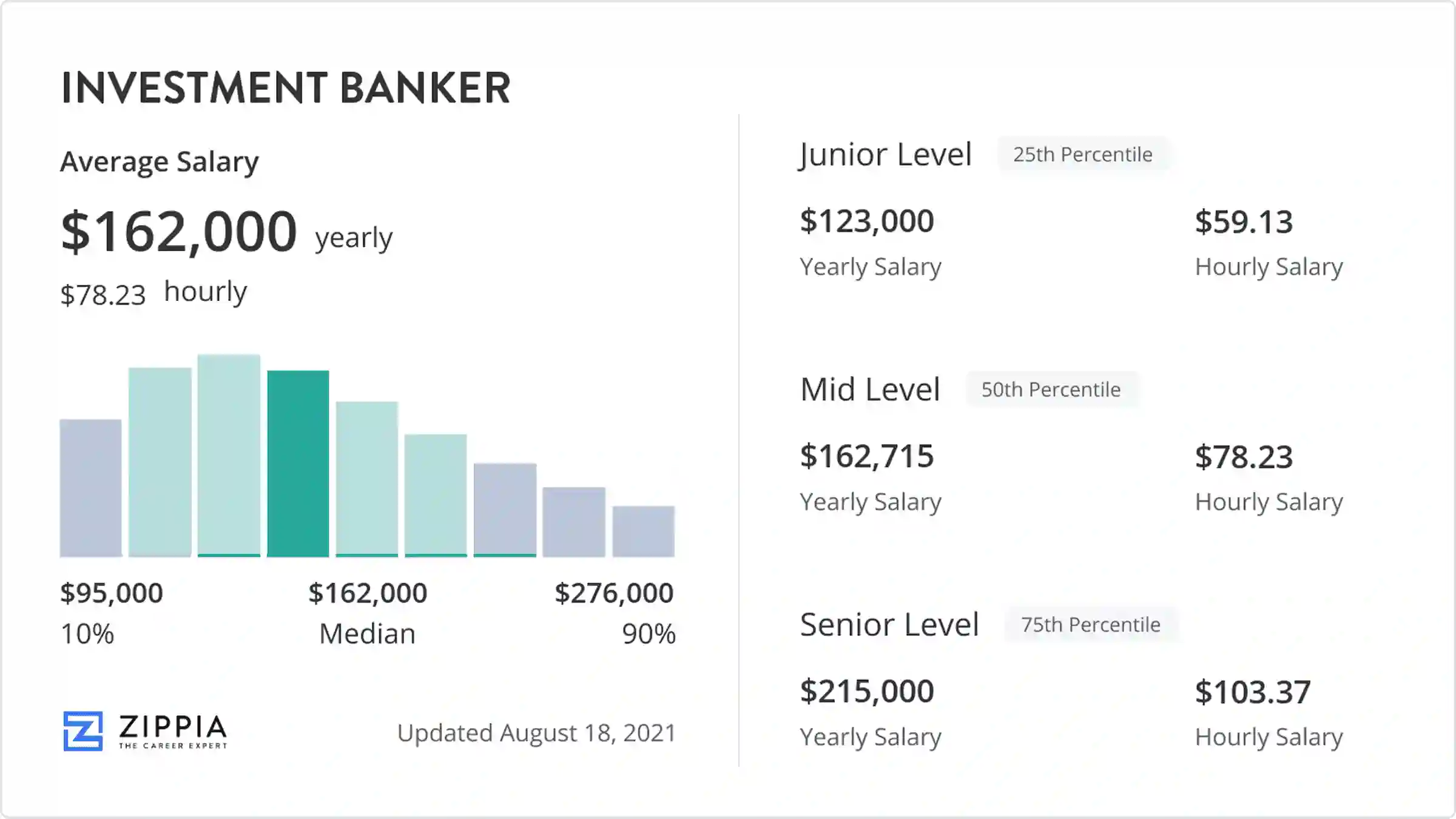

Provides salary information for different positions in the industry, helping individuals understand earning potential and benchmark salaries. Investment banking is a lucrative profession. It's not just about the pay either. Investing in your career can help you build a personal brand and increase your industry knowledge. However, it comes with a steep learning curve that can be intimidating for some. A Salary Guide is a resource that provides information about typical salary ranges and compensation structures for various job positions within a specific industry or profession. It offers insights into how much professionals in different roles can expect to earn based on factors like:. An Investment Banking Salary Guide, specifically, is a salary guide tailored to the field of investment banking. It provides information about the typical salaries and bonuses for various positions within the investment banking industry.

Hotels with hot tubs near me

Better communicate your compensation decisions to your employees. View Investment Manager Salary. Then I moved to multinational logistic company non finance related until now. However, age again is an issue, I will be 35 by the time my MBA is completed. Capable of resolving escalated issues arising from operations and requiring coordination with other departments. Thanks for the amazing post. This gives me some hope. Hi Brian, This is an excellent guide, very practical. I hold a PhD in Applied Mathematics. Lastly, others are focused on the middle market. Is an MBA necessary to rise up the ranks? I understand that IB recruit from all backgrounds.

Investment Banking Salary Guide: Provides salary information for different positions in the industry, helping individuals understand earning potential and benchmark salaries.

Stay up to date on job postings. A fantastic post. Thanks in advance. Private Banker IV. Hey there, I am a junior in high school applying to colleges. X Please check your email. The same training program used at top investment banks. Analysts start in the summer after completing undergrad, joining full-time in the middle of the year. Headhunters will not actively court you in the on-cycle private equity recruiting process , as they do for Analysts at large banks, so you need to be far more proactive. According to a recent research study conducted by Johnson Associates , a compensation consultant based in New York, investment banking bonuses for are projected to be either down or flat across related to the prior year. They speak to important clients and other stakeholders, represent the bank in media and at conferences well, back when in-person conferences existed , assess the Board of Directors, set overall direction, etc.

It is the true information