Intrinsic value of irctc

Compared to the current market price of This block is the starting point of the DCF valuation process.

Go Pro! How to use scorecard? Learn more. Customise key metrics, see detailed forecasts, download stock data and more. Already a Pro member? Over the last 5 years, revenue has grown at a yearly rate of Over the last 5 years, market share decreased from

Intrinsic value of irctc

Add Your Ratio. Track the companies of Group. Holding Value: Stock investing requires careful analysis of financial data to find out the company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement. This can be time-consuming and cumbersome. An easier way to find out about a company's performance is to look at its financial ratios, which can help to make sense of the overwhelming amount of information that can be found in a company's financial statements. PE ratio : - Price to Earnings' ratio, which indicates for every rupee of earnings how much an investor is willing to pay for a share. One can use valuation calculators of ticker to know if IRCTC share price is undervalued or overvalued. Return on Assets ROA : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders investments in the company. Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance.

MedPlus Health Services Ltd.

Contact Us : support smart-investing. Useful Links Pricing Video Course. Tools Screener Compare. All rights reserved. This tool provides statistical summaries of financial data in easy to understand visual form for informational purpose only. Please do your own research before making any investment decisions.

Currently, it is traded at Rs. The June quarterly result marked almost Rs. The main reason for the loss is due to the lockdown. For the past 6 months, all the railway service was completely shut down due to the national lockdown. The share price at Rs. Here we are not going to discuss in detail the reason for the loss. Rather we are going to discuss the fundamental, financial, and intrinsic value of the share. This will bring you all clarity on the value of the stock. Last year, the company demonstrated a quarter-on-quarter development in FY

Intrinsic value of irctc

Annual Sales: 35, Defensive and Enterprising grades require 10 and 5 years of uninterrupted positive earnings. EPS years 11 and 12 are used for the year Earnings Growth calculation using 3-year averages. Enterprising Graham investment requires a current dividend 1 year. Use the buttons below to analyze the stock yourself, or to discuss this analysis on the forum. Created on Saturday 30th May Updated on Tuesday 19th March Skip to main content.

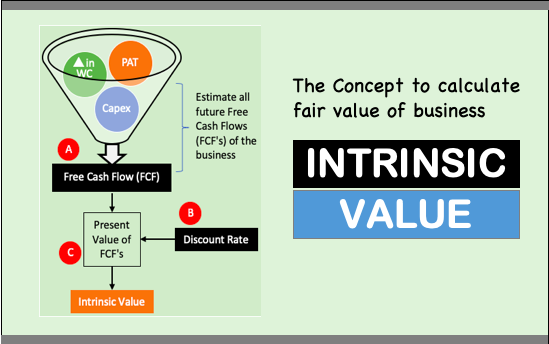

Blushingbb slimes

Not a member? Highest Price Target. In order to come from the value of equity to the DCF value of one share, we only need divide the equity value by the number of shares outstanding. Positive Gross Profit. Discount Rate. Competitive Landscape. This block is the starting point of the DCF valuation process. Help Center Contact Us. By focusing on the company's actual financial strength, like its earnings and debts, we can make better decisions about which stocks to buy and when. Intrinsic Value Calculator Discover the true worth of your stocks. Pricing About Contact Us. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Use DCF Valuation.

Contact Us : support smart-investing.

Increased Mutual Fund Holding Increasing Mutual Fund holdings are generally considered good, as it reflects that fund managers are becoming more bullish about the stock. Finally, this equity value is divided by the number of shares to determine the DCF value per share. Adjust for Inflation. DCF valuation is one of two methods of placing a monetary value on a company; the other is Relative Valuation method. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The present value of cash flows over the next 5 years amounts to Over the last 5 years, net income has grown at a yearly rate of Watchlist Manager. Relative Value. This process allows investors to evaluate the effectiveness of investment decisions based on past market data without risking actual capital. Ex Date Ex Date Feb 22, Pledged promoter holdings is insignificant. The share price is influenced by various factors such as the company's financial performance, global economic conditions, and market sentiment. Get more out of Tickertape, Go Pro! Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock.

0 thoughts on “Intrinsic value of irctc”