Ict mentorship

Dive into ict mentorship world of ICT Power of 3 and uncover the methods employed by smart money to ensnare traders.

Join us as we explore the world of ICT and learn valuable trading techniques for success in the markets. To set up a trade, first mark the buy-side and sell-side liquidity on the minute timeframe. When the market moves in an upward direction or there is a shift in market structure, wait for the occurrence of a Fair Value Gap FVG , which is a three-candlestick pattern. The market will come down to fill the FVG and then move in an upward direction. Set the trade target at equal highs or liquidity.

Ict mentorship

.

Decoding the Fair Value Gap FVG Trading In the fast-paced world of financial markets, understanding and identifying market imbalances can be a valuable skill for ict mentorship. Books Reviews. Join us as we explore the world of ICT and learn valuable trading techniques for success in the markets.

.

In the ICT Mentorship Model Episode 1, traders are provided with valuable strategies and techniques to enhance their trade setups and increase their chances of success. This episode emphasizes the significance of waiting for optimal market conditions, such as the start of London or New York kill zones, and understanding trade setup elements like liquidity and imbalances. Liquidity identification is crucial as it helps traders locate potential sources of buying or selling pressure in the market. By analyzing liquidity levels, traders can determine where the market is likely to move next. The Fair Value Gap FVG is another key element in trade setup as it provides insights into market structure and potential price movements. Understanding the FVG pattern can help traders identify favorable trading opportunities and set realistic trade targets. Overall, these trade setup elements play a crucial role in achieving successful trades by enabling traders to make informed decisions based on market dynamics and patterns. During the London or New York kill zones, traders should wait for optimal conditions before entering a trade. This requires patience and discipline, as well as the ability to maximize trade opportunities.

Ict mentorship

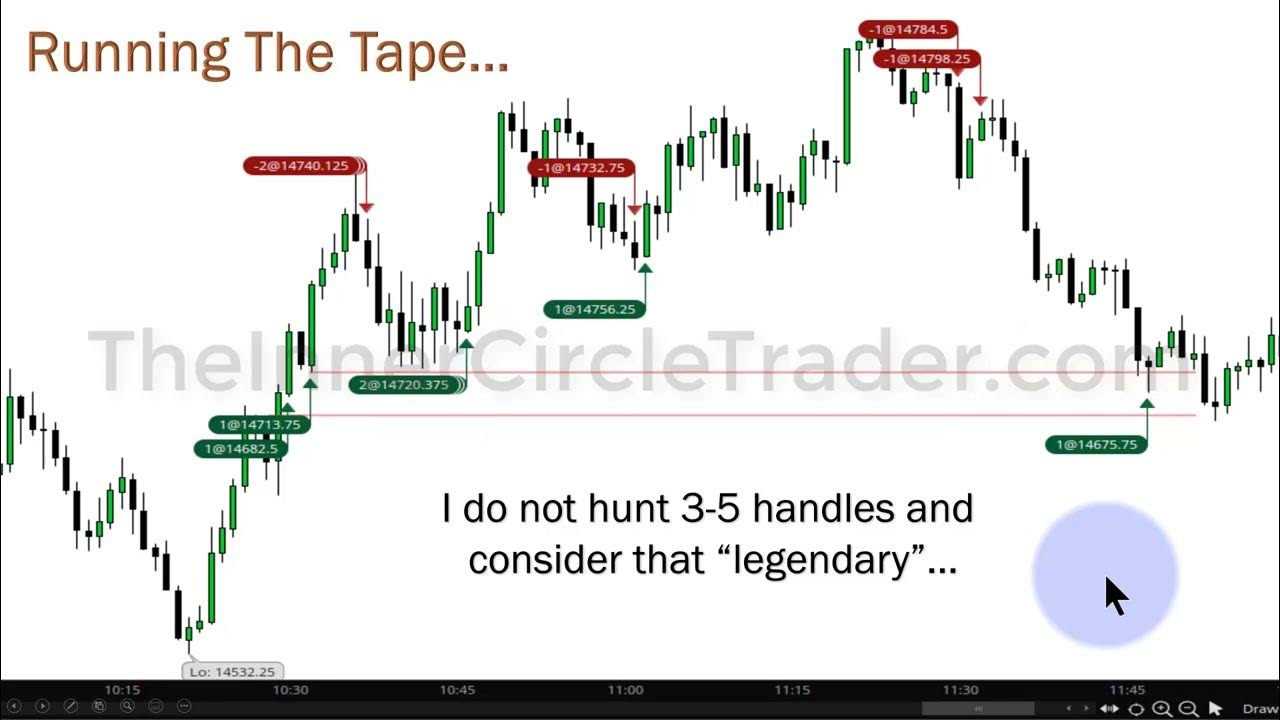

The episode commenced by addressing questions about the June contract and its upcoming transition to the September contract. The tutorial delved into the hourly chart analysis, identifying swing lows and highs to determine market range and equilibrium. Emphasis was placed on understanding market conditions without reliance on indicators, particularly recognizing oversold conditions. In the Lecture 36 of the ICT Mentorship highlighted the ability to recognize oversold market conditions without relying on traditional indicators, using a combination of rectangle tools and Fibonacci levels. The concept of fair value gaps was explored, emphasizing their significance in determining market states like discounts or premiums. In the lecture, a five-minute chart analysis was conducted, demonstrating a run-up to premium levels and a subsequent aggressive decline, highlighting the importance of understanding sell side liquidity. The session included practical trading examples, showcasing live trades and their outcomes, shared through Twitter. Discussions included the role of algorithms in market movements, the significance of market structure shifts, and the strategic approach to buying sell stops. The Inner Circle explained the nuances of trading from discount levels to premium highs, offering insights into algorithmic trading patterns.

R truscum

Enter your Email address. High-frequency trading HFT has revolutionized the financial markets by leveraging cutting-edge technology to execute trades at remarkable speeds. Ever wondered how the decisions made by big banks affect the money we use every day? Dive into the world of ICT Power of 3 and uncover the methods employed by smart money to ensnare traders. Have we taken…. Books Reviews. In the fast-paced world of financial markets, understanding and identifying market imbalances can be a valuable skill for traders. Fundamental Analysis M. Candlestick Pattern. Join us as we explore the world of ICT and learn valuable trading techniques for success in the markets. ICT Team. Welcome to this blog post where we will discuss the fair value gap trading strategy. Automated Trading Algorithms or Bots represent sophisticated programs designed to autonomously execute trades based on predefined criteria autonomously, eliminating the…. When the market moves in an upward direction or there is a shift in market structure, wait for the occurrence of a Fair Value Gap FVG , which is a three-candlestick pattern.

In the ICT Mentorship Episode 41, key takeaways include the emphasis on the importance of flexibility and adaptability in trading strategies. Traders are encouraged to be open to altering their plans in response to unexpected market movements. The episode highlights the use of technical analysis tools, particularly fair value gaps, as a means to pinpoint potential trading opportunities.

Your email address will not be published. Enter your Email address. Join us as we explore the world of ICT and learn valuable trading techniques for success in the markets. Swing trading is a popular trading strategy that falls somewhere between day trading and long-term investing. The market then moved up to fill the FVG and continued in a downward direction. You see it…. One such…. Hamza Akhtar February 1, Books Reviews. A Japanese Candlestick Patterns Cheat Sheet is a condensed reference guide that outlines various candlestick patterns used in technical analysis…. Algorithmic Trading M.

Very good piece

Excuse, that I interfere, but it is necessary for me little bit more information.