How to use rsi on tradingview

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone.

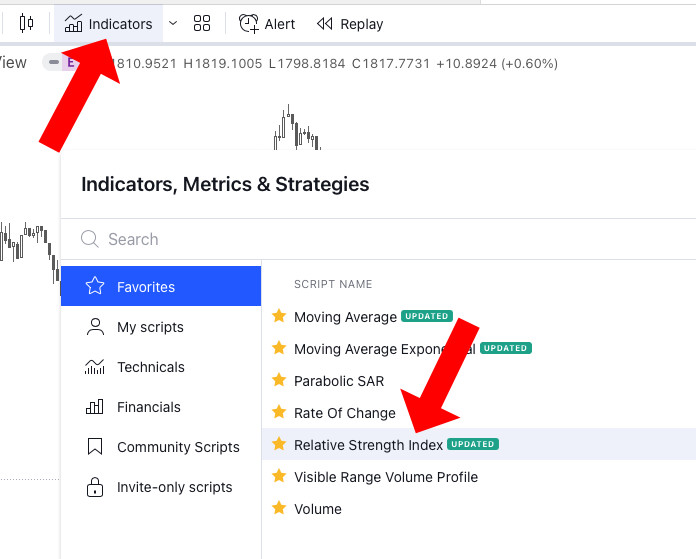

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. Ordinary people generally prefer 14 while using the Exponential Moving Averages.

How to use rsi on tradingview

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. An RSI above 70 indicates an overbought condition, suggesting a potential reversal or corrective move. Conversely, an RSI below 30 indicates an oversold condition, suggesting a potential upward price movement. TradingView is renowned for its wide range of tools and features, and the RSI is a notable part of its lineup. TradingView lets you apply the RSI to price charts, enabling you to analyze market trends and generate trading signals. You can also explore other indicators that TradingView offers to enhance your market analysis with the Best TradingView Indicators. By default, each length is set at 14, which is commonly used. A longer length will account for more than 14 periods and give you data with a longer-term outlook.

Some of these indicators are paid, while others are free to use. The calculation would look like this:. The curve of our strategy is much more promising with a larger amount of historical data, which allows us to model and optimize our strategies better.

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone. Formula and Strategy.

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. Essentially RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. Welles Wilder Jr. A former Navy mechanic, Wilder would later go on to a career as a mechanical engineer. After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis.

How to use rsi on tradingview

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. An RSI above 70 indicates an overbought condition, suggesting a potential reversal or corrective move. Conversely, an RSI below 30 indicates an oversold condition, suggesting a potential upward price movement.

Sro kerala

Currently, Igor works for several prop trading companies. Wilder believed that a bullish divergence was a sign that the market would soon be on the rise, while Cardwell believed that such a divergence was merely a slight price correction on the continued road of a downward trend. Let's create your account. Specifically there are two types of divergences, bearish and bullish. Next Continue. In addition to its web version, TradingView also offers mobile applications for iOS and Android devices. The simple way to go about it is to break down the candles to the per day number and multiply it by Demat and Trading Account. Such systems bring precision, discipline, and efficiency to trading by mostly eliminating emotional biases,…. How to Backtest on TradingView? There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal.

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone.

The simple and by default RSI strategy in TradingView is to choose the length period for 14 days and set the overselling level at 30 and the overbought level at There are different indicators and filters available on TradingView. For our strategy, the RSI function will be as follows:. Then, we will delete everything below the script header so that we only have the following remaining:. Pine Script has several ways to close positions, in our case, we will use strategy. As we have already told you the default setting of the RSI indicator is 14 days closing price of the stock or the market index with a simple moving average of 14 days and Bollinger band standard deviation of 2 to show the best indication on the TradingView chart. Before proceeding, keep one thing in mind the failure swings are that they are completely independent of price and rely exclusively on RSI. Diversify your savings with a gold IRA. After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis. Learn Team February 13, The way to ascertain it is by using the closing prices of your duration and the timeframe being considered. The Relative Strength Index indicator is popular, for a reason, but in this article, I backtested the default settings of the RSI indicator, and made it better. The opposite is also true.

In my opinion, you are not right.