How to use revolut virtual card

Using virtual cards for online payments and transactions has become increasingly popular in recent years. Revolut is one of the most well-known providers of virtual cards.

Stack the cards in your favour. Virtual is your new reality. Go fully digital and manage your spending with debit cards that live exclusively in your Revolut app. A virtual card is a payment card that exists only in digital form. Just like a traditional bank card, it contains a digit card number, a 3-digit CVV code, and an expiry date that you can enter for online purchases. Meet your new best friends.

How to use revolut virtual card

So, what is this virtual debit card, and why would you want one? Actually, there are many reasons why virtual payment cards are incredibly useful. A virtual card is a payment card that only exists in a virtual form. You can use it to make purchases online and in-app, and you can pay in-store with mobile payment services like Google Pay and Apple Pay, too. Apart from that, however, a virtual card has a digit number, an expiry, and a CVV like any normal card — and will share an account number and sort code with your account. What is important to know, though, is that, whilst your virtual card will be linked to the same account as your physical card, this card number will be different. This means that you can spend online without worrying about security. Simply lock your virtual card whilst still using your physical card as normal. Whilst your Revolut virtual card can be stored and used over again, a disposable virtual card ups the security for one-off uses. These can be regenerated as many times as you require, each time with a new unique card number — meaning that your actual card details are never shared with vendors. Instead, vendors receive surrogate card information. This is generated in seconds and is linked to your Revolut account. Virtual credit cards are offered by financial institutions and work in exactly the same way as other virtual payment cards. Virtual cards help to protect against this by being easily freezable or, in the case of disposable cards, simply single-use.

Revolut virtual card alternatives scroll down Stay Secure.

Learn more about Revolut virtual cards and find out whether they're the best option for your business. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. Revolut cards have the same card details and card number as any physical card - 16 digits, the cardholder's name, and the three-digit CVC number. Purchases are quick and secure, and virtual cards offer great protection against card fraud. Your virtual card has a different card number and card details from your physical Revolut card. So you can lock the virtual card to prevent abuse and continue using your Revolut card as normal. Revolut lets you create disposable virtual cards for one-off use.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. This does not affect the opinions and recommendations of our editors. The Revolut virtual card is a convenient digital payment card that can be used to make online purchases. Unlike physical plastic or metal cards, virtual cards are generated using a unique card number, expiration date, and security code. The virtual card details are saved and used across online devices, allowing for secure and convenient online transactions. In this article, we will explore what the Revolut virtual card is, how it works, what the benefits are, and how to get one yourself!

How to use revolut virtual card

So, what is this virtual debit card, and why would you want one? Actually, there are many reasons why virtual payment cards are incredibly useful. A virtual card is a payment card that only exists in a virtual form. You can use it to make purchases online and in-app, and you can pay in-store with mobile payment services like Google Pay and Apple Pay, too. Apart from that, however, a virtual card has a digit number, an expiry, and a CVV like any normal card — and will share an account number and sort code with your account. What is important to know, though, is that, whilst your virtual card will be linked to the same account as your physical card, this card number will be different. This means that you can spend online without worrying about security. Simply lock your virtual card whilst still using your physical card as normal. Whilst your Revolut virtual card can be stored and used over again, a disposable virtual card ups the security for one-off uses.

Two and a half men zoe

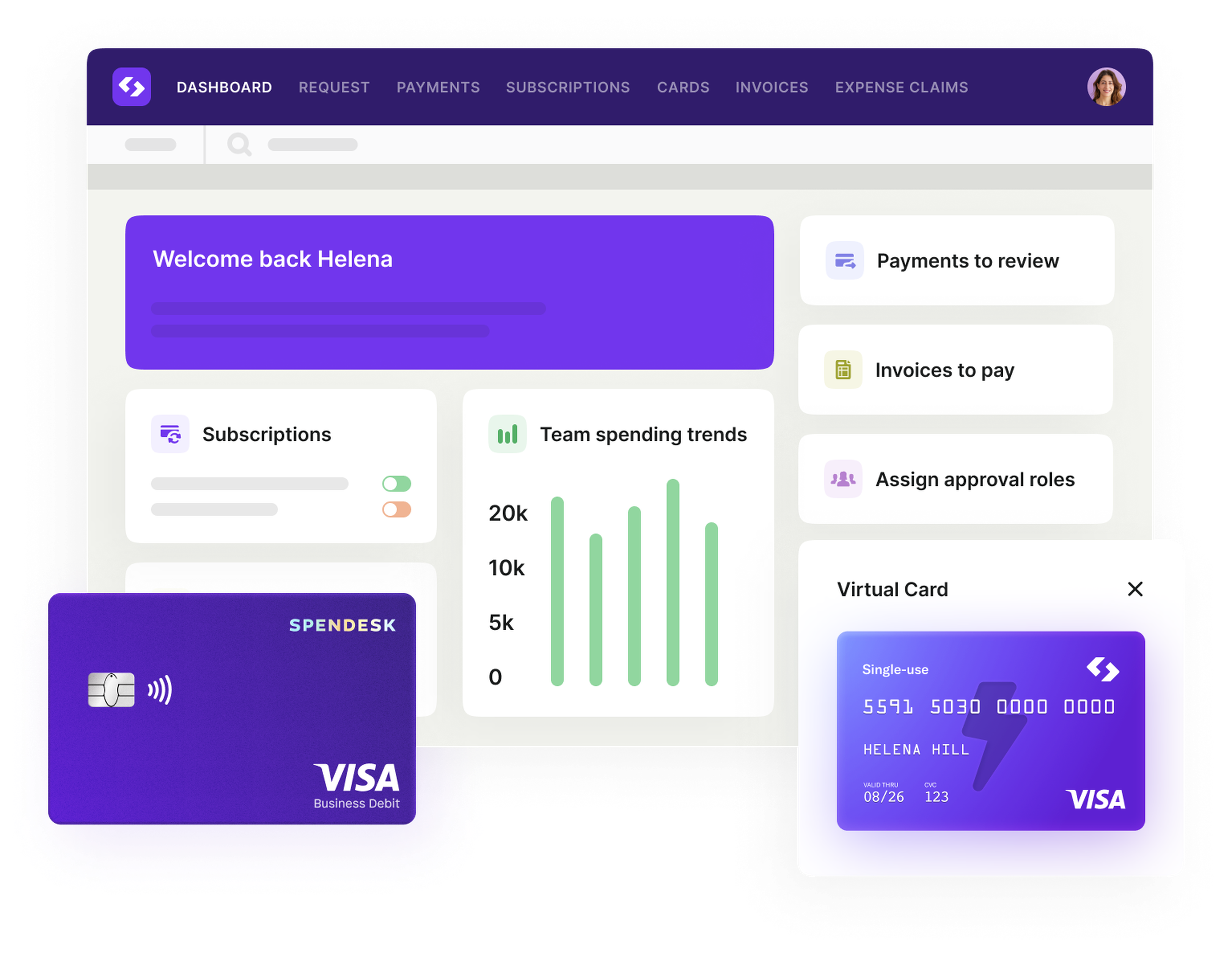

Make sure to double-check that you have entered the details correctly. Your card will show up in your app instantly, so you can start using it right away. The key differences between Monzo and Revolut will be pricing and the package you choose, as both companies primarily serve the same buyers. More info: See our full Starling Bank review. Want to know more about Spendesk? This security measure ensures that only you can log on to your account, view your card details, and complete payments. Help to provide you with tailored information about our products and services, to improve content selection, and to improve the functionality of the website. Control: With virtual cards, you can set limits on spending, define expiration dates, and revoke them at any time, providing better control over your spending. By following these simple steps, you will be able to obtain your very own virtual card and enjoy the added security that comes with it. Once you have successfully completed the premium subscription process, follow these steps to acquire a virtual card:. Important: Some cookies are essential for the proper functioning of this website.

Learn more about Revolut virtual cards and find out whether they're the best option for your business.

Revolut offers 2 types of virtual debit cards. Multi-use cards have permanent card details, so you can use them to set up recurring payments, subscriptions, and deposits. You can use your virtual debit card in most places around the world that accept online or contactless payments with Visa and Mastercard. Choose cookies Necessary These cookies are necessary for the website to function and cannot be disabled, therefore they do not require consent of the user. Pack light and pay like a native. Debit Card Disadvantages Abroad. Renata Pacheco. If you're a company with software subscriptions or making lots of online payments, Spendesk is probably the best choice for you. You don't have to play favourites. Stack the cards in your favour. Which one is right for you? Travel Money Comparison in the UK. Contactless payments are becoming the go-to option. Tap the type of card you want. All the alternatives to Revolut mentioned in this article also offer virtual cards, which you can conveniently activate from your smartphone.

0 thoughts on “How to use revolut virtual card”