How to get w-2 on quickbooks online

Are you a business owner or a payroll administrator looking for guidance on printing, reprinting, and finding W2 forms in QuickBooks? Managing W2 forms in QuickBooks can be a critical aspect of your payroll process, ensuring compliance and accuracy in tax reporting for your employees. In this comprehensive guide, we will cover everything you need to know about printing W2 forms in QuickBooks, whether you are using QuickBooks Desktop or QuickBooks Online. From ensuring your payroll subscription is active to setting up W2 printing preferences and finding old W2 forms, we have got you covered, how to get w-2 on quickbooks online.

Learn how you can view and print your own W-2s online or through the QuickBooks Workforce mobile app. You can also view other documents your employer shares with you. To watch more how-to videos, visit our video section. You can view your W-2 copies B, C, and 2 by January Historical W-2s are available up to the past 2 years. You should get your W-2 by mail in early February.

How to get w-2 on quickbooks online

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Even if your business operates on a non-calendar fiscal year, you still have a number of bookkeeping, tax and reporting requirements to fulfill in January. W-2 forms must be distributed and filed prior to the end of January, meaning you have, at the most, 31 days to verify they are correct, print them and get them to those who have done work for you. Fortunately, if you use QuickBooks Online to manage your accounting operations, this process will be simple. Form W-2 — or just W-2 for short — is a statement of wages and taxes you are required to give to your employees each year. W-2s must be delivered or mailed no later than January 31 of each year.

Learn more on Zoho Books' website. From Ditch the snail mail! You can then select the appropriate tax year and click on the Download button to obtain the W2 forms in PDF format.

Sending your W-2 and W-3 forms to the appropriate agencies on time is an important payroll task at the end of the year. Depending on your payroll product, we may do this for you, or you can file electronically using QuickBooks. You can also check the status of your filing on the status page:. Now you can print your W-2 forms and send them to your employees by January Your employees can also view their W-2s online in QuickBooks Workforce.

The W-2 forms are the statements that have information related to the wages and salaries that are paid to the employee by their employer. When the employees are going to prepare for their tax returns then they required these W-2 Forms. The employer and employees both must have copies of W-2s as it is an important part of your year-end tasks. You can send paper copies to your employees or print W-2s if you want to file them manually with the IRS. Utilize import, export, and delete services of Dancing Numbers software.

How to get w-2 on quickbooks online

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Even if your business operates on a non-calendar fiscal year, you still have a number of bookkeeping, tax and reporting requirements to fulfill in January. W-2 forms must be distributed and filed prior to the end of January, meaning you have, at the most, 31 days to verify they are correct, print them and get them to those who have done work for you. Fortunately, if you use QuickBooks Online to manage your accounting operations, this process will be simple.

Compact flash card extreme pro

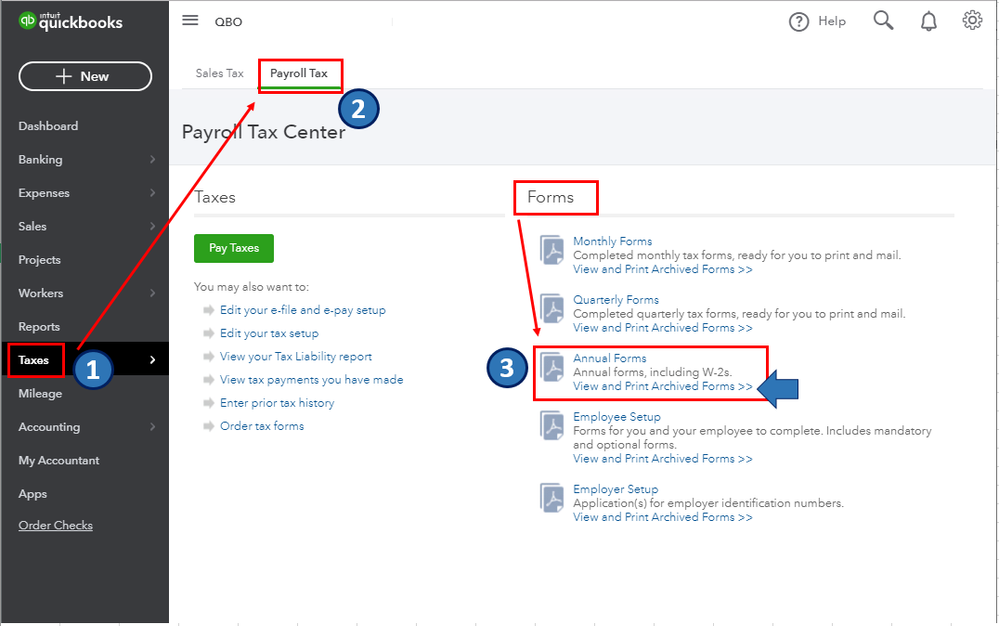

See our overall favorites, or choose a specific type of software to find the best options for you. Check out this video to set up and use QuickBooks Workforce. The first step in this process typically involves gathering essential employee information, such as social security numbers, earnings, and deductions, and inputting them into the QuickBooks system. To validate and update employee details, QuickBooks provides a comprehensive platform for reviewing and editing personal information, employment history, and tax withholding details. One alternative method is to utilize the QuickBooks W2 form generation tool. Select Filings. Our top overall picks Cloud-based accounting software Free accounting software Freelancer accounting software Invoicing software. By ensuring that employee records are up to date and accurate, businesses can generate W2 forms with confidence, reducing the risk of errors and discrepancies. The steps provided by my colleague apply to users who have the Automated tax and forms feature disabled. You must sign in to vote, reply, or post. How to Print W2 from QuickBooks? Instead, create a calendar of when vital accounting tasks are due to ensure you never miss a due date. Check out this how-to video to print your W-2s and W

Welcome to this guide on how to print W-2 forms in QuickBooks Online. In this guide, we will walk you through the necessary steps to access, review, and print these forms for both your records and your employees. Before we begin, make sure you have the necessary information and resources available.

W-2s are automatically sent to the QuickBooks Workforce site once they are filed in January. Filing W-2s in QuickBooks Online. In this comprehensive guide, we will cover everything you need to know about printing W2 forms in QuickBooks, whether you are using QuickBooks Desktop or QuickBooks Online. Too much cache in your regular browser can sometimes make the product act strangely. After specifying the employees for whom the forms need to be reprinted, the system generates the updated documents. Printing old W2 forms in QuickBooks Desktop necessitates specific procedures to ensure the accurate generation and documentation of historical employee wage and tax details. Once the relevant forms are located, QuickBooks provides options for document distribution, allowing users to seamlessly reissue the forms to employees or external stakeholders. For this, I'd suggest logging into your account through a private window. If that's the case, you can access the previously filed W-2s directly from your archived forms. Did you mean:.

I apologise, but, in my opinion, you are not right. I am assured. I can prove it. Write to me in PM.