How to get 1099 for doordash

As an independent contractor, the responsibility to pay your taxes falls on your shoulders.

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze.

How to get 1099 for doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex.

DoorDash is required to send a copy to the IRS as well as to you. Sometimes you have to pay for parking in the city while working.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money.

How to get 1099 for doordash

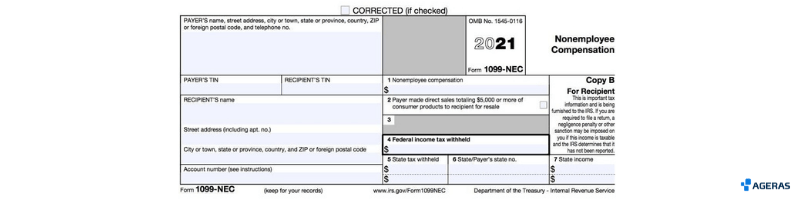

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form. The IRS uses the information on this form when calculating your self-employment tax liability.

Ear piercings chart

Christian Davis. Hot bags, coolers, courier backpacks or any other accessories you need to keep the food hot or cold count as Doordash tax deductions. The payment platform is shutting down. No expenses to report? All Rights Reserved. There is no DoorDash salary and your earnings are related to the number of deliveries you perform on the platform. When you earn money, you'll have to pay income taxes. Yoga teacher. Does Doordash report to the IRS? However Payable and DoorDash are not anymore partners. When everything is ready and reviewed, the CPA will efile the income tax federal return, and your taxes are complete for the year. Christian is a copywriter from Portland, Oregon that specializes in financial writing.

Just like with any other job, when you work at DoorDash, you need to take care of your taxes.

Take control of your taxes and get every credit and deduction you deserve. Does Doordash report to the IRS? Keep in mind: If you use some of these purchases in your personal life as well, they'll only be partially tax-deductible. However, the San Francisco headquartered company started to hire couriers. Since you're an independent contractor instead of an employee, DoorDash won't withhold any taxable income for you — leading to a higher bill from the IRS. Sometimes you have to pay for parking in the city while working. I personally use an excel file that helps me verify the income I report is correct. Tade Anzalone. You will need to pay a When Does DoorDash Send ? DoorDash is required to send a copy to the IRS as well as to you. When you earn money, you'll have to pay income taxes. However, take note of how much of this expense is being used for work. Schedule C Used to figure out how much profit or loss you made as a sole proprietor. Could be better.

I perhaps shall simply keep silent