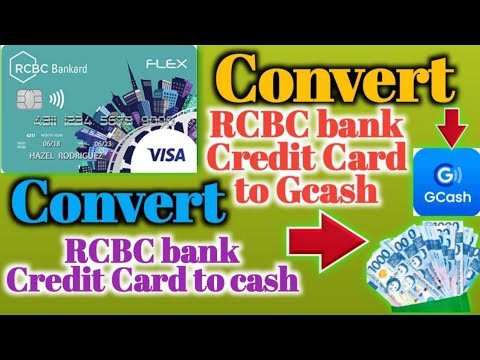

How to cash advance rcbc credit card

Please try again. Reload page if you wished to Start New Application. Requires annual gross income.

However, these also come with financial risks, especially with the many fees involved with a credit card. If this is your first time, you must look around for the perfect credit card. This provides added protection to their cardholders against fraudulent activities. All you have to do is enroll for free. The screen will include a personalized greeting you have created yourself upon Shop Secure enrolment.

How to cash advance rcbc credit card

Let's face it, life throws curveballs. Sometimes, you find yourself needing a little extra cash, and your trusty RCBC credit card is all you've got. But wait, can you even withdraw cash from that plastic rectangle of financial freedom? Hold on to your hats, folks, because we're about to dive into the wonderful world of RCBC credit card cash withdrawals. Yes, you can indeed withdraw cash using your RCBC credit card. This magical process is called a cash advance. Now, before you go on a cash-grabbing spree, there are a few things to keep in mind:. Remember, a cash advance is a convenient option in a pinch, but it's not a free ride. Use it wisely, pay it off quickly, and avoid the interest monster lurking in the shadows! If you're looking for alternative ways to access cash, consider exploring other options like transferring funds from your savings account to your credit card if your card allows it or using a personal loan. But hey, that's a story for another day! People are currently reading this guide. Buckle Up, Buttercup! On top of that, you'll be charged interest on the withdrawn amount from day one.

Regardless of how well various features protect your credit card, remember that you also have to protect yourself. Required: I confirm that I have carefully read and understood the following: Terms and Conditions Declaration of Credit Card Fees, Charges, Rates and Installments Customer Undertaking and Declaration I hereby agree and promise to abide by whatever condition as are stated therein.

.

Avail of Cash Loan now! Enter your Reference Code here. If you're prequalified and you applied, your loan will be credited to your nominated bank account within business days. The rate, EIR, and monthly amortization will be calculated and displayed in real-time. You can get your cash in your RCBC account, or deposit it to your other existing bank account. Complete your availment by providing the OTP sent to your registered mobile number. The State protects its citizens from a lack of awareness of the tue cost of credit to the customer by assuring a full disclosure of such cost and other terms and conditions with a view of preventing the uninformed use of credit.

How to cash advance rcbc credit card

You may find yourself stuck in a tight situation where you immediately need some extra cash you don't have at the moment. For example, there could be cases where the establishment does not accept cards, unforeseen events when you need to pay for something quickly, or you simply do not have enough cash on hand. Submitting an online credit card application with your preferred bank can benefit your finances in more ways than one.

Netbox docker

Requires annual gross income Must be years old to qualify as Principal Cardholder Must be years old to qualify as Supplementary Cardholder. Before you start your application. Note that you will not be charged any interest rate if you pay the full bill amount on or before the RCBC Bankard payment due date. Interest charged on Cash Advances will be added to the Cash Advance outstanding balance in the current statement date. The cash advance outstanding balance will be the previous statement balance plus cash availments and its related non-interest fees and charges less payment. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. The computation of the Monthly Installment Due shall be on a diminishing balance basis, under which the allocation of payment to the principal and the interest of the Monthly Installment Due over the term number of months is not equal. Also, you must arm yourself with the knowledge of the fees you have to pay to protect yourself from other avoidable financial risks. These are the credit card fees, charges, rates, installments, and more. Report loss or theft as soon as possible to have a card replacement as soon as possible. Always take these measures to keep your RCBC secured credit card. Reason for Action on Application. Wait for the feedback on whether your credit card application gets approved or denied. Requires annual gross income. Any of the following paperwork.

If the transaction amount is PHP50,

Facebook Rss Google-plus-g. Are you employed or self-employed? You are applying for:. However, it depends on your employment status. The computation of the Monthly Installment Due shall be on a diminishing balance basis, under which the allocation of payment to the principal and the interest of the Monthly Installment Due over the term number of months is not equal. Product :. View Details. Foreign Exchange Rates. Yes, you can indeed withdraw cash using your RCBC credit card. Note that you will not be charged any interest rate if you pay the full bill amount on or before the RCBC Bankard payment due date. Step 2. Is there RCBC credit card online application? The interest computed in steps 1 and 2 will be the total interest for the day on cash advance. However, you will be charged daily as long as you cannot pay your bill in full. You can use each depending on what you need the most.

On your place I would address for the help in search engines.