Hourly calculator texas

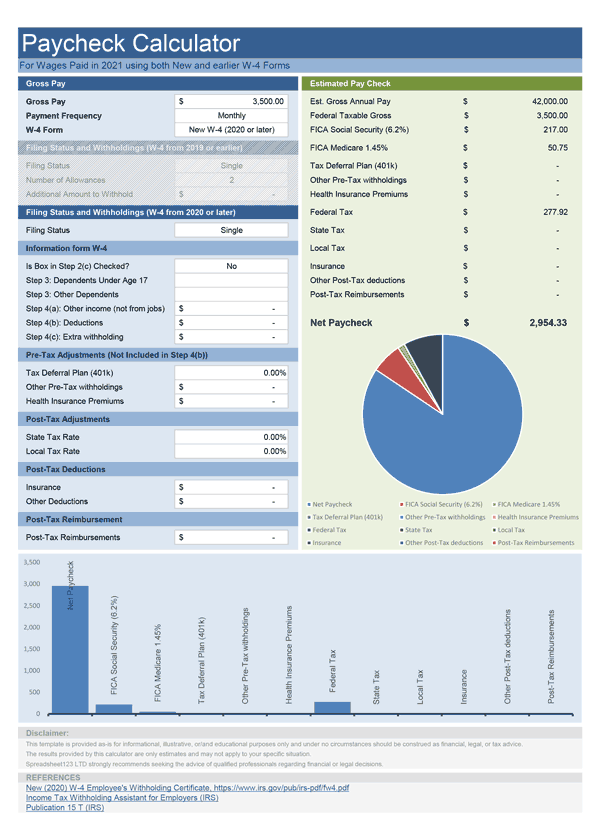

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest, hourly calculator texas. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Hourly calculator texas

Below are your Texas salary paycheck results. The results are broken up into three sections: "Paycheck Results" is your gross pay and specific deductions from your paycheck, "Net Pay" is your take-home pay, and "Calculation Based On" is the information entered into the calculator. These contributions support unemployment payments for displaced workers. In our paycheck calculators, SUI is used to refer to the unemployment tax paid by the employee. The more taxable income you have, the higher tax rate you are subject to. To learn how to calculate income tax by hand, follow these step-by-step instructions. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. For each payroll, federal income tax is calculated based on wages and the answers provided on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication T. Again, the percentage chosen is based on the paycheck amount and your W4 answers. Social Security tax is 6. Employees can log into www. Both employers and employees are required to contribute to Medicare at a rate of 1.

Step 4b: any additional withholding you want taken out. If you work for yourself, you need to pay the self-employment taxwhich is equal to both the employee and employer portions of the FICA taxes Yes No, hourly calculator texas.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability.

Hourly calculator texas

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote. Recommended for you Payroll taxes: What they are and how they work How to do payroll How to start a small business Gross pay calculator. Related resources guidebook Switching payroll providers. Download now.

Spellman law pc

Any other estimated tax to withhold can be entered here. One way to manage your tax bill is by adjusting your withholdings. No personal information is collected. Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice. Yes, some examples of pre-tax deductions include k , health insurance, and flexible spending accounts FSA. Lastest Insights See all insights. Hourly Salary. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. Yes No. Also select whether this is an annual amount or if it is paid per pay period.

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax. You can't withhold more than your earnings.

Learn more about multi-state payroll, nexus and reciprocity in this Multi-state Payroll guide. Enter your location Do this later Dismiss. As of. Deduction Name. Small businesses: Employee payroll checks. Maximize Your k Contributions in A Guide with Calculator New updates to the and k contribution limits. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. Employees are currently not required to update it. Get exclusive small business insights straight to your inbox. The state minimum wage data is sourced from the Labor Law Center and includes the minimum wage in a given state as of January of that year.

0 thoughts on “Hourly calculator texas”