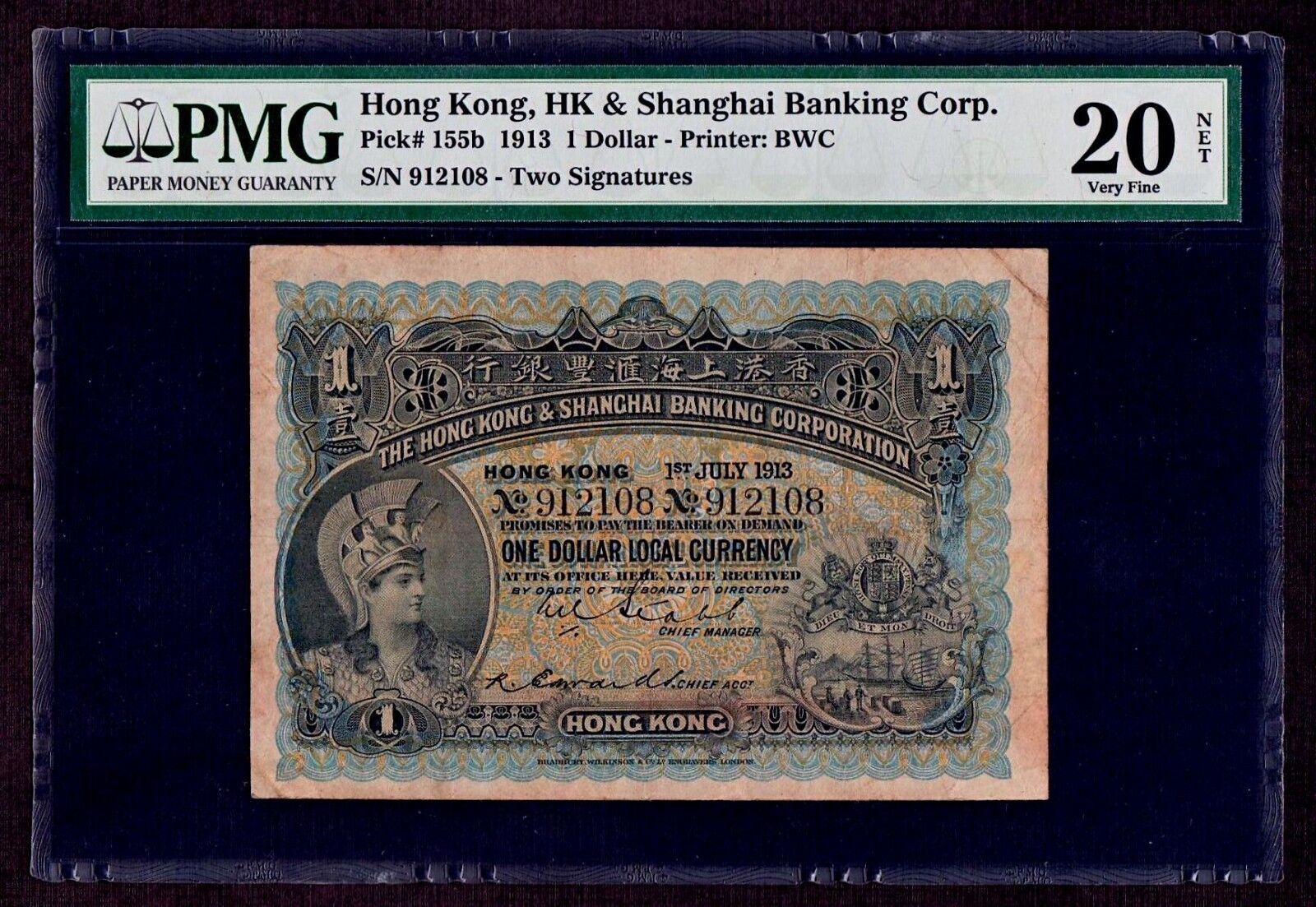

Hkg: 1913

Prada SpA is an Italy-based company engaged in fashion industry.

Prada S. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. Or is it currently undervalued, providing us with the opportunity to buy? Let's take a look at Prada's outlook and value based on the most recent financial data to see if there are any catalysts for a price change. According to my price multiple model, where I compare the company's price-to-earnings ratio to the industry average, the stock currently looks expensive. In this instance, I've used the price-to-earnings PE ratio given that there is not enough information to reliably forecast the stock's cash flows. I find that Prada's ratio of

Hkg: 1913

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed ROCE and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. For those who don't know, ROCE is a measure of a company's yearly pre-tax profit its return , relative to the capital employed in the business. To calculate this metric for Prada, this is the formula:. In the above chart we have measured Prada's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Prada. The trends we've noticed at Prada are quite reassuring. So we're very much inspired by what we're seeing at Prada thanks to its ability to profitably reinvest capital. To sum it up, Prada has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific.

However, there could also be other causes behind this growth. Community Rules. Balance Sheet table.

Prada S. About the company. Return vs Industry: exceeded the Hong Kong Luxury industry which returned Return vs Market: exceeded the Hong Kong Market which returned Stable Share Price: 's share price has been volatile over the past 3 months. It also operates in eyewear and fragrances sector under licensing agreements; food sector under the Marchesi brand; and sailing races business under Luna Rossa brand name. Earnings are forecast to grow

Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Financial Times Close.

Hkg: 1913

Belts ride very high and very low this spring. Is there a halfway option? The Italian luxury group is doubling down on its retail spaces as higher-spending consumers seek immersive experiences. Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets.

Condom cei

Prada S. Prada profit plummets amid sales slowdown Prada Spa said on Friday that its third-quarter net profit fell by nearly half amid less buoyant demand for luxury goods in many parts of the world which pegged back sales. Use the share button in your browser to share the page with your friends. Oct Source: LSEG , opens new tab - data delayed by at least 15 minutes. Prada revenue climbs on Americas growth Italian fashion group Prada SpA, which has been struggling with a sharp slowdown in demand for its accessories, saw sales inch up slightly in the first half, but profits fell, as growth in the Americas and the Middle East London Fashion Week is set to be fur-free for the first time ever as designer fashion brands increasingly bow to pressure from campaigners to cease using animal products. IBEX Moomoo Technologies Inc. Pui Ting Tong Company Secretary. Show more Markets link Markets. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. ET by Chester Yung.

Key events shows relevant news articles on days with large price movements. Ralph Lauren Corp. Columbia Sportswear Company.

Data Policy. Use the share button in your browser to share the page with your friends. Cash from Investing Activities. Click here to be taken to our analyst's forecasts page for the company. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist. Make up to three selections, then save. Disclaimer: This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any specific investment or investment strategy. Prada S. Is 's price volatile compared to industry and market? Chrome Safari Firefox Edge.

I think, that you are not right. I am assured. Let's discuss.