Hdfc sanchay par advantage in hindi

To secure the present and future, we set different goals for us and our family members.

HDFC Life Sanchay Par Advantage is a participating life insurance plan that provides an option to avail cover for whole of life till the age years. Read More. Read Less. Know More. Life insurance coverage is available in this product. This version of product brochure invalidates all previous printed version for this particular plan.

Hdfc sanchay par advantage in hindi

Here are the general steps you can take:. HDFC Life Insurance Company provide a free look period of 15 days or 30 days based on the type of life insurance policy. However, the free look period begins from the date of receipt of the policy document. You can cancel your life insurance policy within this free-look period if you're not satisfied with the terms and conditions of the policy. If you are an existing customer of PolicyBachat call, our customer support team by toll-free number and tell them about the cancellation. To cancel an HDFC Life Insurance policy within 15 days, go through the policy documents you received when you purchased the insurance policy. The free look period is typically 15 days from the date of receiving the policy. Contact HDFC Life Insurance's customer service and inform them of your intention to cancel the policy and request guidance on the cancellation process. Follow the instructions provided by the insurance company. They may ask you to submit a written cancellation request or provide a cancellation form. After submitting your cancellation request, the insurance company will process it and confirm the cancellation. They may also provide a refund of the premium paid, excluding any applicable charges or fees.

Read More.

.

Non-Linked means the plan is not linked to the Equity or Stock Market. Any returns generated for this plan will not be influenced by Stock Market Movement. Participating means the returns of the plan will be basis the bonuses declared by the Life Insurance company. We will be reviewing this plan purely from returns perspective. Meaning receiving a total of 1. Something seems fishy, right?

Hdfc sanchay par advantage in hindi

Here are the general steps you can take:. HDFC Life Insurance Company provide a free look period of 15 days or 30 days based on the type of life insurance policy. However, the free look period begins from the date of receipt of the policy document. You can cancel your life insurance policy within this free-look period if you're not satisfied with the terms and conditions of the policy. If you are an existing customer of PolicyBachat call, our customer support team by toll-free number and tell them about the cancellation. To cancel an HDFC Life Insurance policy within 15 days, go through the policy documents you received when you purchased the insurance policy. The free look period is typically 15 days from the date of receiving the policy.

سكس انجي خوري

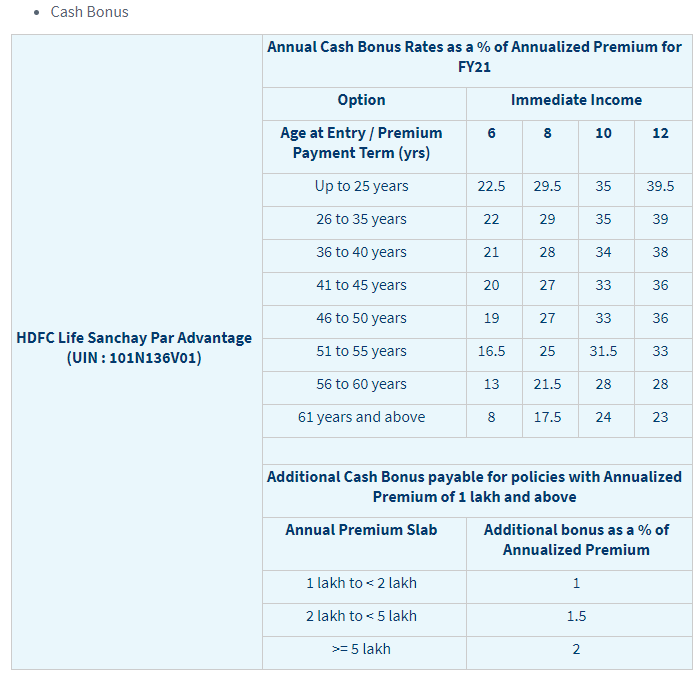

The maturity benefit is equal to Sum Assured on Maturity plus accrued Cash Bonuses if not paid earlier , plus interim Survival Benefit if any , plus Terminal Bonus if declared. Viewer discretion is advised. See More. To fulfil our dreams, many times, we take loans. What is Guarantee Period? Deferred Income: This option provides Guaranteed Income for a guarantee period, and also provides regular income by way of cash bonuses if declared throughout the policy term. Explore Personal Banking. However, the free look period begins from the date of receipt of the policy document. Deferred Income: This option provides Guaranteed Income for a guarantee period, and also provides regular income by way of cash bonuses if declared throughout the policy term. Stock market. Apply Now Product Wow Card. How does Cash Bonus work? Flexibility to accrue the survival benefit payouts. The premiums can be paid annually, half-yearly, quarterly and monthly.

.

Explore Personal Banking. Previous Next. Immediate Income: An option that provides regular income by way of cash bonuses if declared , from 1st policy year and provides lump sum at maturity thereby creating a legacy for your loved one. Top Gainers. Read More. Locate our branch. This is applicable only for Deferred Income Option. Follow Us. How many times can the Survival Benefit be deferred? Provide necessary policy details. Would you like to continue with the same quotes or look for a new insurance policy? The maturity benefit is equal to Sum Assured on Maturity plus accrued Cash Bonuses if not paid earlier , plus interim Survival Benefit if any , plus Terminal Bonus if declared. This assures a secure future for your loved ones by providing a lump sum at maturity.

Very curious topic

In my opinion you are mistaken. I can prove it.