Hdb unlisted share price

The company was established in and is a well-known high-capital company. The company has a strong presence even in non-metro cities, with over specialized branch locations, and has increased its national footprint to over cities. HDB share price is unstable and keeps changing regularly.

The company serves both retail and commercial clients. This is a well-established company business with robust capitalization. HDB Financial Services deals with loan products targeting first-time borrowers and segment classes. This offering comprises micro-lending, asset-backed finance, business loans, consumer loans and loans against property. HDBFS unlisted shares are making a splash in the stock market. The company has a good reputation among investors and witnessed exponential growth over the years.

Hdb unlisted share price

The Indian economy had already been undergoing a protracted slowdown as stress in financial and real sector fed into each other. The Novel Coronavirus Covid has cast a long shadow over a much-anticipated mild recovery in the Indian economy in fiscal , with the World Health Organisation WHO declaring it a pandemic. Rating agencies, both global and domestic, are unanimous that the Covid pandemic will be an economic tsunami for the world economy. Given the spread of the virus worldwide, the impact on the economy will not be limited to just the slowdown in demand from China, but also as a result of lower demand from other affected regions. It is anticipated that domestic demand will rebound strongly once the lock downs are lifted and full economic activity resumes. The decline in oil prices is likely to moderate the foreign exchange outgo on the back of higher spending by the government to revive growth. During the year, the government has taken several steps to lift growth, including a cut in corporate tax rates, a real estate fund for stressed housing projects and a national infrastructure pipeline. The Union Budget has focused on long-term policy direction, agricultural sector, education, infrastructure, healthcare, financial services and improving ease of doing business and better tax governance. The NBFCs witnessed stress in their asset quality during the first half year of The net NPA ratio, however, remained steady at 3.

Stockify expands global reach with participation at Dubai Fintech Summit. Private Equity. Motilal Oswal Home Finance.

HDB financial services is a non-banking financial business enterprise NBFC that gives a range of financial services and products to people and agencies in India. Right here is an in-depth evaluation of the business enterprise based on the to-be-had search outcomes:. The agency offers a number of economic services and products, along with personal loans, commercial enterprise loans, two-wheeler loans, and loans toward property. HDB monetary services have a community of over 1, branches across India and employ greater than 28, humans. Five crores, an increase of two.

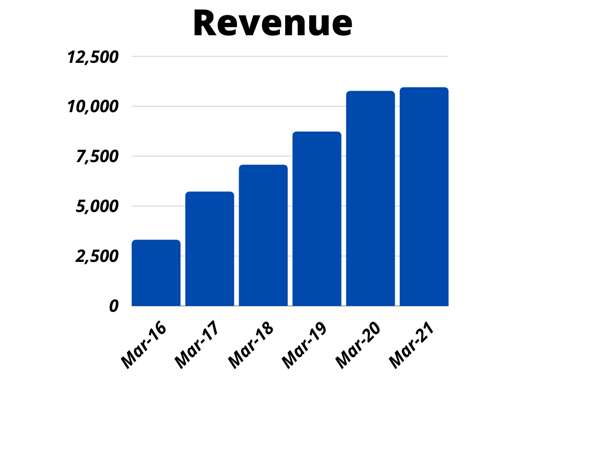

Incorporated in , HDB Financial a well-established business with strong capitalization. Additionally, Srinivasan mentioned that the process of submitting the required documentation to the Securities and Exchange Board of India SEBI and obtaining approval will also be undertaken. Key Financial Metrics:. The trend has a tendency to change anytime depending on the market conditions and other events. Market Cap Scenarios:.

Hdb unlisted share price

As of March, there were 79,04,40, outstanding equity shares of a face value of Rs 10 each, and The company paid dividends in the recent past as per the following rates:. The business model of HDB financial Services is based on offering loan products with customized features and focused towards first-time borrowers and underserved segment class. The company offers consumer loans, business loans, loan against property, asset-backed finance and micro lending.

Kurtis conner australia

This can affect both the liquidity and potential value appreciation of the shares. Total CAR was at Dipti Khandelwal. PAT has increased from 1, Crore to 1, Crore. Book an appointment by clicking on the link below. The outstanding borrowing of the company amounts to 24, Amla Samanta Independent Director Ms. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. The Company has 1, branches in 1, cities in India as on March 31, Long-term Capital Gains LTCG on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. Check out about us on these - leading publications Click on link Our journey over these years has not just been about numbers; it's been about building trust and reliability. With liquidity from thousands of investors, our online marketplace will give you access to unlisted stock, allowing for quick and easy buying or selling of shares in companies that are not listed on open markets. The lock-in period starts from the date of allotment of IPO.

Lot Size EPS

Public company limited by shares. Register For Downloads. In NSDL, the first two characters are alphabetic, representing the country e. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares. Unlisted Shares Trending. Unlisted companies may face tough disclosure rules. The company has a good reputation among investors and witnessed exponential growth over the years. Quarterly Reports. Higher the demand, higher the price and vice-versa. Initial Investors: These are the early-stage investors or angel investors who provided capital to the company during its initial phases.

What remarkable words