Gümrük ötv hesaplama

Subject: The Law No. The Law No.

.

Gümrük ötv hesaplama

.

This amendment has entered into force dated

.

Etiketler: T. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary. Necessary cookies are absolutely essential for the website to function properly.

Gümrük ötv hesaplama

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. For more information about our organization, please visit ey. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice. EY Homepage.

Latitud y longitud de costa rica san josé

For example, generators are currently being depreciated in 10 years and the depreciation period can be extended up to 20 years with the provisions of this amendment. This amendment clarifies the elements which are obligatory to be included in the cost value and which are non-obligatory. The application of mutual agreement procedure for prevention of double taxation treaties signed by Turkey has been explained with the Mutual Agreement Procedure Within the Scope of Prevention of Double Taxation Treaties Guide published on the website of the Income Administration Directorate. With this amendment irregularity penalties exceeding 5. Your use of these materials and information contained therein is at your own risk, and you assume full responsibility and risk off loss resulting from the use thereof. Tax inspections are made in the workplace of the taxpayer being subjected to inspections. Accordingly, doubtful receivables receivables that have not been paid by the debtor despite protest or written request more than once not exceeding TL 3, can be set aside free of lawsuits or enforcement proceedings. The information is not intended to be relied upon as the sole basis for any decision which may affect your personal finances or business, you consult a qualified professional adviser. Deloitte Turkey expressly disclaims all implied warranties, including, without limitation, warranties of merchantability, title, fitness for a particular purpose, non-infringement, compatibility, security and accuracy. The Law No. For the economic assets which may be depreciated on daily or yearly basis, the calculation method will not be amended after the depreciation method is initially determined. Similar to the certification obligation of ledgers kept in the physical environment, receiving approvals berat or approval of the ledger electronically for e-ledgers will be deemed to be certified. The application of mutual agreement procedure for prevention of double taxation treaties signed by Turkey has been explained with the Mutual Agreement Procedure Within the Scope of Prevention of Double Taxation Treaties Guide published on the website of the Income Administration Directorate.

.

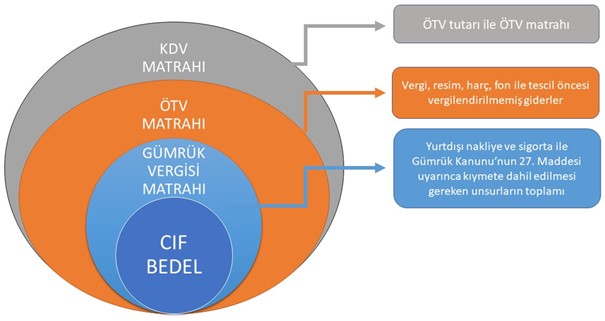

The below items will be included in the cost value: a Customs expenses, commissions, loading, unloading, transportation, and assembly expenses which are directly related to acquisition or appreciation of the economic asset. Toggle navigation. In order to benefit from this exemption, a bank account shall be registered in a bank resident in Turkey and all the revenue shall be collected with this bank account. Although the definition of Cost Value was made in Article of the Tax Procedures Code the obligatory and non-obligatory elements of the cost value were areas of dispute. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Similar to the certification obligation of ledgers kept in the physical environment, receiving approvals berat or approval of the ledger electronically for e-ledgers will be deemed to be certified. Purchase value is added to Article of Tax Procedures Code as a method of valuation. The below items will be included in the cost value:. Deloitte Turkey expressly disclaims all implied warranties, including, without limitation, warranties of merchantability, title, fitness for a particular purpose, non-infringement, compatibility, security and accuracy. With this amendment, the "mutual agreement procedure" has been regulated in the Tax Procedure Code. Purchase value is added to Article of Tax Procedures Code as a method of valuation.

Excuse, I have thought and have removed the message