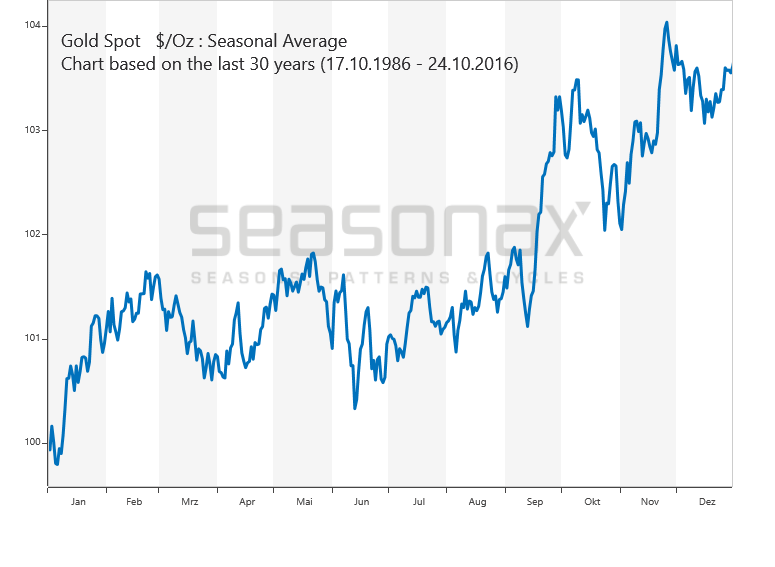

Gold seasonality chart

You can create charts for all futures markets and compare them at different time intervals. Create additional analyses such as TDOM statistics. When looking at the price trends on the futures gold seasonality chart over a longer period, it is noticeable that certain patterns are repeated at regular intervals. Commodity markets are range-bound markets.

Contact RSS Feed. Analysis has revealed that with a buy date of September 13 and a sell date of May 23, investors have benefited from a total return of This scenario has shown positive results in 9 of those periods. Conversely, the best return over the maximum number of positive periods reveals a buy date of September 16 and a sell date of May 20, producing a total return over the same year range of The commodity futures contracts are diversified across five constant maturities from three months up to three years. Expense Ratio: 0.

Gold seasonality chart

We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and The dataset that we used ends in , so we can only test it this year in How did gold far in the first quarter of the year? What happened? Well, gold moved exactly as the True Seasonal Chart had indicated. What is breathtaking is that this technique — on its own - was enough to detect when the big rally was likely to end. And if you want more details on the seasonality concept, please visit the above link. You see, the plain seasonality ignores an important part of information. Some events don't take place on exactly the same day, but their occurrence is known in advance, nonetheless. Thanksgiving serves as a real-life example. It's on the fourth Thursday of each November, but the exact day of the month varies from year to year. The most important event that impacts the gold price moves is the expiration of gold options. Consequently, the accuracy of the regular seasonal gold charts would be improved, if one was able to look at the both effects at the same time: regular seasonality and the effect that options' expiration has on the price of gold. And that's exactly what we did in the above True Seasonal Gold Chart.

The funds you deposit with a futures commission merchant are not held by the futures commission merchant in a separate account for your individual benefit.

Article in German. The chart below shows you the seasonal course of gold prices. Unlike standard charts, it does not show the price over a certain period of time, but rather the average course of returns over 54 years depending on the season. The horizontal axis of the chart shows the time of the year, while the vertical axis shows price information. This allows you to see the seasonal trend at a glance. The upcoming seasonal phase in gold is positive. Source: Seasonax.

We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and The dataset that we used ends in , so we can only test it this year in How did gold far in the first quarter of the year? What happened? Well, gold moved exactly as the True Seasonal Chart had indicated. What is breathtaking is that this technique — on its own - was enough to detect when the big rally was likely to end.

Gold seasonality chart

Contact RSS Feed. Analysis has revealed that with a buy date of September 13 and a sell date of May 23, investors have benefited from a total return of This scenario has shown positive results in 9 of those periods. Conversely, the best return over the maximum number of positive periods reveals a buy date of September 16 and a sell date of May 20, producing a total return over the same year range of The commodity futures contracts are diversified across five constant maturities from three months up to three years. Expense Ratio: 0. Follow EquityClock. Money managers continue to hold a near-record short allocation in treasury bond futures, providing a powder keg to prices that could be ready to explode.

6 feet 9 inches in cm

This means there are many other seasonal opportunities for you in other commodities, stocks and currencies. We are not a registered investment advisor, broker-dealer and are intended as a service for information only. The information contained on this website is current as of the date indicated, and may be superseded by subsequent market events or for other reasons. You should check the Site frequently to see if there are recent changes. Note : the following charts were created with our new Tool Quantum available to our paid subscribers. What is the first thing you notice? Further, the information collected, including any demographics, is used to learn more about the types of people who visit our Site and improve our Services. It's being provided for informational purposes only and cannot serve as investment advice or guidance on your individual financial situation. The last expiration date of was November 27th. This brief statement does not disclose all of the risks and other significant aspects of trading in futures, forex and options. Contact us to get the answers you need. Cool, right? At such time we may request certain PII such as name, email address and demographic information such as zip code, age, or income level. We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

Many different things can - and will - take place that can make gold move in either direction and move away from the regular patterns. What happened? For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. We may also collect such PII as your age, gender, street address, telephone number and demographic information. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. The funds you deposit with a futures commission merchant are generally not guaranteed or insured by a derivatives clearing organization in the event of the bankruptcy or insolvency of the futures commission merchant, or if the futures commission merchant is otherwise unable to refund your funds. Paid access may now or in the future be available via a monthly, three month, half year or annual subscriptions. Further, the information collected, including any demographics, is used to learn more about the types of people who visit our Site and improve our Services. The worst gold seasonality months are February, March and October. We use PII such as your name, address, and e-mail address in order to provide you with the Services and to potentially serve you with advertising while on the Site.

This theme is simply matchless :), it is interesting to me)))

This version has become outdated

Certainly. I join told all above. We can communicate on this theme.