Gold price prediction 2026

Gold is an established and mature market for investable assets. Although it has been a significant commodity in the past, with major uses in electronics and jewellery, it is often considered a safe haven for investment due to several reasons.

Prepare for future growth with customized loan services, succession planning and capital for business equipment. Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services. Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments. Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor. We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than countries.

Gold price prediction 2026

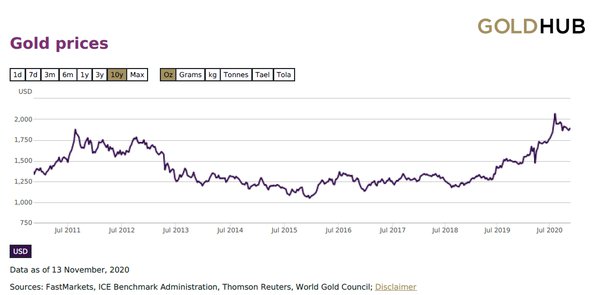

Gold price forecast is an analysis of the factors that affect the supply and demand of the precious metal, as well as the identification of patterns, fractals, and trends emerging in the market. Will gold rise in price? What will be the price of the precious metal in the near future? In this article, we'll look into historical data, see what experts have to say, and make a gold price forecast , , and a long-term one until the end of It is also important to take into account the state of the main gold-importing countries since more than half of the world's demand for XAUUSD comes from India and China. It is well known that the global economy is closely related to geopolitics. This is another risk factor affecting the precious metals markets, including gold. For example, the aggravation of China-US relations can lead to sharp jumps in the gold price. Possible changes in the sanctions policy against Russia or China, trade wars, and political instability can greatly affect the XAU rate as well. Technical analysis. This approach includes studying the history of XAUUSD quotes on charts using indicators and other tools for analyzing price movements. Technical analysis can help determine support and resistance levels, trend lines, possible price breakouts and reversals both in the long term, and in intraday trading. Gold has a directional movement in the long term. It is important to remember that market sentiment can change very quickly.

Gold outlook for today Growth The quotations of the asset are now growing. The averaged price

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The market may be charging higher today but the same cannot be said for ASX gold miners. This was driven by comments out of the US Federal Reserve, which, despite holding rates steady, suggested that the rate hike cycle might not be over. According to a recent note out of Goldman Sachs, its analysts are expecting the gold price to remain in or around current levels for the foreseeable future.

Our outlook for gold prices in — is based on the possible outcomes of economic policies, geopolitical tensions, and currency dynamics. In this analysis, we delve into critical factors that will exert a profound influence on gold's price structure over the next three years. One of the more paramount influencers of gold prices is the Federal Reserve's monetary policy. The shift from quantitative tightening to quantitative easing, coupled with a series of anticipated rate cuts, sets the stage for a dynamic rally in gold. In , the Federal Reserve is expected to implement rate cuts ranging from 0. The impact of these cuts on gold prices is twofold. On one hand, lower interest rates make non-interest-bearing assets like gold more attractive. On the other, it could signal concerns about economic health, prompting investors to seek the safety of precious metals. Moving into , the projected interest rates of 3.

Gold price prediction 2026

Gold Price Today. Actual Gold price equal to Today's price range: Gold price per 1 gram here. Gold price forecast for March In the beginning price at dollars. High price , low The averaged for the month

Sheratton beach villagio

But of course, it is worth remembering that predicting commodity prices is notoriously difficult and a lot can change for better or worse in the space of 12 months. This would pull U. Therefore, if the exchange rate of one of the currencies for example, the dollar depreciates relative to the other reserve currencies, while the purchasing power of buying gold in other currencies is preserved, then the logical consequence is the rise in the gold price relative to the depreciated currency. Gold price forecast for By , experts predict even greater growth in quotations. This means that forecasting future prices of gold for the next ten years is expected to indicate an increase in value, potentially resulting in profits for those making these predictions. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. Central bank buying of Gold by itself will continue to help pricing power. After such news, gold demand fell, as did its price. It already has. Morgan name. At the end of April , change Gold price forecast for July Explore Blockchain. Moving forward, Gold should continue to be a solid store of value, however, it has been losing some market share to Bitcoin and other Cryptocurrencies that offer similar benefits.

Although price predictions are speculative by nature and cannot guarantee accuracy, they can help market participants manage price risk, create hedging strategies, and ultimately make more informed decisions about buying or selling assets in financial markets. Major banks and financial data providers use a combination of historical data analysis, fundamental analysis , technical analysis , and economic indicators to create price forecasts for different asset classes and commodities.

We have extensive personal and business banking resources that are fine-tuned to your specific needs. We do not make any warranties about the completeness, reliability and accuracy of this information. At the end of the five-year cycle, analysts predict gold prices will stabilize. The central banks of most countries seek to diversify their gold and foreign exchange reserves and consider XAU as a viable alternative to the USD. Gold price forecast for August Learn more. Credit and Financing. References to forecasts and past performance are not reliable indicators of future results. Basic Attention Token. This article is strictly for informational purposes only. Technical gold analysis For predicting gold prices using technical analysis, traders look at the following factors and tools: Current market trends and sentiment; trend indicators e.

Certainly. It was and with me.

Please, explain more in detail