Gann cycles

Before entering into the prediction magic, always remember that future is just a repetition of the past, gann cycles. To accurately grab the future with strong predictions you need to about the major cycles.

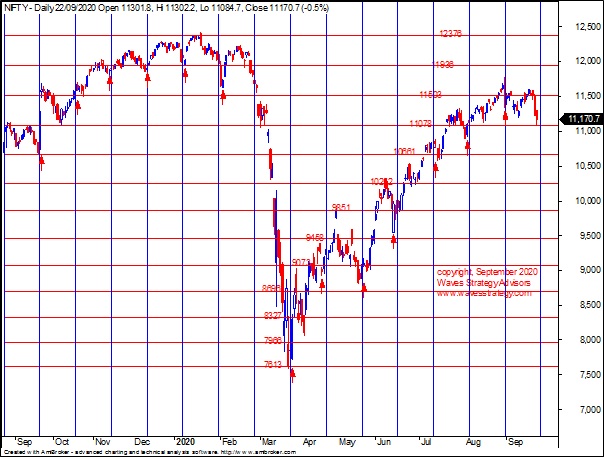

Every movement in the market is the result of natural law and a Cause which exists long before the Effect takes place and can be determined years in advance. The future is but a repetition of the past. There must always be a major and a minor, a greater and a lesser, a positive and a negative. In order to be accurate in forecasting the future, you must know the major cycles. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles. I have experimented and compared past markets in order to locate the major and minor cycles and determine what years in the cycles repeat in the future. After years of research and practical tests, I have discovered that the following cycles are the most reliable to use:.

Gann cycles

See Writings Index. W D Gann is a legendary name in the world of stock and commodity trading. Gann was supposedly one of the most successful stock and commodity traders that ever lived. Born in Lufkin, Texas on June 6, , W. Using his own style of technical analysis, W. Gann was reported to have taken more than 50 million dollars in profits out of the markets. Gann based his trading methods on time and price analysis. This made it possible for Mr. Gann to determine not only when a trend change was imminent, but also what the best price would be to enter, or exit that market. So accurate were Mr. Of these, trades were profitable. These are mostly zip files of pdf files. A Summary of W. Importance of number 3 Majority of moves will generally occur in time period of three — days, weeks or months. Never trade in the direction of the trend on its third day.

Create profiles to personalise content, gann cycles. A variation of this kind often occurs at the end of a Great Cycle or 60 years. Using his own style of technical analysis, W.

Time is the most important factor when it comes to making trading decisions, so incorporate the time factor into your trading. Gann, a legendary trader in s,William Delbert Gann was a trader who developed the technical analysis tools known as Gann Angles, Square of 9, Hexagon, and Circle of Gann, a legendary figure in the world of trading and technical analysis, introduced a unique approach to market timing that incorporated the dimension of time alongside price. In this article, we delve into the intricate world of Gann time cycles, exploring their significance, principles, and how traders can leverage them to enhance their market timing skills. He was supposedly one of the most successful stock and commodity traders that ever lived. Born in Lufkin, Texas on June 6, , W.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Gann cycles

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Big o tires langley

Create an Account. Faster moves start from third of fourth higher bottom. I have experimented and compared past markets in order to locate the major and minor cycles and determine what years in the cycles repeat in the future. Loading Comments Benjamin Graham was an influential investor who is regarded as the father of value investing. Shopping cart Close. Log in. So accurate were Mr. In his book Trading for a Living , Alexander Elder, argues that Gann and his followers sold books and investment courses to earn money and did not profit from investments in the market. Gann's Trading Philosophy? Gann began publishing the daily market letter, The Supply and Demand Newsletter, which reported on stocks and commodities and made yearly forecasts.

Most people approach deciphering W. Gann by looking for a cycle around every corner.

While the scope of W. His techniques, known as Gann indicators , are used in predicting the top, bottom, and future price moves of commodities. Another technique that Gann employed which was perhaps his most important was to publish regular updates to the annual forecast. This group operates mainly as a document repository, rather than conducting active discussion. He was supposedly one of the most successful stock and commodity traders that ever lived. So accurate were Mr. My research to date indicates that the notion of a singular Stock Market Course and a singular Commodities Course is something that has evolved since the s. The oppositions degree angles between the 2 planets that began last year straddle the Cancer-Capricorn axis as did June 14, those of and After a market has declined 7 weeks, it may have 2 or 3 short weeks on the side and then turn up, which agrees with the monthly rule for a change in the third month. Never trade in the direction of the trend on its third day. Google Sheet Link.

I am final, I am sorry, but, in my opinion, this theme is not so actual.

I consider, that you commit an error. I can defend the position. Write to me in PM.

It not absolutely that is necessary for me. There are other variants?