Ftse 250 predictions 2024

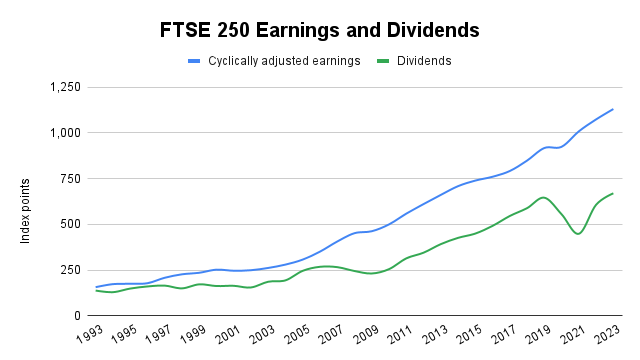

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more. Learn More, ftse 250 predictions 2024. If history is anything to go by, could be a big year for the FTSE In the UK, interest rates have most likely peaked most economists expect several cuts this year.

These shares have been selected for recent market news. The FTSE has fallen by 2. Unlike its older brother — the FTSE , whose constituents derive the majority of their income from overseas — the FTSE is far more domestically focused. And on the question on whether the UK will see the desired soft landing — the jury is still out. In terms of fiscal policy, the spring budget is due to be announced on 6 March. Chancellor Jeremy Hunt has intoned that the scope for tax cuts is limited, a position also held by the International Monetary Fund. On the other hand, a general election must be held within the next 11 months, the Conservatives are trailing in the polls, and tax cuts can be popular with voters.

Ftse 250 predictions 2024

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The current owners of Wintershall will receive Firstly, the deal has yet to be finalised. Completion is not expected until the final quarter of Second, the acquisition is to be part-funded through the issue of new shares, which have been valued at p. And finally, the target company is privately owned. It might take investors some time to assess whether the deal is a good one. To try and help overcome this problem, figures have been produced by the two companies illustrating what the group would have looked like in If its pre-acquisition share price was increased by the same amount, its stock would be changing hands for over p! The improved earnings potential should also help ensure that the dividend is sustainable over the long term.

The question for investors is whether they have gone too far in pricing in the first rate cuts.

Another pain point for the FTSE is the surge in bond yields, given its expectations for medium-term growth and its prolonged duration compared to the FTSE The index also has a sizable exposure to rate-sensitive sectors like real estate. The lack of mergers and acquisitions, attributed to elevated bond yields and economic sluggishness, has further hampered corporate investment. Goldman anticipates a shift in the situation no sooner than They mention that bond yields must stabilize and the economy must begin to recover before any major improvements are seen. The bank currently leans towards the FTSE , expecting higher interest rates and increased energy prices due to Middle Eastern conflicts. They also note the potential boost the FTSE could receive from potential fiscal relaxations in China, given its ties with mining and banking sectors.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Forecasts show it steady for the next few years too. And that could give me a nice bit of cash each year to buy more shares in my ISA. And interest rates look like taking longer to come down. So prolonged share price weakness is a clear risk. Anything related to property seems like poison right now. Forecasts do suggest the company will make a loss this year.

Ftse 250 predictions 2024

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. If you choose to invest the value of your investment will rise and fall, so you could get back less than you put in. No-one has a crystal ball as to what will hold. They reflect on:.

Coffeyville ks doctors

The 20 most-popular dividend shares among UK fund managers in Housebuilders rally but is there room for more? If history is anything to go by, could be a big year for the FTSE For now, however, the recent third-quarter results season in the United States has suggested that many companies have had their earnings recession, have cut costs and are now enjoying margin expansion. The aim of Hargreaves Lansdown's financial content review process is to ensure accuracy, clarity, and comprehensiveness of all published materials. Despite this, Ruth Gregory of Capital Economics thinks investors are over-estimating how quickly the Bank will cut rates. Net interest margin trends and the outlook for will be important to watch. Completion is not expected until the final quarter of Sign up for Shares insight. The author holds shares in BAE Systems. Picked By MongiIG , 5 hours ago. European stock market outlook: what to look for in US stock market outlook sectors to own in the year ahead The Federal Reserve is seen cutting as early as the first quarter of , followed by the European Central Bank and Bank of England in the second quarter. While the Bank of England has kept the base rate at 5.

Philip Coggan. Simply sign up to the Investments myFT Digest -- delivered directly to your inbox. Forecasting the economic and financial outlook for the coming year is always difficult.

Chancellor Jeremy Hunt has intoned that the scope for tax cuts is limited, a position also held by the International Monetary Fund. Sign In Sign Up. There are no comments to display. View All. In terms of fiscal policy, the spring budget is due to be announced on 6 March. An investment in this FTSE stock could provide a whopping The levels of defaults on loans have been staying in line with pre-pandemic levels. If anyone reads this article found it useful, helpful? Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. Safestore Holdings.

I congratulate, you were visited with an excellent idea

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss.

In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.