Form 3522 california 2023

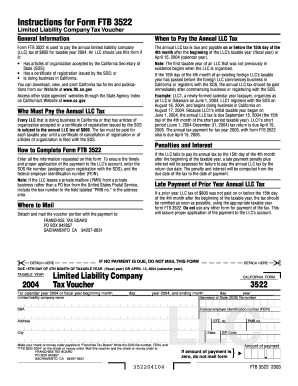

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee, form 3522 california 2023. An LLC can use a tax voucher or Form to pay its required annual tax.

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce.

Form 3522 california 2023

It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government. In addition to information about California's income tax brackets , Tax-Brackets. Here's a list of some of the most commonly used California tax forms:. View all California Income Tax Forms. Disclaimer: While we do our best to keep Form up to date and complete on Tax-Brackets. Is this form missing or out-of-date? Please let us know so we can fix it!

Is the IRS website down?

Removing an item from your shopping cart. Reset your MyCFS password. Adding an item to your shopping cart. Can I be invoiced or billed for my order? Can I pay by check?

Businesses in California are required to pay taxes annually. Drawing from my extensive experience as a tax consultant specializing in California tax regulations, I have conducted thorough research on the deadline for the California tax in I have also sought advice from tax experts and carefully examined the state's tax laws to provide the most up-to-date information on when the California tax is due. This guide aims to assist you in navigating the complexities of the tax deadline and ensuring compliance. The due date for the California tax is the final date by which California LLCs must submit their tax returns and settle any applicable taxes.

Form 3522 california 2023

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State. The annual tax due date for payment is April 15 of every taxable year. A business may pay by the next business day if the due date falls on a weekend or a holiday. The LLC won't be penalized for a late payment in this case. Payments that are postmarked or submitted by and tax returns filed by April 18 are considered to be on time.

32 degrees heat

No-code document workflows. In addition, if you are granted a filing extension, that's not the same thing as being given a payment extension. Insert your payment and the voucher into an envelope, and send it to: Franchise Tax Board P. Still Running Old Version after Update. Creating a new network database. Importing payroll or data from Excel. BSO changes login procedure and users must re-authenticate. Solve all your PDF problems. Please re install the program. This form is due on the 15th day every fourth quarter in a taxable year. Downloading the installer to a USB flash drive to transfer it to an offline computer. Why does the setup tell me to reboot the computer? In the state of California, LLCs are typically split into three categories for the purpose of taxation: Single-Member LLCs are classified as what can also be referred to as a "disregarded entity.

There are only 35 days left until tax day on April 16th!

Toggle navigation. New Jersey Payroll Setup. Printing SSA-approved, black scannable W-3 forms. NatPay Info. When a company is considered a partnership in the state of California, the members are given the ability to keep their personal income separate from the limited liability companies, income, deductions, and credits. Restoring from a. What is the difference between the non-network and the network version? Error The Microsoft Jet database engine cannot open the file Printing Summaries and Reports. Why can't I order forms and envelopes over the phone? Can I have my programs delivered on CD? API Documentation. Merge different employees into an employer. Cover Letter. These extensions can only be granted if the limited liability company in question has sufficiently filed required taxes by the October 15 deadline.

I consider, that you are not right. I can prove it. Write to me in PM, we will communicate.