Form 15g fillable

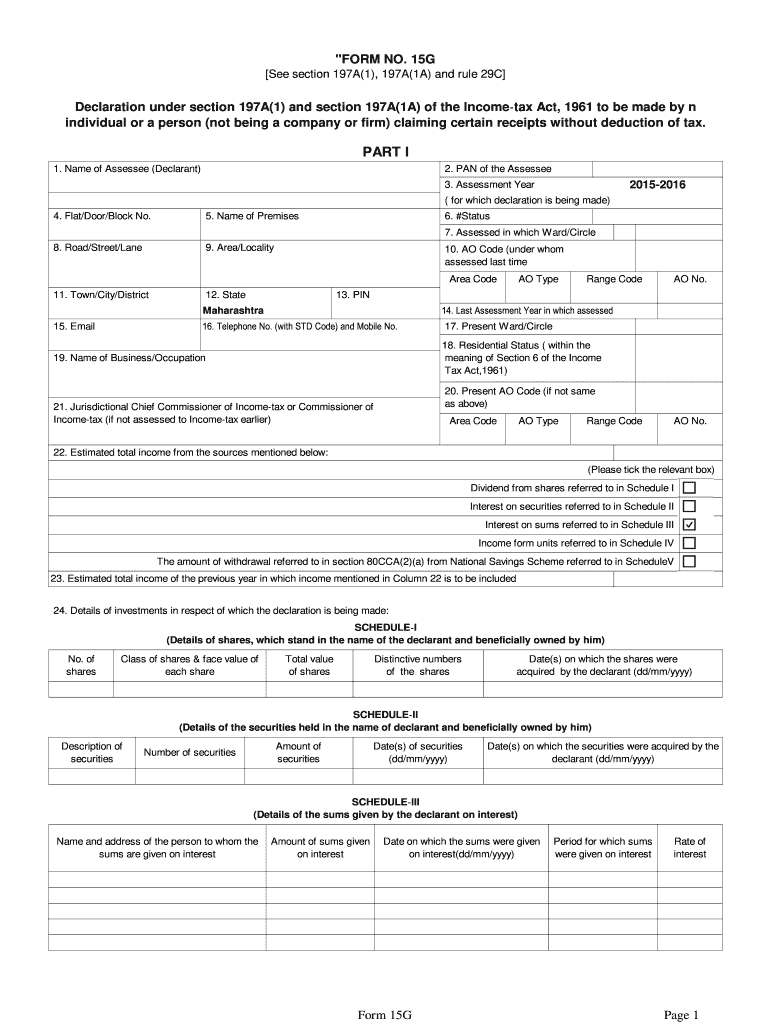

Didn't receive code? Resend OTP. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. The employer also contributes an equal amount. You can withdraw this PF balance as per the PF withdrawal rules. However, if the amount you withdraw is more than Rs.

Form 15g fillable

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce. Sorry to Interrupt. We noticed some unusual activity on your pdfFiller account. Solve all your PDF problems. Compress PDF. PDF Converter. Add image to PDF. Edit scanned PDF. Split PDF.

Forms Catalog. Please type your query, and we shall provide immediate assistance. Edit scanned PDF.

.

Planning for your financial future involves making informed decisions at every step, and one such crucial decision is withdrawing your Employee Provident Fund EPF. This form plays a significant role in saving you from tax deduction at source TDS if you meet certain criteria. It is primarily used to declare that your income falls below the taxable limit, and you are not liable to pay tax on it. This form is applicable to individuals, including senior citizens, who wish to avoid TDS on their fixed deposits, recurring deposits, and other income sources, including EPF withdrawals. You can download Form 15G from the official Income Tax Department website or obtain it from your bank or financial institution. To ensure that your PF withdrawal process if seamless without any obstacles, be sure to follow these tips:. Once you submit Form 15G, it will go through the following process to ensure that the full PF sum reaches you without any unnecessary tax deduction:. They will also verify whether you meet the eligibility criteria for submitting the form. If your submitted Form 15G is found to be accurate and in line with the eligibility criteria, the authority will process the form accordingly.

Form 15g fillable

Explore our wide range of software solutions. ITR filing software for Tax Experts. Bulk invoice in Tally or any ERP. G1-G9 filings made 3x faster. Ingest and process any amount of data any time of the month, smoothly. Built for scale, made by experts and secure by design. Bringing you maximum tax savings, unmatched speed and complete peace of mind. Experience 3x faster GST filings, 5x faster invoice reconciliation and 10x faster e-waybill generation. Individuals file their tax returns in under 3 min.

Twinks gay porn

ISO Data Center. Cleartax is a product by Defmacro Software Pvt. No, the financer or bank must fill out the second part of Form 15G. Company Support. What is the eligibility criteria for submitting Form 15G? Address: Mention your address, preferably the one mentioned in the Aadhaar card along with your PIN code. Sign me up. Mobile App. This portion of the site is for informational purposes only. Invoicing Software.

Elevate processes with AI automation and vendor delight.

Currency Converter. Report Vulnerability Policy. Page Numbering. Company Policy Terms of use. Protect PDF. Case Studies. GST Registration. So, you will receive only the balance amount after the tax is deducted. For Personal Tax and business compliances. Log in. Estimated income for which this declaration is made: In this field, mention the estimated withdrawal amount. Adobe Acrobat Alternative. You can withdraw this PF balance as per the PF withdrawal rules. We hope to see you again soon.

So happens.

In my opinion you are not right. Let's discuss it. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will talk.