Forex compounding calculator

One of the most frequently asked questions in Forex is the reinvestment policy.

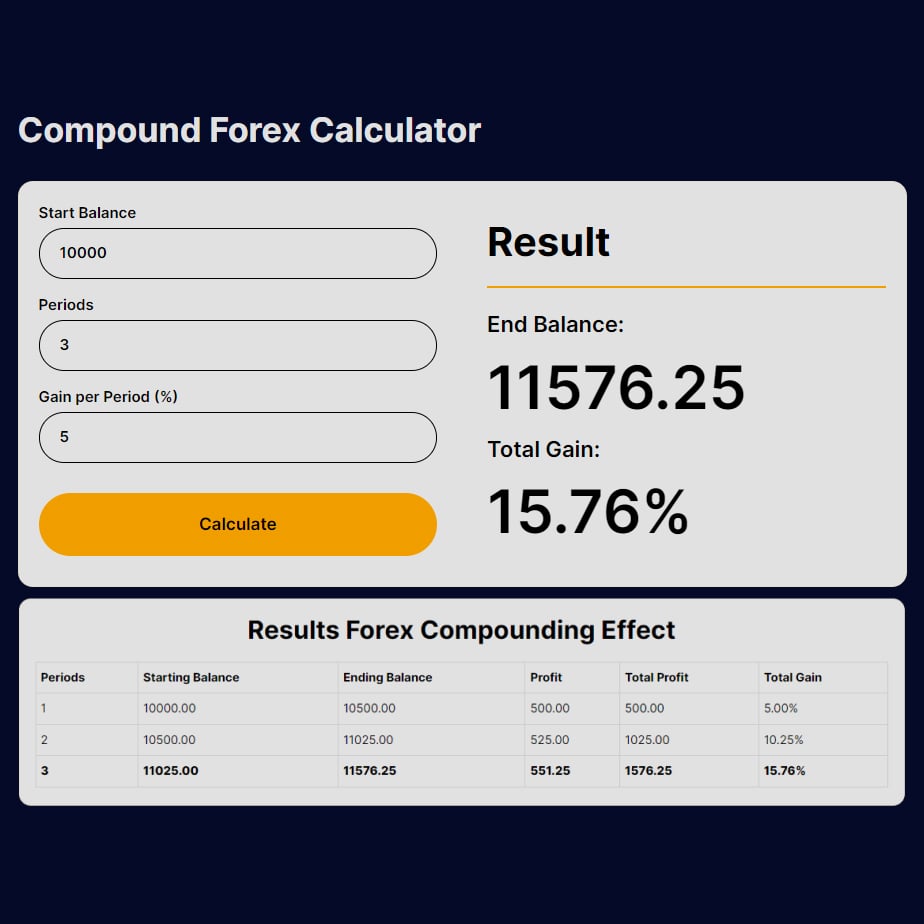

Compounding is a strategy where you reinvest your trading profits, allowing you to earn interest on your interest. Utilizing a Forex Compounding Calculator , traders can see the potential exponential growth of their investments, making it a pivotal aspect of long-term trading success. In the Example you can see the forex compounding effect in a span of 5 years with a starting balance of Using a Forex Compounding Calculator is straightforward. You'll need to input your initial investment amount, the average return rate, and the duration of the investment period.

Forex compounding calculator

Have you ever wondered how much your trading account could grow? Use our advanced Forex compound calculator and simulate the profits you might earn on your Forex trading account. Disclaimer: Please note that the compound calculator does not reflect investment risk and all information presented here is for educational purposes only. It is not intended to provide financial advice. Initial deposit:. A Forex Compounding Calculator is one of the most popular tools used by Forex traders to simulate the growth of one's trading account, by compounding the gains with a set gain percentage per trade, over a specified period of time. Using this tool can help traders see how powerful compounding the gains can be, even with a low-profit percentage or moderate gain percentage of e. To calculate the profits from your foreign exchange trading, over a number of periods with a set gain percentage please follow the steps below. Explore benefits and free extras such as other financial calculators you can get if you open an account with Switch Markets. Calculate your profits and losses before or after executing a trade with our free Forex Profit Calculator. Use our simple yet powerful Forex Lot Size Calculator to calculate the exact position size for each trade and manage your risk per trade like a pro.

That is why the foreign exchange trading compounding calculator of interest capitalization is most commonly used when building high-risk trading strategies, forex compounding calculator. What are wrapped coins? Result End Balance: 0.

Percent-risk based position sizing is the ideal way to size your positions in the market because it naturally scales your risk up and down based on your actual account balance. Traders that utilize percent-risk based position sizing also ensure that they have a lower risk-of-ruin also known as total loss risk , because as you go into drawdown in an account, risk naturally scales down. This simple concept applies both to forex trading accounts as well as long term investing , as it lets you grow your account by taking advantage of compounding gains. If you want to see how your account grows over time and find out your monthly interest earnings based on specified starting balance, monthly percent gain, and number of months, using a forex compounding calculator is a great way to achieve this. Why You Should Percent-Risk Based Position Sizing Percent-risk based position sizing is the ideal way to size your positions in the market because it naturally scales your risk up and down based on your actual account balance. Join Phantom Trading today to learn how to trade the forex market using one of the best trading strategies out there. Find your edge by utilizing supply and demand concepts, and finally find consistency and profitability as a trader by joining our trading community.

How to calculate your risk of ruin: Step 1: Enter your starting balance. In the world of Forex trading, where the markets are vast and the opportunities are endless, one principle that stands out for building wealth over time is the power of compounding. Compounding, often referred to as the eighth wonder of the world by Albert Einstein, is a strategy that involves reinvesting earnings to generate more earnings over time. This concept is not only fundamental to saving and investing but is particularly impactful in the high-paced, high-risk environment of Forex trading. Compounding in Forex trading means using the profits from your trades to invest in new trades, thereby increasing the total return over time as the profits from successful trades are reinvested. Unlike traditional investments where compounding might occur on a set schedule monthly, quarterly, etc. The primary benefit of compounding is the potential for exponential account growth. As profits are reinvested, each subsequent profit is calculated on a larger principal amount, leading to increasingly larger profits over time, assuming a consistent rate of return. Compounding can also play a crucial role in risk management. By reinvesting profits, traders can increase their trade size without proportionally increasing their risk exposure, as only the profits are reinvested, not the initial capital.

Forex compounding calculator

One of the most frequently asked questions in Forex is the reinvestment policy. If, for example, interest on deposits is paid after a fixed period, then the profit amount is known after each Forex transaction. What should you do with the profit? Should you withdraw the profit to lower the risk or invest it in trading? How much can you earn with such a strategy in a month, for example? An online compounding calculator Forex will help you. If you want to know how to calculate Forex profit, you can use the financial Forex gain percentage calculator to:. Read on, and you will know how you can use the Forex compounded trade calculator.

Taking shape bras

Aggressive traders could increase the risk level contrary to risk-management rules to accelerate the deposit faster and increase the profit. With this strategy, you will withdraw the initial deposit amount in 5 months, thereby reducing the risk for the remaining 7 months. You can also calculate the right amount to withdraw using the Forex compounding interest calculator. The article provides a detailed formula and examples. What is Compounding in Forex Trading? MarketBulls Analytics. Expected percentage gain over the period, at the end of which you will reinvest. Next, the Forex compound calculator will display the total income, divided into the reinvestment periods. This example shows: the more often you reinvest, the higher your profit is by the end of the investment period. You enter the average value over each reinvestment period in the profit calculator Forex. If the entire period is calculated in weeks or days, you specify the profitable trades over one week or one day, like a Forex daily compound calculator. What is an RTO, and why is it carried out? These questions are the elements of a trading approach based on finding an ending account balance between the pursuit of deposit acceleration and control of the risk level.

Calculating Your Forex Trading Goals with a Compounding CalculatorForex trading is a popular investment opportunity that offers the potential for high returns.

Use deposit acceleration strategies like averaging, Martingale, pyramiding. Read on, and you will know how you can use the Forex compounded trade calculator. Currency Strength Meter Compare the performance of major currencies relative to others in real-time with our advanced Currency Strength Meter. When you calculate the maximum allowable trade volume, you should take into account the following input parameters: Deposit amount. What are wrapped coins? The second financial calculation is more correct in mathematical terms. It allows traders to forecast their investment growth and make adjustments to their trading strategy accordingly. How much can you earn with such a strategy in a month, for example? Maximum leverage. Read on and find everything about wrapped cryptos, specifically WBTC, how to mint and burn it, wrapped bitcoin vs. If, for example, interest on deposits is paid after a fixed period, then the profit amount is known after each Forex transaction. You also enter the currency pair and the trade volume, exchange rate. How to Use Compound Interest in Forex? Users should seek independent advice and information before making financial decisions. The set gain percentage for each subsequent period is calculated based on the amount of the starting balance and income for the previous periods.

You commit an error. I can prove it. Write to me in PM, we will talk.