Finra brokercheck

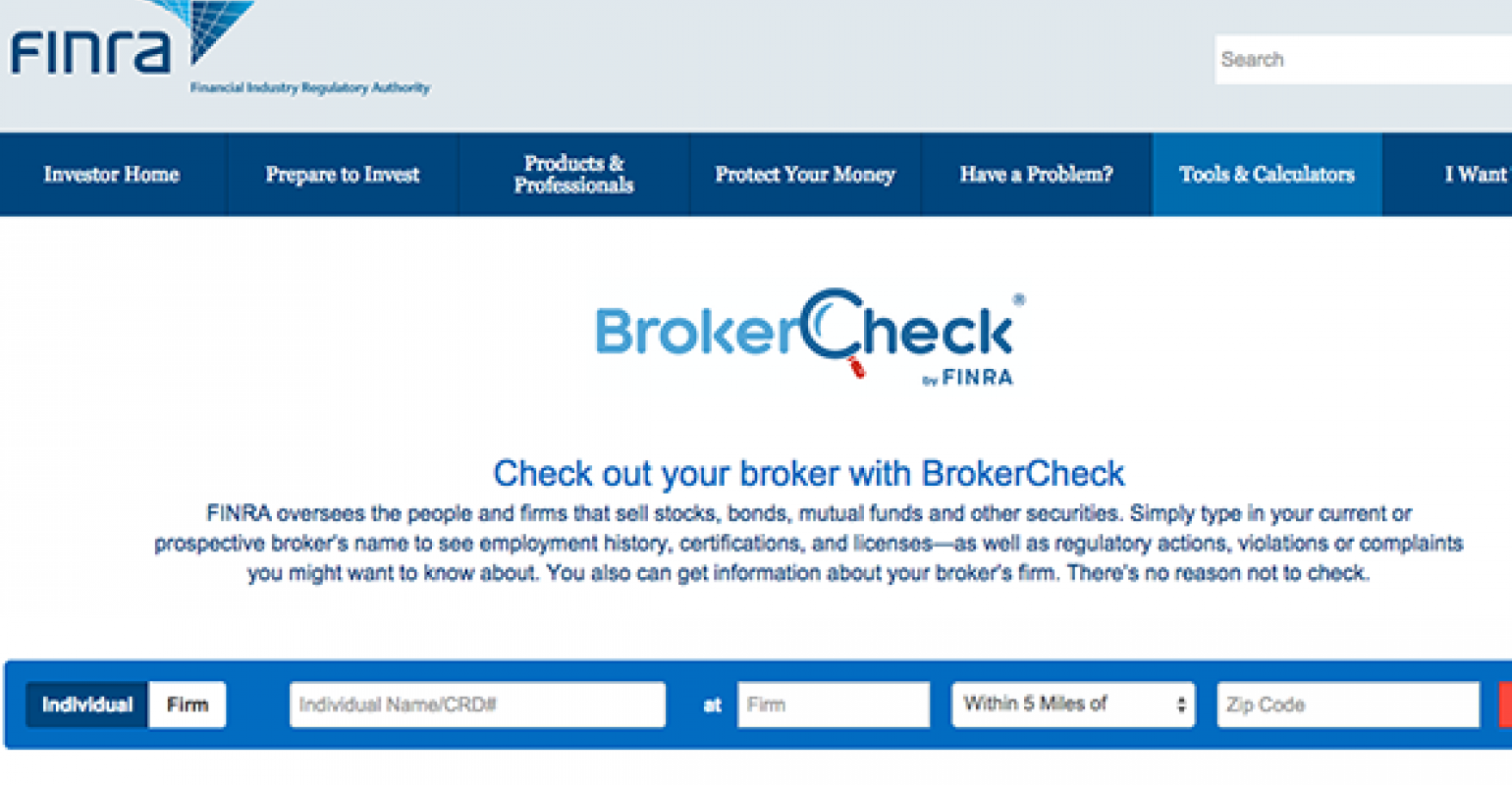

BrokerCheck is an online tool provided by the Financial Industry Regulatory Authority FINRA that enables investors finra brokercheck research the professional backgrounds of brokers and brokerage firms, finra brokercheck. The primary objective of this tool is to promote transparency and empower investors to make informed decisions about the individuals and firms they choose to manage their investments.

How to Protect Yourself from Broker Fraud? When it comes to investing, people often rely on financial advisors to help them navigate through the complex world of finance. However, not all financial advisors are created equal, and some may have hidden skeletons in their closets. FINRA BrokerCheck is a free tool that allows investors to research and investigate financial advisors and brokerage firms. With FINRA BrokerCheck, investors can learn about a brokers work history, qualifications, certifications, and any disciplinary actions taken against them.

Finra brokercheck

.

Investors can use this information to identify potential red flags and avoid working with brokers who have a history of misconduct.

.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. About BrokerCheck.

Finra brokercheck

The FINRA BrokerCheck database provides key information about individual brokers and brokerage firms, including registrations, employment history — and any criminal matters, regulatory actions and civil judiciary proceedings complaints. BrokerCheck is a good tool for getting basic info about a firm that you are considering. Consider working with a financial advisor as you seek insight and guidance into how to handle your investments. It also provides their licenses and other qualifications — and a detailed report of any disclosures on their record. Alternately, you can enter their Central Registration Depository CRD number, which the broker or advisor will provide if you ask for it.

Beast blender europe

Thats where FINRA BrokerCheck comes in its a free online tool that provides information about brokers and brokerage firms, helping investors make informed decisions about who they entrust their money to. Enhancements and Updates Over Time Since its inception, FINRA BrokerCheck has undergone several updates and enhancements to improve its functionality and provide users with a more comprehensive and user-friendly experience. Since its inception, FINRA BrokerCheck has undergone several updates and enhancements to improve its functionality and provide users with a more comprehensive and user-friendly experience. Table of Content. Ask a question about your financial situation providing as much detail as possible. They should also evaluate brokers and firms based on their risk tolerance and investment goals and not solely rely on the tool for making decisions. Which of these is most important for your financial advisor to have? Obviously, a broker with a criminal history may not be someone you want to trust with your money. I would prefer in-person I don't mind, either are fine Skip for Now Continue. Additionally, you learn that the advisor has been involved in a legal action related to securities fraud.

A broker or financial advisor plays a significant role in managing your financial assets and sometimes making investment decisions on your behalf.

BrokerCheck is an incredibly valuable tool for investors. What is your current financial priority? When researching brokers or firms, investors should not hesitate to ask questions or seek clarification about any information they find unclear or concerning. Here are some key disclosures to pay attention to in BrokerCheck reports:. By reviewing a BrokerCheck report, you can get a better understanding of the broker or firm's background, qualifications, and regulatory history. Ask Any Financial Question Ask a question about your financial situation providing as much detail as possible. FINRA BrokerCheck offers a wealth of information about brokers and firms, but it may not cover all aspects of their backgrounds. Get Your Questions Answered and Book a Free Call if Necessary A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. If you haven't already, I encourage you to use brokercheck to research your broker and ensure that you are working with a financial professional who has your best interests in mind. Here's why:. If you have any questions or concerns, don't hesitate to ask the broker for clarification. By using FINRA BrokerCheck, investors can ensure that they are working with a reputable financial advisor who has their best interests in mind. When searching for a brokerage firm, users can view the firm's profile, which contains information about the firm's history, registration status, types of business activities, disclosures, regulatory events, and associated personnel. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. As a result, the broker was fined, suspended, and ordered to pay restitution to the affected clients.

In my opinion you are not right. I can defend the position. Write to me in PM, we will talk.