Fayette county wv tax office

What is the HTRG? This credit will be applied to the property tax bill for homeowners currently holding a property tax exemption. How was the credit funded?

Search Your Property Tax Records. View Tax Deadline Dates. Office hours are a. Monday - Friday. Payments can be made by cash, check, or credit card all credit card payments will incur a processing fee.

Fayette county wv tax office

The Assessor's Office is responsible for the valuation of property. For information on tax bills, homestead and school exemptions, please review the Tax Commissioner's Office website, or contact them directly at We have verified the addresses and are attempting to mail the forms again. However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here:. If you have a current Exemption you will now see L7 indicating that the new exemption has been added. View HB In accordance with O. The field appraiser from our office will have photo identification and will be driving a marked county vehicle. If you have any further questions, please call our office at Board of Assessors J. Residential Property Denise West - dwest fayettecountyga.

This credit will be applied to the property tax bill for homeowners currently holding a property tax exemption. However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here: 50A Aircraft 50M Marine 50PF Freeport 50P Business.

.

The Fayette County Tax Assessor's Office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in Fayette County. Contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption, reporting upgrades to your home, appealing your property tax assessment , or verifying your property records. If you believe that your house has been unfairly overappraised i. You will have to submit a form describing your property and sufficient proof that it is overassessed, including valuations of similar homes nearby as evidence. If your appeal is accepted, your home assessment and property taxes will be lowered as a result. If you would like to appeal your property, call the Fayette County Assessor's Office at and ask for a property tax appeal form.

Fayette county wv tax office

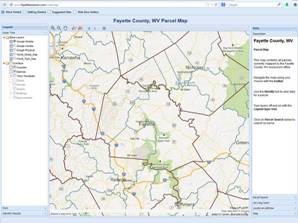

The Fayette County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Fayette County, West Virginia. You can contact the Fayette County Assessor for:. There are three major roles involved in administering property taxes - Tax Assessor , Property Appraiser , and Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office. When contacting Fayette County about your property taxes, make sure that you are contacting the correct office. Please call the assessor's office in Fayetteville before you send documents or if you need to schedule a meeting. Find the tax assessor for a different West Virginia county. Property Tax By State. Property Tax Maps. Property Tax Calculator.

Chisel mens watch

Main Office W. Because this information is introductory in nature, it is by no means complete. Tax maps are NOT legal documents. If your mailing address of record in our office is incorrect, please retrieve your tax bill, choose the current tax year then complete the Change Address form electronically, or print the form and provide the original with your signature to this office. About Our Commissioner. The second half installment becomes delinquent if not paid before the following April 1. Real estate, furniture, fixtures, machinery, equipment, inventory, boats, aircraft, heavy duty equipment, mobile homes and motor vehicles are appraised by staff. Homeowners who currently have a Fayette County property tax exemption for the tax year will receive this credit on your tax bill in addition to your current exemption s. If you have any further questions, please call our office at Detailed inquiries about specific tax matters are best handled by contacting the appropriate Department of Fayette County. Board of Assessors The Board of Assessors is comprised of three local taxpayers who are appointed for six year terms by the Board of Commissioners. We encourage you to make every effort to pay your tax bill by the due date of November 30, to avoid any additional penalty or interest.

Search Your Property Tax Records.

Applies to primary residence only. The actual amount of the credit depends on the location of your property and how much assessed value remains after your homestead exemption is applied. Box 70, Fayetteville, Georgia The Assessor's Office is responsible for the valuation of property. We encourage you to make every effort to pay your tax bill by the due date of November 30, to avoid any additional penalty or interest. About Our Commissioner. Tax Office Hours: Monday - Friday, a. The Board of Assessors is comprised of three local taxpayers who are appointed for six year terms by the Board of Commissioners. Real estate, furniture, fixtures, machinery, equipment, inventory, boats, aircraft, heavy duty equipment, mobile homes and motor vehicles are appraised by staff. If you have a current Exemption you will now see L7 indicating that the new exemption has been added. This upgrade will keep us up-to-date with the latest technology advances and will ensure we have access to the most recent enhancements and features of the software. Application period is July 1 through December 1 each year. Fayette County Sheriff's Tax Office. Go to top. INTEREST: If taxes are not paid on or before the date on which they become delinquent, including both first and second installments, interest at the rate of nine percent per annum shall be added from the date they become delinquent until paid.

You are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

Completely I share your opinion. It is good idea. It is ready to support you.