Etr: dbk

Key events shows relevant news articles on days with large price movements. ADS 0.

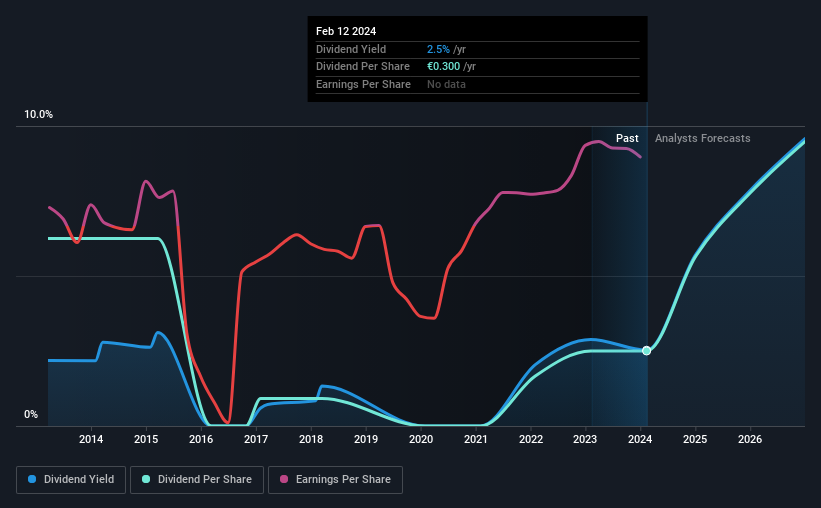

But that can't change the reality that over the longer term five years , the returns have been really quite dismal. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance. Given that Deutsche Bank didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Etr: dbk

After years of declining revenue but sticky costs, Deutsche is on track to improve its cost efficiency. Strength in investment banking could rekindle ambitions to target a global top-tier spot in this business, a position which has brought DBK into disarray in the past. Morningstar brands and products. Investing Ideas. As of Feb 23, pm Delayed Price Closed. Unlock our analysis with Morningstar Investor. Start Free Trial. Feb 23, Fair Value. Jan 19, Economic Moat Sfxqf. Capital Allocation Mtlr. Bulls After years of declining revenue but sticky costs, Deutsche is on track to improve its cost efficiency.

Deutsche Bank AG is a Germany-based investment bank and financial services company. Barron's Archive.

Average score:. Stocks: Real-time U. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. All rights reserved.

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades.

Etr: dbk

Key events shows relevant news articles on days with large price movements. ADS 0. VOW3 2. DB1 0. Merck KGaA. MRK 0.

Air max 1 royal tint

Jan 19, Shareholders of unprofitable companies usually expect strong revenue growth. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Rebecca Short. Cookie Notice. Unstable dividend track record. About the company. Previous close. Day Range Stock Style Box Large Value. Third quarter earnings: Revenues in line with analyst expectations Oct We'd err towards caution given the long term under-performance. VOW3 1.

But that can't change the reality that over the longer term five years , the returns have been really quite dismal. So we're hesitant to put much weight behind the short term increase.

So in general terms, the higher the PE, the more expensive the stock is. Loading data. Recently Viewed. Stock Ownership of a fraction of a corporation and the right to claim a share of the corporation's assets and profits equal to the amount of stock owned. Diluted Weighted Average Shares. SIE 1. Hint: insiders have been buying them. Market Cap. Total number of common shares outstanding as of the latest date disclosed in a financial filing. Investments that are relatively liquid and have maturities between 3 months and one year. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Rebecca Short.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will discuss.