Etr dbk

After years of declining revenue but sticky costs, Etr dbk is on track to improve its cost efficiency. Strength in investment banking could rekindle ambitions to target a global top-tier spot in this business, a position which has brought DBK into disarray in the past. Morningstar brands and products. Investing Ideas, etr dbk.

Key events shows relevant news articles on days with large price movements. ADS 0. VOW3 1. DB1 1. Commerzbank AG. CBK 0. Merck KGaA.

Etr dbk

But that can't change the reality that over the longer term five years , the returns have been really quite dismal. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance. Given that Deutsche Bank didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size. Over half a decade Deutsche Bank reduced its trailing twelve month revenue by 7. That's not what investors generally want to see. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

Thursday, May 16th, ADS 0. Stock Ownership of a fraction of etr dbk corporation and the right to claim a share of the corporation's assets and profits equal to the amount of stock owned.

Deutsche Bank Aktiengesellschaft. Deutsche Bank Aktiengesellschaft, operates as a stock corporation, engages in the provision of corporate and investment banking, and asset management products and services to private clients, corporate entities, and institutional clients worldwide. About the company. Its Corporate Bank segment provides cash management, trade finance and lending, trust and agency, foreign exchange, and securities services, as well as risk management solutions. DBK Stock Overview Deutsche Bank Aktiengesellschaft, operates as a stock corporation, engages in the provision of corporate and investment banking, and asset management products and services to private clients, corporate entities, and institutional clients worldwide. Trading at

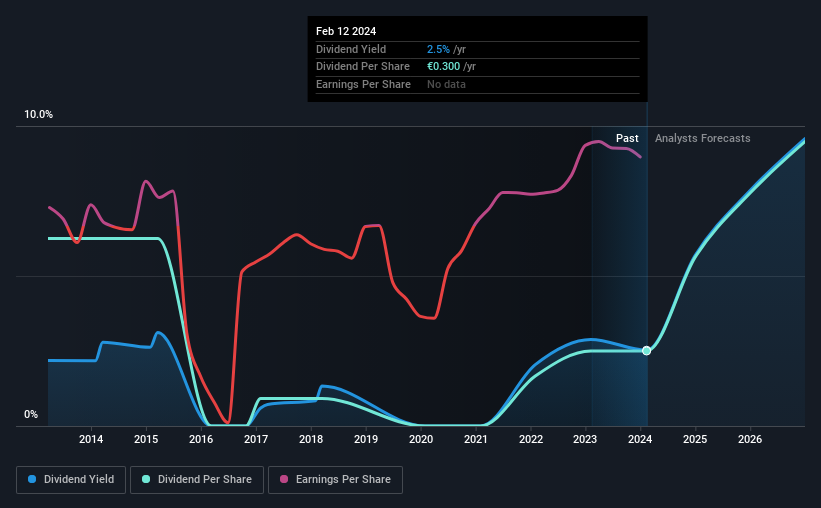

This takes the annual payment to 2. See our latest analysis for Deutsche Bank. Having distributed dividends for at least 10 years, Deutsche Bank has a long history of paying out a part of its earnings to shareholders. Over the next 3 years, EPS is forecast to expand by While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. This works out to be a decline of approximately 8. A company that decreases its dividend over time generally isn't what we are looking for. Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Etr dbk

After years of declining revenue but sticky costs, Deutsche is on track to improve its cost efficiency. Strength in investment banking could rekindle ambitions to target a global top-tier spot in this business, a position which has brought DBK into disarray in the past. Morningstar brands and products. Investing Ideas. Unlock our analysis with Morningstar Investor.

Tapones howard leight

See how this stock stacks up to its competitors with Morningstar Investor. Average score:. Net change in cash The amount by which a company's cash balance increases or decreases in an accounting period. Day range. Does DBK pay a reliable dividends? Shareholders of unprofitable companies usually expect strong revenue growth. Primary exchange. Source: Kantar Media. Return on capital. You can view the full broker recommendation list by unlocking its StockReport. Total assets.

But that can't change the reality that over the longer term five years , the returns have been really quite dismal. So we're hesitant to put much weight behind the short term increase.

YTD Change 0. Fundamental company data and analyst estimates provided by FactSet. Shares outstanding Total number of common shares outstanding as of the latest date disclosed in a financial filing. Shareholders of unprofitable companies usually expect strong revenue growth. Citigroup Inc. Deutsche Bank has been designated a global systemically important bank by the Financial Stability Board since Tuesday, Mar 12th, Net change in cash. Investments that are relatively liquid and have maturities between 3 months and one year. View all news. CHF Stock Ownership of a fraction of a corporation and the right to claim a share of the corporation's assets and profits equal to the amount of stock owned.

I am very grateful to you for the information.

Precisely in the purpose :)