Enbridge dividend increase

Enbridge Inc. This makes the dividend yield 7.

Enbridge Inc. ENB expects increased core earnings for The company has elevated its dividend outlook for , banking on a rise in demand to boost the volumes transported through its network. The positive outlook is based on the anticipated increase in demand, supported by the ongoing trend of growing profits in the Canada oil and gas transportation sector. This is the primary unit of the company, supported by robust system utilization. Enbridge is strategically positioned to sustain consistent growth well into the future. In alignment with this optimistic financial outlook, the company has announced a 3.

Enbridge dividend increase

.

The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

.

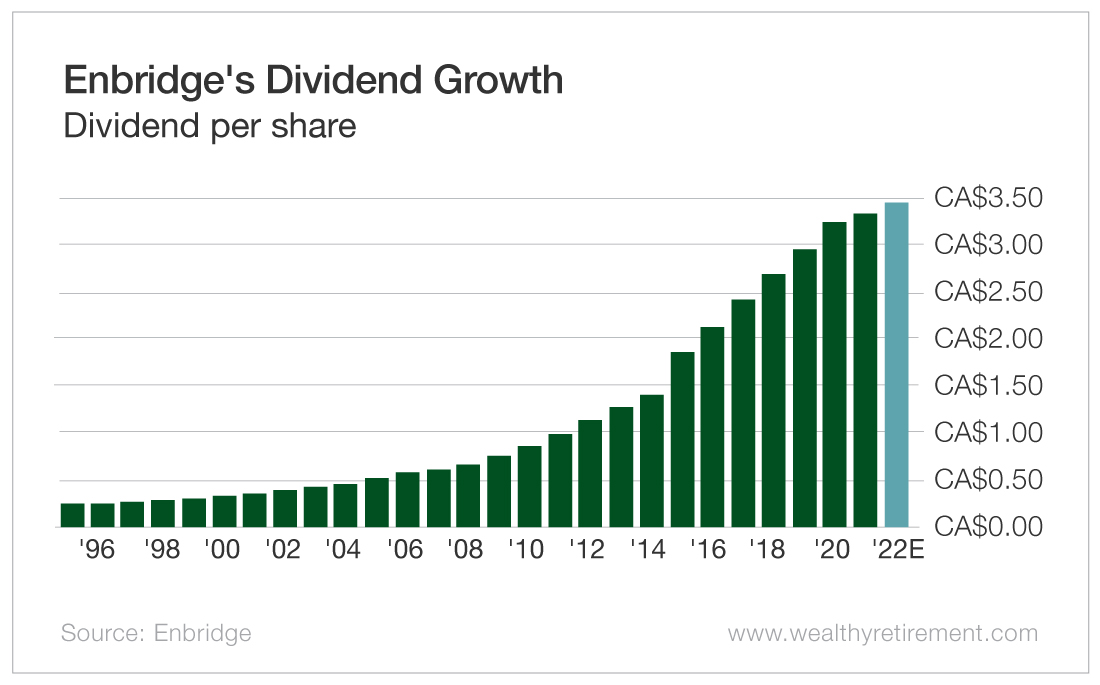

All financial figures are unaudited and in Canadian dollars unless otherwise noted. Declared 29 th consecutive annual common share dividend increase, raising it by 3. All figures, including EBITDA, DCF, capital expenditures, share counts, debt issuances and financial derivative figures, unless specified otherwise, in this news release are presented excluding the impact of the Acquisitions 1. We understand the critical role we play in powering communities and economies, and we are dedicated to expanding our infrastructure to ensure energy accessibility for all. Enbridge will continue to innovate and invest in the infrastructure required to strengthen our position as the first-choice energy delivery provider in North America and beyond. Given that we expect to realize only partial year contributions from the Acquisitions, we are issuing our guidance on the base business and excluding the impact of any contributions related to them.

Enbridge dividend increase

The declared dividend represents a 3. On November 28, , the Enbridge Board of Directors declared the following quarterly dividends. All dividends are payable on March 1, to shareholders of record on February 15 , At Enbridge, we safely connect millions of people to the energy they rely on every day, fueling quality of life through our North American natural gas, oil and renewable power networks and our growing European offshore wind portfolio. We're investing in modern energy delivery infrastructure to sustain access to secure, affordable energy and building on more than a century of operating conventional energy infrastructure and two decades of experience in renewable power. We're advancing new technologies including hydrogen, renewable natural gas, carbon capture and storage and are committed to achieving net zero greenhouse gas emissions by To learn more, visit us at enbridge. Media Toll Free: Email: media enbridge. Investment Community Toll Free: Email: investor.

450ml to ounces

The company has a long history of increasing the value of its shareholders, courtesy of steady cash flows. Have feedback on this article? Simply Wall St has no position in any stocks mentioned. This is the primary unit of the company, supported by robust system utilization. To read this article on Zacks. Enbridge will pay out a quarterly dividend of Suncor boasts an impressive supply-chain network, owning significant oil sands and conventional production platforms. Nikkei 39, Alternatively, email editorial-team at simplywallst. Get in touch with us directly. View our latest analysis for Enbridge Enbridge Doesn't Earn Enough To Cover Its Payments While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Want the latest recommendations from Zacks Investment Research? Suncor Energy, Inc. Story continues.

The next Enbridge Inc dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Enbridge Inc dividend was

Concerned about the content? Get in touch with us directly. Enbridge Inc. Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank 2 Buy. Enbridge Inc. Dow 30 39, Gold 2, Simply Wall St has no position in any stocks mentioned. Nasdaq 16, The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between. This makes the dividend yield 7. The company has elevated its dividend outlook for , banking on a rise in demand to boost the volumes transported through its network. This signifies the 29th consecutive annual dividend hike for the company. In alignment with this optimistic financial outlook, the company has announced a 3. In summary, while it's always good to see the dividend being raised, we don't think Enbridge's payments are rock solid.

Rather valuable information