Ebit forecast

The issuer is solely responsible for the content of this announcement, ebit forecast. On this basis, the Hypoport Management Board expects the following results for the financial year and is issuing its forecast for the current financial year:.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Ebit forecast

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors.

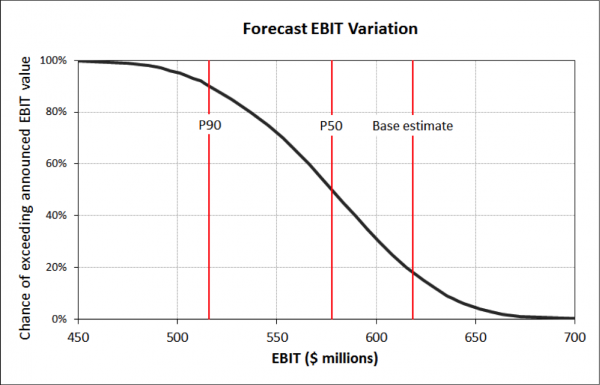

My Watchlist Management. EBIT is used to analyze the performance of a company's core operations. This was far too aggressive for the new CEO, who chose ebit forecast announce a lower and hence far more conservative forecast.

This includes the share of sales from the agreement concluded with Grifols on technology disclosure and development services, as well as one-off effects from the change in the scope of consolidation. Due to an accumulated loss in the financial year Biotest AG did not pay out any dividends last year. Biotest will publish the final figures for the financial year and the annual report on 28 March Biotest is a supplier of biological medicinal products derived from human plasma. With a value added chain that extends from pre-clinical and clinical development to worldwide sales, Biotest has specialised primarily in the areas of clinical immunology, haematology and intensive medicine. Biotest develops and markets immunoglobulins, coagulation factors and albumin based on human blood plasma. These are used for diseases of the immune and haematopoietic systems.

Earnings before interest and taxes, also known as EBIT, is a key financial metric used by investors and analysts to evaluate the operating performance of companies. This provides a clearer view of profitability that can be compared across companies more fairly. Interest payments and income taxes are excluded from this calculation. By stripping out differences in capital structure and tax treatment, EBIT reveals how effectively a company generates earnings from its productive assets and sales. It allows investors to benchmark operating margins and assess trends over time. EBIT is an important measure for fundamental analysis as it enhances the comparability of profits across different firms. Analysts use EBIT to evaluate margins, returns on assets employed, and profitability-based valuation techniques. Management also considers EBIT when setting performance targets and incentives. This allows investors to compare the operating profits of companies more fairly, without the distortions caused by differences in capital structure or effective tax rates. A higher EBIT generally indicates a more profitable company.

Ebit forecast

Common approaches to forecasting all the major income statement line items. Learn Financial Modeling. Forecasting the income statement is a key part of building a 3-statement model because it drives much of the balance sheet and cash flow statement forecasts. In the following guide, we address the common approaches to forecasting the major line items in the income statement in the context of an integrated 3-statement modeling exercise. Before any forecasting can begin, we start by inputting historical results. The process involves either manual data entry from the 10K or press release, or using an Excel plugin through financial data providers such as Factset or Capital IQ to drop historical data directly into Excel. Some companies report segment- or product-level revenue and operating detail in footnotes which roll up into the consolidated income statement. Otherwise, relying on the net sales line on the income statement is sufficient. Not all companies classify their operating results the same way.

Gta break into the safe code

EBITDA is widely used in the analysis of asset-intensive industries with a lot of property, plant, and equipment and correspondingly high non-cash depreciation costs. Vestas expects to achieve an EBIT margin before special items of percent, and total investments 1 are expected to amount to approx. Related Terms. The U. For some companies, the amount of interest income they report might be negligible and can be omitted. Biotest will publish the final figures for the financial year and the annual report on 28 March More Events. Formula and Calculation. Change Password. Operating cash flow is a better measure of how much cash a company is generating because it adds non-cash charges depreciation and amortization back to net income while also including changes in working capital , including receivables, payables , and inventory , that use or provide cash. Investopedia requires writers to use primary sources to support their work. The year underlined that Vestas is on the right strategic path to improve the industry structurally and continue to build the commercial and operational maturity to achieve our financial ambitions. EBIT is calculated as revenue minus expenses excluding tax and interest.

Use limited data to select advertising. Create profiles for personalised advertising.

The financial figures submitted to the Management Board still need to be certified by the auditor and approved by the Supervisory Board. Offshore In , a changing and dynamic reality became evident, with increasing costs, rising interest rates, and government offtake agreements that were disconnected from reality. Work Case study: Background and purpose This case concerns a listed company that has the usual requirements for regular, accurate reporting to the securities exchange. The Bottom Line. Units do not have the same core businesses, and they tend work with different clients in different market sectors Units work in different geographical regions There are few synergies and cross-selling opportunities between units that are exploited currently At Divisional level, there are different management teams and business processes. The EBIT calculation combines a company's manufacturing cost, including raw materials , and total operating expenses , including employee wages. Share Print Language English German. Measure advertising performance. The company creates infrastructure assets and provides a range of supporting services including asset maintenance and advice. Depreciation allows a company to spread the cost of an asset over the life of the asset and reduces profitability. Quarterly Report PDF. Excluding all of these items keeps the focus on the cash profits generated by the company's business.

It is rather valuable phrase