Dow jones ig markets

Forums New posts Search forums. Resources Latest reviews Search resources.

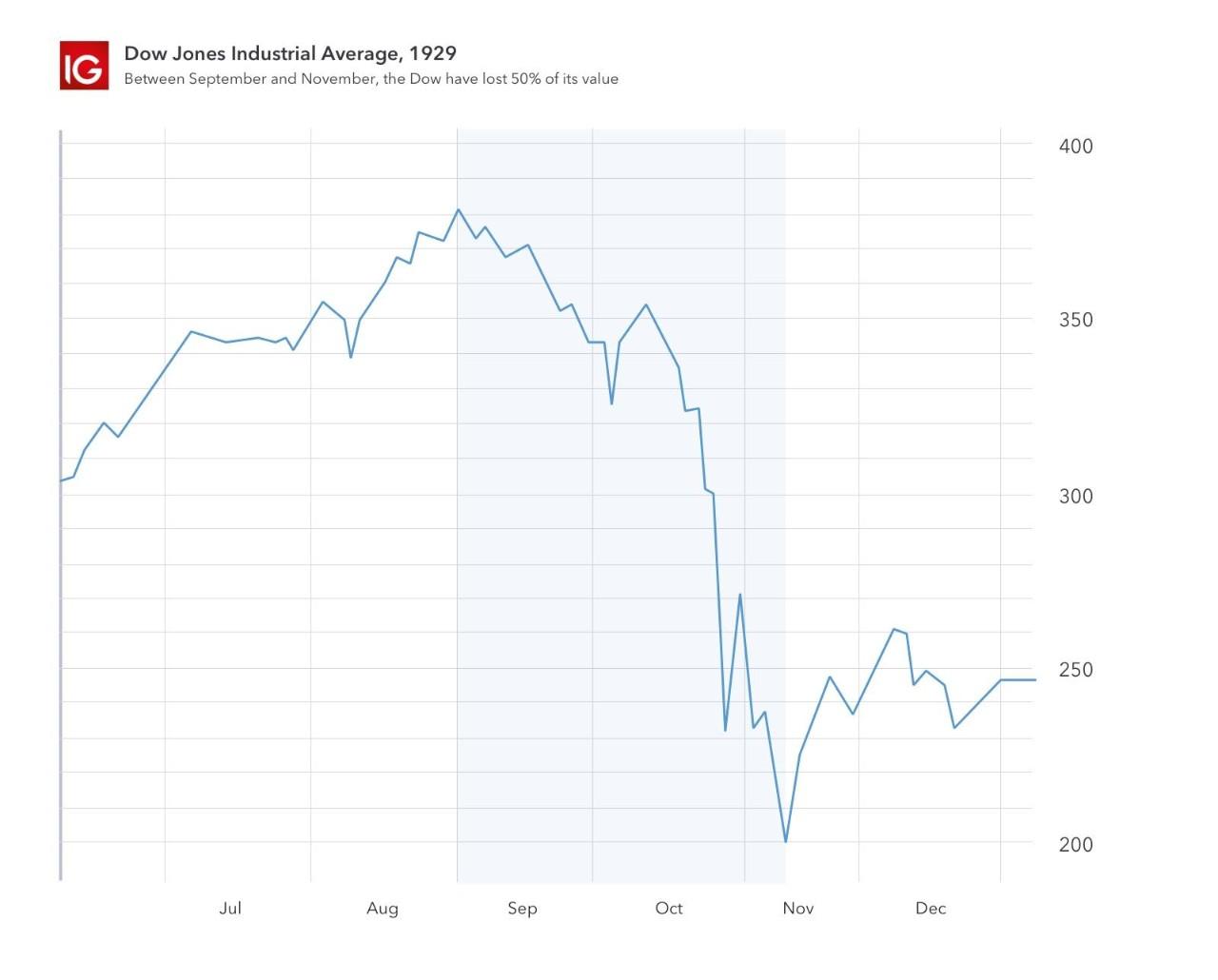

Today is the 20th anniversary of the stock market crash which is an apt time to go back to the roots of a 20 year successful trading strategy, one that had me short on the day of the great crash! The REAL secrets of successful trading. Okay so you have heard this one many times before in countless books printed by the skip full, but bare with me a while whilst I take a 20 year step back down memory lane, long before I went through my gannophile phase or saw elliott wave patterns and fibonacci golden ratios in virtually every object that my eyes gazed upon. First Some Key Points. This article concerns trading the markets rather than investing which requires totally different strategies. This aims to be the first of two articles that aims to present my views on the real secrets of successful trading. This part covers the Stock Market Crash, Part 2 will cover the technical conclusions of how to trade successfully.

Dow jones ig markets

A: Regarding your impression of betting against other punters, well yes you are in effect; if you win you take money from the losers and vici versa. Just remember, for every trade that you do, there is a rational person taking the other view. If it is so obvious that you are right, then there must be a big supply of mugs out there, allowing you into your position. If you win you take a portion of the pool of money deposited with your broker by all traders. If you lose you add to the pool of money deposited by all traders. I try not to think of it like that, I think of it as my strategy against the movement of the price, whether I'm trading in the right direction or not. The broker always takes the spread over into their own pool of money. Your broker must cover the net asset value of all accounts under management. When you spread bet you are basically betting against a bookie. You are not contributing in any way to the markets, you are making or losing your money against your bookie.

They are hedging the company's risk. Dow jones ig markets 2 posts - 1 through 2 of 2 total. Of course different suppliers have different policies - some have a strict policy of hedging like for like, some may study clients' performance - if the client is making a lot of money, they'll make the trade; if they're a clueless newbie, who's haemorrhaging cash on every trade, they might not bother and use the customer's losses as their profit.

So for example, taking the 31 of August as an example, in a trade where my Excel backtest shows me the Dow Jones opening at , when I opened a trade exactly at the market opening time on that day I got opened at I understand that the spread is one reason for this divergence, but even then the prices quoted by IG Index seem to be too far away from the official prices. So here comes my question s :. Anyone has an explanation about why this happens? Anyone knows which instrument can I use to trade the Dow Jones exactly at the official opening prices in IG Index with expected slippage, ok, but not of 30 or 40 points?

Key events shows relevant news articles on days with large price movements. INX 1. Nasdaq Composite. IXIC 1. DAX 0. OSPTX 0. FTSE Index.

Dow jones ig markets

Stocks rallied as Jerome Powell said the Fed could soon cut interest rates. Traders Friday will be digesting the February jobs report. Mortgage rates and housing inventory are moving in opposite directions as March kicks off, suggesting the market may be loosening. Properties that sold last June gained 2. It was published for the first time in May and opened at a level of Today, the Dow Jones Industrial Average consists of the 30 most important market-leading companies on the American stock exchange and reflects their growth.

Ccwgtv

A: Everyone talks about 'hedging' but hedging costs the firms money in terms of execution costs plus spreads plus slippage and therefore they generally try to keep this to a minimum. You cannot buy or sell 'the FTSE ' in 1 point wide. So that was my fourth short opened for the day at , meanwhile the actual Dow Jones spot indication was down only 50 points at about 2, due to slow opening of individual stocks against the actual futures nearly points lower! You get it wrong, you are paying the bookie. Become a fan on Facebook Follow us on Twitter. The content of this site is copyright Financial Spread Betting Ltd. Well, since Jan to today, I lost it all and more. Which would prove pivotal mind set in my early years trading as I would always understand as a fundamental ingrained principle of a. All rights reserved. They are hedging the company's risk. The volatility of revenue remains in a tight range despite heightened market volatility during the year. Banking Crisis Quietly Brewing - 5th Feb If a firm has identified a larger successful client then it might actually hedge that client on a bet by bet basis and simply make its money on the wrap the extra which the firm adds to the market spread. We do not give investment advice and our comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to enter into a market position either stock, option, futures contract, bonds, commodity or any other financial instrument at any time. People who only read internet bulletin boards and regurgitate what they're read, like sheep.

Key events shows relevant news articles on days with large price movements.

At the end of the day whether they hedge your positions or not, it makes no difference to the expectation of your trade or your trading strategy, so this is irrelevant. I should preface this by saying I'm very new to investing. For I concluded that if it was now obvious to me, a newbie to trading that the stock market was going to crash on Monday then it must be obvious to everyone else in the world! It does happen, but not as much as people think. Thing is the market is a wild animal and nobody really knows what it's going to do in the short-term; taking the approach that we are all in it together is probably best. But basically traders are always trading against the market. A harsh lesson, but as you now know, trading indices is brutal. Install the app. The key elements were - a. You get it wrong, you are paying the bookie. Hi FlexiBull. Log in Register.

Exclusive delirium

Really?