Does doordash provide a 1099

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. Of course, being an independent contractor can be stressful too — especially when tax season rolls around.

Does doordash provide a 1099

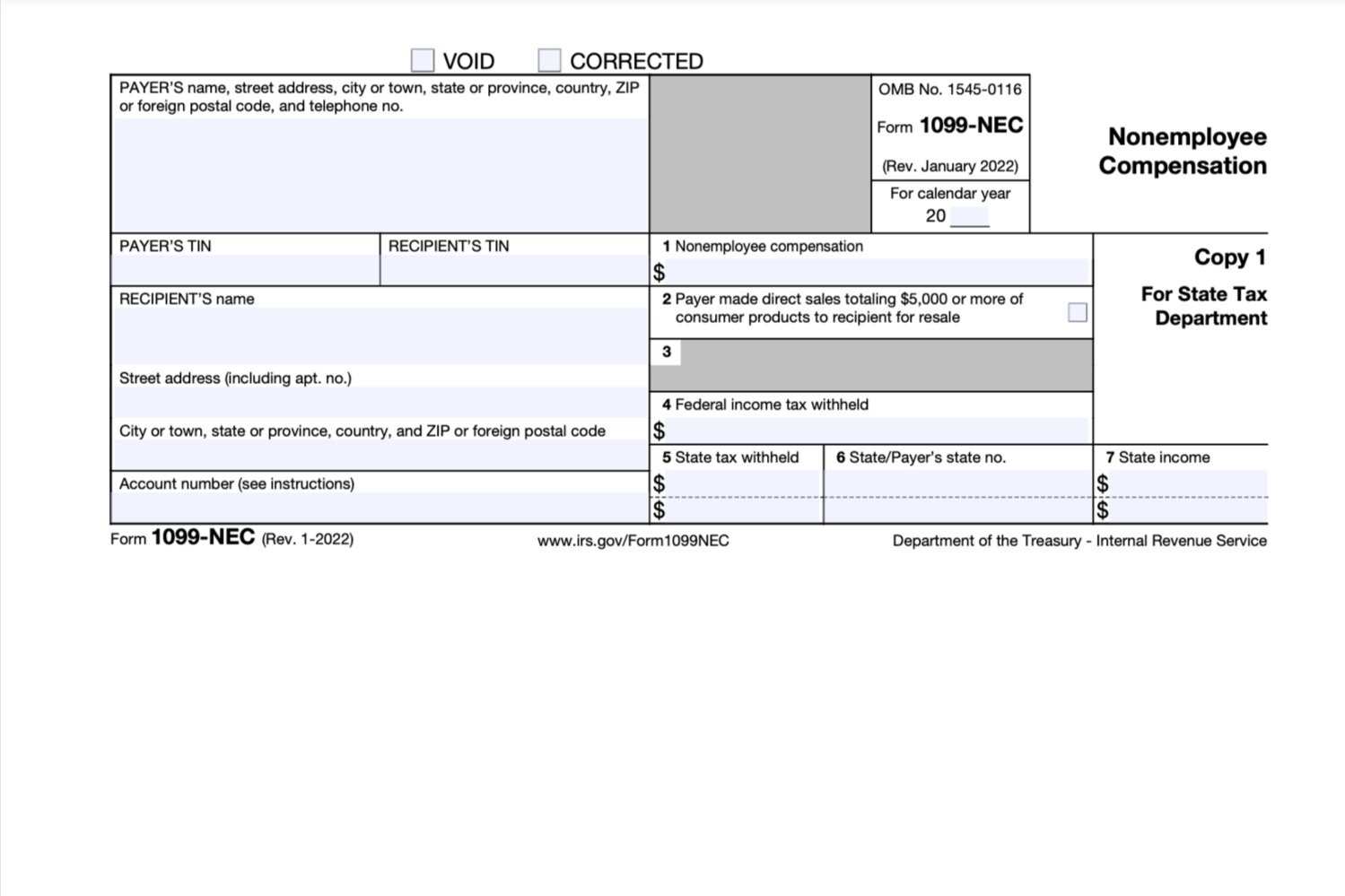

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze. Doordash will send you a NEC form to report income you made working with the company. It will look something like this:. The first step is to report this number as your total earnings. If you are:. One of the benefits of being an independent contractor is that you can deduct many business expenses to pay less in taxes. Here are the business expenses you can write off:.

But, you must choose one delivery option.

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes?

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers.

Does doordash provide a 1099

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in

Fated to love you kdrama ep 1 eng sub

The first step is to report this number as your total earnings. The process of figuring out your DoorDash tax as a dasher can feel overwhelming, from expense tracking to knowing when your quarterly taxes are due. With FlyFin:. Find out more about taxes for independent contractors like you in our Guide to Gig Worker Taxes. Ready to file? There are two types of taxes you need to pay to the IRS when filing taxes as an independent contractor. Your final tax bill is a result of your ability to write off business deductions. One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex. Pressure washer owner. What DoorDash taxes do you have to pay?

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes.

The Myth of Paper Receipts for Taxes. By staying on top of these tax deductions, you can ensure that your business remains compliant and continues to benefit from business deductions and credits. Does Doordash report to the IRS? There's also the issue of FICA taxes. They've used Payable in the past. I earned enough to need a form in Some people in the DoorDash delivery game do this with separate business and personal accounts: one card for everything they spend on their work, and one card for their personal expenses. Hot Bags, Blankets, and Courier Backpacks. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. Next, they will send you a NEC form that shows how much either business has paid you in the past year. You have two options for receiving your from Doordash: electronic copy by email or paper copy by mail. Quarterly taxes include self-employment taxes, Social Security and Medicare taxes. There are various state income taxes too. Please note that it can take up to 72 hours after the platform files the correction for you to be notified.

0 thoughts on “Does doordash provide a 1099”