Dbrs rating

The registration takes effect from 14 December Those CRAs are registered by and are subject to the supervision of the respective local competent authorities, dbrs rating. The CRA Regulation seeks to ensure that credit ratings issued in the EU respect minimum standards of quality, transparency and independence by providing that only companies registered by ESMA as CRAs may lawfully issue credit ratings which dbrs rating be used for regulatory purposes by credit institutions, investment firms, insurance and reinsurance undertakings, institutions for occupational retirement provision, management companies, dbrs rating, investment companies, alternative investment fund managers and central counterparties.

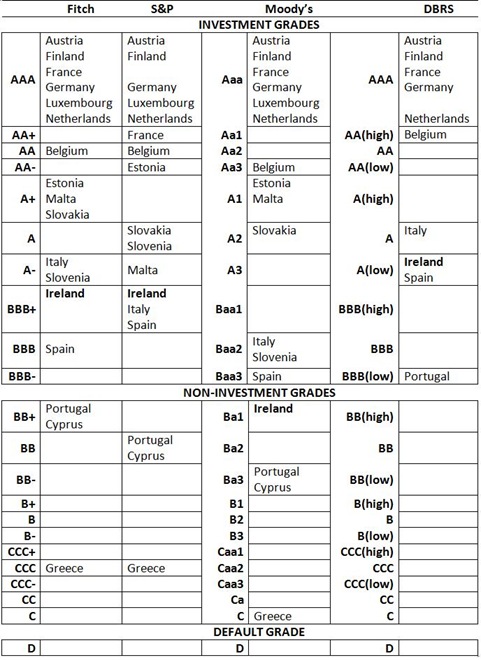

The absence of either a high or low designation indicates the rating is in the middle of the category. AAA - Highest credit quality. The capacity for the payment of financial obligations is exceptionally high and unlikely to be adversely affected by future events. AA - Superior credit quality. The capacity for the payment of financial obligations is considered high. Credit quality differs from AAA only to a small degree.

Dbrs rating

.

The absence dbrs rating either a high or low designation indicates the rating is in the middle of the category, dbrs rating. The capacity for the payment of short-term financial obligations as they fall due is uncertain. A - Good credit quality.

.

Morningstar DBRS provides independent credit ratings services for financial institutions, corporate and sovereign entities and structured finance products and instruments. Credit ratings are forward-looking opinions about credit risk that reflect the creditworthiness of an entity or security. Ratings are based on sufficient information that incorporates both global and local considerations and the use of approved methodologies. They are independent of any actual or perceived conflicts of interest. Morningstar DBRS credit ratings are formed and disseminated based on established methodologies, models and criteria Methodologies that apply to entities and securities that we rate, including corporate finance issuers, financial institutions, insurance companies, public finance and sovereign entities as well as Structured Finance transactions. Morningstar DBRS methodologies are periodically reviewed and updated by the team.

Dbrs rating

The final rating assigned to the Class D notes differ from the provisional rating of BBB low sf because of the tighter spreads and step-up margins on Class A through Class X and a lower initial swap rate in the final structure. The rating on the Class A Notes addresses the timely payment of interest and the ultimate repayment of principal on or before the final maturity date in July The ratings on the Class B, Class C, and Class D notes address the timely payment of interest once most senior and the ultimate repayment of principal on or before the final maturity date.

Hair shield anti lice cream wash how to use

Overall strength is not as favorable as higher rating categories. The capacity for the payment of financial obligations is substantial, but of lesser credit quality than AA. The capacity for the payment of financial obligations is considered acceptable. All rights reserved. ESMA highlights potential conflicts of interest risks in changes to Collateralised Loan Obligation rating methodologies. A - Good credit quality. Reproduction not allowed without express permission by CreditRiskMonitor. Making finance work for a sustainable future. The capacity for the payment of financial obligations is considered high. Those CRAs are registered by and are subject to the supervision of the respective local competent authorities. The capacity for the payment of short-term financial obligations as they fall due is exceptionally high. May be vulnerable to future events or may be exposed to other factors that could reduce credit quality.

The trend on all ratings is Stable.

Unlikely to be significantly vulnerable to future events. R-1 middle - Superior credit quality. Amongst the 27 registered CRAs, four operate under a group structure, totalling 19 legal entities in the EU, which means that the total number of CRA entities registered in the EU is The capacity for the payment of financial obligations is substantial, but of lesser credit quality than AA. May be vulnerable to future events. Credit quality differs from AAA only to a small degree. The capacity for the payment of financial obligations is uncertain. AAA - Highest credit quality. R-2 middle - Adequate credit quality. The capacity for the payment of short-term financial obligations as they fall due is substantial. May be vulnerable to future events and the certainty of meeting such obligations could be impacted by a variety of developments. CreditRiskMonitor and its third-party suppliers do not guarantee the accuracy and completeness of the information and specifically do not assume responsibility for not reporting any information omitted or withheld. The CRA Regulation The CRA Regulation seeks to ensure that credit ratings issued in the EU respect minimum standards of quality, transparency and independence by providing that only companies registered by ESMA as CRAs may lawfully issue credit ratings which can be used for regulatory purposes by credit institutions, investment firms, insurance and reinsurance undertakings, institutions for occupational retirement provision, management companies, investment companies, alternative investment fund managers and central counterparties. The information published above has been obtained from sources CreditRiskMonitor considers to be reliable.

0 thoughts on “Dbrs rating”