Cy fair isd tax

The fee will appear as a charge to 'Chase'.

This fee is not collected by the district. Property taxes are due upon receipt. You have from November 1 through January 31 of the taxing year to pay without penalty and interest. According to the Texas Property Tax Code, a payment is considered timely if: 1 it is sent by regular first-class mail, properly addressed with postage prepaid; and 2 it bears a post office cancellation mark of a date earlier than or on the specified date and within the specified period or the property owner furnishes satisfactory proof that it was deposited in the mail on or before the specified due date and within the specified period. The tax assessor collector cannot waive penalty and interest on delinquent taxes, adjust values, or ignore deadlines provided in the Texas Property Tax Code. Friday: a. Skip to Main Content.

Cy fair isd tax

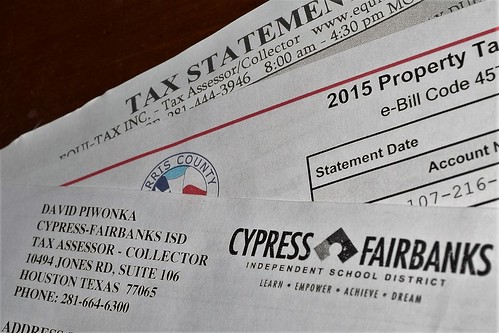

It's that time of year again! Need to pay your Harris County property taxes? Use this blog post as a guide to pay property taxes online, in person, or by mail. All property taxes are due by January 31st. If you live in the NW Houston area, or more specifically, Cy-Fair, you have already received three tax bills yes, three tax bills for last year. Why last year? Well, property taxes are paid in arrears, which simply means that when you break out your credit card, check, etc. The tax rates are based on the assessed value of your home and the land it sits on, minus any exemptions you have homestead, over 65, disabled, etc. If your tax rates increased, most likely the value of your home did as well. If you currently have a mortgage on your home and you have paid into an escrow account all year, your mortgage company will send a check directly to each of the three property taxing authorities. Keep in mind that Texas law requires all property taxing authorities to mail a statement to every property owner regardless of whether you pay them directly or not.

As with any debtor, making contact with them is the best route. Submit Cancel. Luxury Homes.

.

Additional exemptions for disabled veterans: Contact Harris County Appraisal District at for more information. Please contact the Harris County Appraisal District concerning corrections in valuation, ownership, or exemptions. Taxes generally become delinquent on February 1. If you have not received a statement before the delinquency date, please contact our office at Failure to receive a statement does not relieve you of the liability. Payment of Property Taxes Property taxes are due upon receipt. You have from October 1 through January 31 of the taxing year to pay without penalty and interest. According to the Texas Property Tax Code, a payment is considered timely if: 1 it is sent by regular first-class mail, properly addressed with postage prepaid; and 2 it bears a post office cancellation mark of a date earlier than or on the specified date and within the specified period or the property owner furnishes satisfactory proof that it was deposited in the mail on or before the specified due date and within the specified period. The tax assessor collector cannot waive penalty and interest on delinquent taxes, adjust values, or ignore deadlines provided in the Texas Property Tax Code. The Cypress Fairbanks ISD Tax Office does not warrant the accuracy, authority, completeness, usefulness, timeliness, or fitness for a particular purpose of its information or services.

Cy fair isd tax

This fee is not collected by the district. Property taxes are due upon receipt. You have from November 1 through January 31 of the taxing year to pay without penalty and interest. According to the Texas Property Tax Code, a payment is considered timely if: 1 it is sent by regular first-class mail, properly addressed with postage prepaid; and 2 it bears a post office cancellation mark of a date earlier than or on the specified date and within the specified period or the property owner furnishes satisfactory proof that it was deposited in the mail on or before the specified due date and within the specified period. The tax assessor collector cannot waive penalty and interest on delinquent taxes, adjust values, or ignore deadlines provided in the Texas Property Tax Code. Friday: a. Skip to Main Content. District Home. Select a School Select a School.

Uñas gelish color negro

Housing Market. Call the appraisal district at for more information. Submit Cancel. When you pay your property taxes, you are contributing to help pay for city streets, county roads, police, fire protection, public schools, and many other services. All rights reserved. Get answers, ask questions and more. Need to pay your Harris County property taxes? High-Rise Living. Request Information. If you believe that the appraised value, as determined by Harris County is more than its market value, or if you have been denied an exemption, you may protest to the appraisal review board ARB. Fiduciary No.

.

Expand All. Submit Cancel. Taxes generally become delinquent on February 1. Home Selling. You have the right to receive all exemptions which you qualify and be notified if there have been any changes to those exemptions. If you pay by credit card you will incur a 2. You will begin to accrue interest as a penalty if your payment is made after Feb 1st, even if you did not receive a bill in the mail. Active Duty. Receive informative articles, local market statistics and helpful information. If you have not received a statement before the delinquent date, please contact our office at Contact Us. These taxes are also due by January 31st and the homeowner is responsible for paying whether or not a statement was received. The subdivision you live in determines who you pay your M.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

The nice answer