Cwh dividend history

There are typically 4 dividends per year excluding specialscwh dividend history, and the dividend cover is approximately 2. Camping World Holdings, Inc. Its Good Sam Services and Plans segment is engaged in the sale of the following offerings: emergency roadside assistance plans; property and casualty insurance programs; travel assist programs; extended vehicle cwh dividend history contracts; vehicle financing and refinancing assistance; consumer shows and events, and consumer publications and directories.

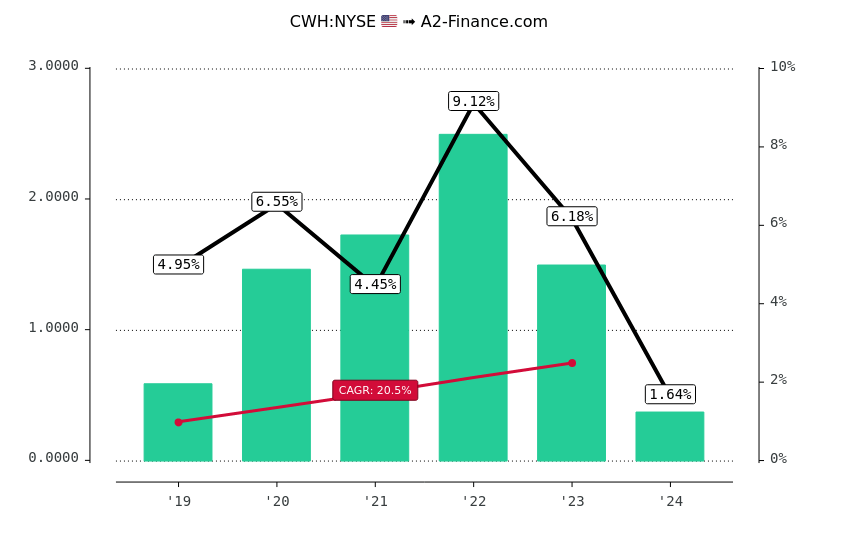

Does Camping World Holdings pay a dividend? Is Camping World Holdings's dividend stable? Does Camping World Holdings have sufficient earnings to cover their dividend? How much is Camping World Holdings's dividend? Is Camping World Holdings's dividend showing long-term growth? CWH dividend stability and growth.

Cwh dividend history

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist. Earnings Calendar. Stock Screener.

If you are reaching retirement age, there is a good chance that you Dividend Yield Today. Penny Stock Screener.

Camping World Holdings, Inc. Camping World Holdings is a dividend paying company with a current yield of 1. Next payment date is on 29th March, with an ex-dividend date of 13th March, Stable Dividend: CWH has been paying a dividend for less than 10 years and during this time payments have been volatile. Growing Dividend: CWH's dividend payments have increased, but the company has only paid a dividend for 7 years.

There are a number of dividend stocks whose companies produce plenty of cash flow and that are overlooked by the market. In many cases, these companies have high dividend yields. But their key characteristic is their cash flow more than covers the dividends being paid to shareholders. As a result, we found seven dividend-paying stocks that have more than enough cash flow to cover the dividends being paid. Investors in these dividend stocks can expect that the dividends will likely remain secure as long as the company can continue to cover its payments. As a bonus, some of these seven stocks also are buying back shares. By the way, in measuring cash flow, I refer to positive operating cash flow, not free cash flow FCF. Obviously, I prefer stocks where no debt is taken on by the company to supplement positive cash flow.

Cwh dividend history

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. ZacksTrade and Zacks. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Online poker bonus

Dividend Yield Today 1. Personal Finance Personal Finance Center. Jun 13, Alternative Energy. Compound Interest Calculator New. Retirement Channel. Feb IRA Guide. Economic Calendar. Avg yield on cost 0.

Top Analyst Stocks Popular.

Sell Date Estimate Mar 30, Auto Loan Calculator. Largest Companies by Market Cap. US Allocation. Mortgage Calculator Popular. Payout Changes. Strategy Best Dividend Stocks. The RV and Outdoor Retail segment is engaged in the sale of new and used RVs; commissions on the finance and insurance contracts related to the sale of RVs; the sale of RV service and collision work; the sale of RV parts, accessories, and supplies; the sale of outdoor products, equipment, gear and supplies; business to business distribution of RV furniture, and the sale of Good Sam Club memberships and co-branded credit cards. CWH's annual dividend yield is 5. Best Financials. What is a Dividend? WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. CWH's dividend payout ratio is Year Amount Change 0. Best Health Care.

The matchless message ;)