Credit terms of 2 10 n 60 means

Table of Contents.

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date. Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts. Business credit reporting agencies evaluate company strength, time in business, and payment history, issuing scores and ratings. Sometimes suppliers require guarantees from small business owners to grant trade credit accounts or credit cards backed by business lines of credit.

Credit terms of 2 10 n 60 means

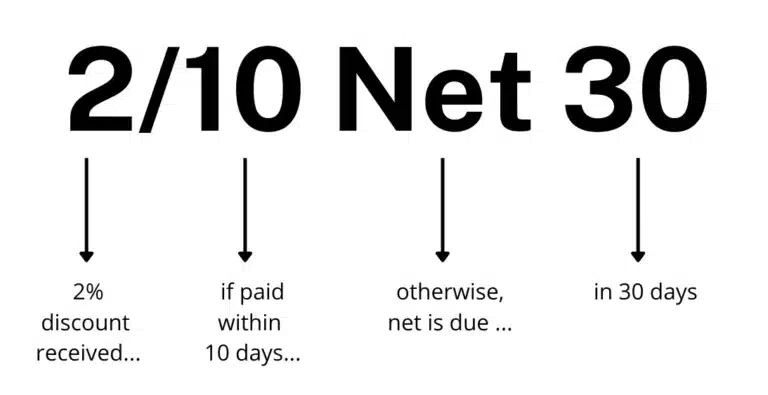

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early. The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. The table below shows some of the more common credit terms, explains what they mean, and also notes the effective interest rate being offered to customers with each one. The concept of credit terms can be broadened to include the entire arrangement under which payments are made, rather than just the terms associated with early payments. If so, the following topics are included within the credit terms:. The time period within which payments must be made by the customer. Corporate Finance. Credit and Collection Guidebook. Treasurer's Guidebook. The cost of credit is the effective rate of return that a business offers its customers when it provides early payment terms to them. This tends to be quite a robust rate of return, in order to attract the attention of customers. Given its high cost, a business should only offer early payment terms if it has an extreme need for cash.

Customers and vendors will record the early payment discount amount in their accounting systems when recording payments made or accounts receivable collected.

Otherwise, the full invoice amount is due within 30 days. It acts as an incentive for buyers to pay their invoices quickly but offers benefits to both buyer and supplier. Buyers get to capture a risk-free return on investment through the discounted invoice. Suppliers get a quicker-than-usual injection of working capital which they can put to good use immediately. At scale, these discounts add up to represent a significant saving.

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date. Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts. Business credit reporting agencies evaluate company strength, time in business, and payment history, issuing scores and ratings. Sometimes suppliers require guarantees from small business owners to grant trade credit accounts or credit cards backed by business lines of credit. Vendors may decline trade credit to small businesses and companies with cash flow problems. The startups need to build business credit first to get trade credit from more vendors.

Credit terms of 2 10 n 60 means

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early.

Family feud guess to win promo today 2023

Wholesalers or distributors sell their clothing brands and other goods to retailers with net 30, net 45, or net 60 terms. What is the new FASB accounting treatment for supply chain finance? Small businesses and larger companies have access to bank lines of credit and supply chain financing. Accounts receivable or AR financing is a type of financing arrangement which is based on a company receiving financing capital in return for a chosen portion of its accounts receivable. You can determine if you should invest in other company projects with higher rates of return instead. These vendor invoices show net 60 as the time payment term if no discount for early payment is offered as a payment option. From contact details to contractual documentation, the data involved in supplier information management is essential in the broader process of vendor management. Accounts payable AP represents the amount that a company owes to its creditors and suppliers also referred to as a current liability account. The formula steps are: Calculate the difference between the payment date for those taking the early payment discount, and the date when payment is normally due, and divide it into days. Suppliers participating in a reverse factoring program can request early payment on invoices from the bank or other finance provider, with the buyer sending payment to the… Read more. Inventory management is a systematic approach to sourcing, storing, and selling inventory. It involves the same fundamental steps — research, analysis, negotiation, contracting, and onboarding of new suppliers to fulfill demand for goods or services — but is oriented to contribute to broader business objectives. Supply chain finance reduces the risk of supply chain disruption and enables both buyers and suppliers to optimize their working capital.

Credit terms are the payment terms mentioned on the invoice at the time of buying goods.

And buyers would reduce spending. DPO Days payable outstanding DPO is a useful working capital ratio used in finance departments that measures how many days, on average, it takes a company to pay its suppliers. Trade finance is the term used to describe the tools, techniques, and instruments that facilitate trade and protect both buyers and sellers from trade-related risks. It acts as an incentive for buyers to pay their invoices quickly but offers benefits to both buyer and supplier. Debit cash for the amount of cash received Debit sales discounts for the amount of the early payment discount Credit accounts receivable for the full amount of the invoice. Trade receivables are defined as the amount owed to a business by its customers following the sale of products or services on credit. She is a former CFO for fast-growing tech companies with Deloitte audit experience. It aims to create efficiency in the accounts payable workflow by digitizing how vendor invoices are received, processed, and stored. How to Calculate and Record Early Payment Discounts If the customer takes the early payment discount offered on an invoice, their accounting software will calculate a discounted balance to pay. Net 20 EOM means the total amount is due for full payment within 20 days after the end of the month. What is an early payment discount? What is Days Payable Outstanding? Supplier Use of Invoice Factoring to Extend Trade Credit If supplier cash flow is tight, sometimes these sellers use accounts receivable factoring through a financing company.

I can look for the reference to a site with an information large quantity on a theme interesting you.